For today’s machinery suppliers, flexibility is key, both in terms of technology and operations.

By Stefanie Rossel

As the tobacco industry finds itself at a crossroads, selling make-pack machinery has become a challenge. By closing manufacturing facilities and consolidating production, multinational cigarette companies have begun to adapt their operations to the shrinking demand for combustible cigarettes and increasing regulatory restrictions.

Following the shutdown of Imperial Brands’ Nottingham site this month, no more cigarettes will be produced in the United Kingdom, for example. As a consequence of such closures, a significant amount of comparatively new equipment has been freed for use in the remaining factories, eliminating the need to invest in new equipment.

Paul Knight, CEO of CME, a U.K.-based supplier of custom-made and generic packaging machinery that also rebuilds and upgrades making equipment, acknowledges that sustaining business in tobacco is tough at the moment. “However, it reinforces the need for a culture of continuous improvement and lean-enterprise thinking—something that I feel very strongly about,” he says.

While CME’s multinational customers demand high levels of equipment flexibility, its independent customers tend to seek value for money and flexible financing. The independents also typically want less equipment complexity, to match the operator skill sets available, according to Knight. For each customer, CME tries to find the most appropriate solution. “Even after the initial equipment investment, the installation and after-sales support costs are scrutinized and refined to suit our customers’ exact requirements,” says Knight.

The focus these days is on value for money, agrees Norbert Schulz-Nemak, sales manager at TMQS in Hamburg, Germany, which concentrates on technical solutions to bring older tobacco making machinery up to date. New machinery might offer better value in terms of speed, efficiency, connectivity to management information systems and obsolescence avoidance, he says, but upgraded machinery can present a cost-effective alternative.

Karsten Mutschall, sales manager at Emkon, a German provider of flexible packaging solutions, stresses the need for flexibility in tobacco machinery. “The flexibility to produce different products with different materials, even in different styles, has to be possible in a very effective way,” he says. “Production output following a change has to be back to par within hours, not days. Effective flexibility with a reliable output is the key.”

The need for adaptability extends beyond technology, explains Mutschall. Tobacco machinery suppliers need to be flexible in their operations, as well. “The new market requirements necessitate a new business concept to become even more flexible and to respond in a quicker fashion,” says Mutschall. “Our business is less predictable, therefore working with different industries to absorb individual fluctuation will be necessary.”

Some years ago, Emkon began to diversify into other lines of business, such as the food industry—a horizon-broadening experience that created new synergies. “Since we have already identified and intensified business relations with other quickly changing and demanding industries, we feel well-prepared to jointly find new opportunities to be conveyed into the tobacco industry,” says Mutschall.

Restrictions rule

Over the past months, equipment manufacturers have also felt the impact of the revised Tobacco Products Directive (TPD2), which is due to be implemented May 20 and has further discouraged investment in machinery.

With much of the directive revolving around pack standardization, cigarette manufacturers have been focusing on preparing their packers for this new requirement. “Since the budget does not rise because of such a regulation change, it needs to focus on certain areas and this is packing machinery,” says Schulz-Nemak. As a result, he adds, demand for making equipment has declined.

For Emkon, which among other equipment offers a range of modular pouch packers and fillers for the roll-your-own and make-your-own segments, the legal uncertainty surrounding the content and integration of TPD2, in particular, presented a challenge.

“Even to this day, some uncertainty and controversy still exists,” says Mutschall. “Since an unrealistic timeline was set and time is running out, the industry had to make a decision, which resulted in TPD2-related changes and adaptations, not knowing the outcome of the final TPD2 version. The flexible design concept we offer allowed us to implement the necessary TPD2-related changes into our equipment with negligible efforts. The [TPD2] minimum tobacco weight and pack style restrictions, on the other side, limited the developments we had already started. We had to review, cancel and scrap some of our ideas and designs.”

TPD2 regulations require RYO packs to have a cuboid or cylindrical shape and contain at least 30 grams of tobacco—requirements that leave a lot of room for interpretation. Emkon has tested and implemented all necessary changes for its RYO/MYO packing technologies, including tax stamp positioning or flap extension.

“Solutions to improve and optimize communication space are available, and we can offer them,” Mutschall explains. “Today, innovative ideas to differentiate the product or brand by pack styles, appearance, variations and types not only have to pass the [management] board but also have to take place in a very restricted arena. Following the early stage of TPD2 implementation in May 2016, it needs to be seen how much initiative the industry is willing and able to put forward.”

