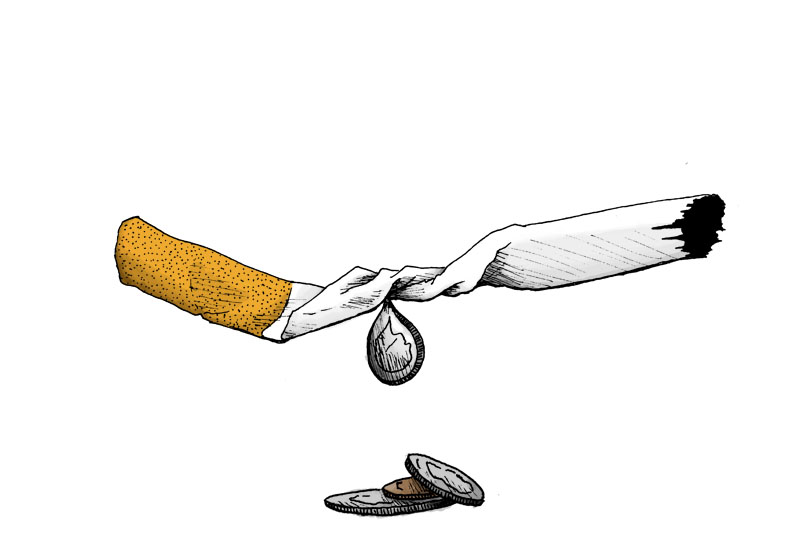

The retail prices of tobacco products and sugary drinks have increased in Qatar following the imposition of new excise taxes, according to a story in The Gulf Times.

The new excise tax rates, which came into effect on Tuesday, have been set at 100 percent for tobacco and energy drinks, and at 50 percent for carbonated drinks.

A pack of Marlboro cigarettes that used to sell for QR11 now costs QR22, while the price for a pack of Pall Mall increased from QR5 to QR10, according to the Times citing an official price matrix.

A Doha-based store owner was said to have told the Times that most of his customers who are smokers had been complaining about the high prices, but that there was nothing that could be done. “These are new prices sanctioned by the government and there is nothing we could do but to comply with the new policy,” he said.

In a general awareness workshop, the Tax Department had previously defined excise tax as ‘a form of indirect tax levied on specific goods that are deemed harmful to human health or the environment’. ‘The intent of excise tax is to reduce consumption of such goods, while also raising revenues for the government that can be spent on public services,’ it said.