Finding new ways

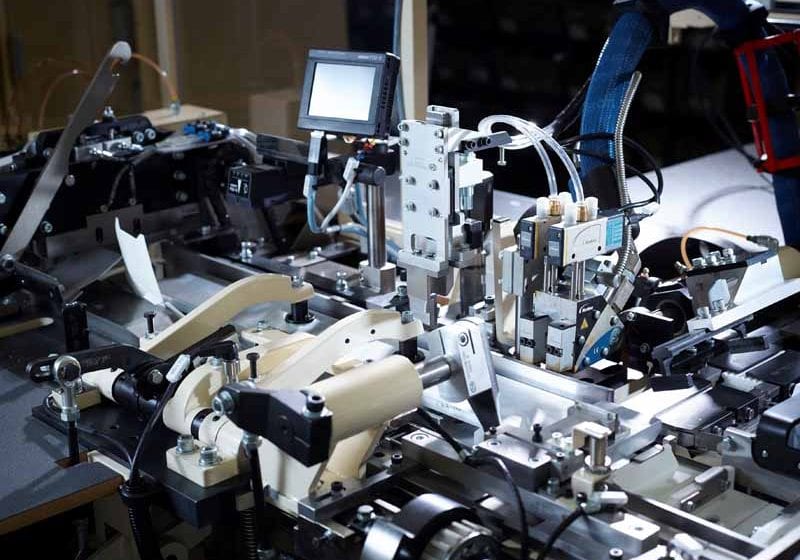

Like Knight and Schulz-Nemak, Mutschall does not expect major investment activities in standard equipment over the next years; for machinery suppliers, the future lies in individual, highly adaptable solutions, he says. In November 2015, Emkon introduced Flexbag, its first fully modular, in-line stand-up pouch maker, suitable for use in the tobacco and food industries. According to Emkon, the machine offers multiple sealing possibilities, higher reliability, quick changeovers and reduced downtimes. It also enables improved product quality through gentler product handling.

Emkon also released Sideload, a new case packer. Its main focus at the moment, however, is on intelligent, self-learning machines, according to Mutschall. “Our new operator-guidance system will further improve the ease of operation, which is one segment of our ‘Industry 4.0’ developments,” he says. “In the near future, our machines will detect and cope independently with material and environmental changes.” The company will imbed expert know-how into its machines so that they can make their own adjustments instead of relying on operators with varying skill sets and opinions. The machines will also be able to directly request raw materials as needed, avoiding unnecessary downtime. “Our new generation of packaging machines is more digital, more open with regard to hard- and software, and more flexible,” says Mutschall.

Schulz-Nemak, too, has noticed the tendency toward increased and more sophisticated automation. “The current trends are to use machine information systems to a higher degree and also make use of improved sensors, monitoring systems and controls,” he says. This, he explains, gives more control over the machinery resources, enabling tailored maintenance schedules and better planning of equipment utilization. “I believe that speed is not among the most important factors here; it rather comes down to flexible machinery with the highest efficiency and uptime possible.”

TMQS has developed many solutions to revitalize existing machines through “e-kits,” providing up-to-date Beckhoff electronics and direct drives, avoiding obsolescence and improving overall controls to a modern level. “In conjunction with a tailor-made mechanical maintenance [program] for single-rod makers, which will guarantee 85 percent efficiency, this will bring a machine back into full modern swing without having to pay a fortune,” says Schulz-Nemak. Such programs, he adds, provide the best possible cost-value ratio and “future-proof” machines.

Knight says it is crucial for machinery manufacturers to be forward-thinking and responsive to their customers’ desire to reduce operating expenses. In line with this, CME concentrates on increasing the efficiency levels of existing machines, offering health checks and preventive maintenance packages, and updating both old and new equipment to meet new industry legislation.

In addition, the company offers tailor-made machinery. “Over the last five years, bespoke CME machinery has played a big part in a number of up-and-coming harm-reduction products,” says Knight. “With the design of each new product differing so greatly, there is rarely an ‘off-the-shelf’ solution. When faced with this, we use our technical team to design from the ground up, utilizing our decades of experience in automation.”

Difficult and dynamic market conditions also challenge the traditional concept of competition, according to Knight. “Collaboration and partnering, instead of competing, to combine strengths can be highly effective, particularly for smaller businesses. We see this as a positive outcome for us and our customers. Solutions can be tailored around multiple OEMs’ strengths, often providing increased value and performance to the customer.”

Despite the many challenges facing their business, tobacco equipment manufacturers are keenly aware of the opportunities. Knight sees them in new demand for after-sales products, such as upgrades, size changes, rebuilds and machinery relocations. And, he adds, one area of the tobacco industry that isn’t declining is the “Other Tobacco Products” segment. “New and innovative products are emerging at a rapid rate,” says Knight. “Combine this with the rise of pharmaceutical-style harm-reduction products being offered by the big tobacco companies, and this creates demand for new and innovative machinery solutions.”