Manufactures of tobacco adhesives adjust their operations to new products and changing requirements

By George Gay

Manufacturers of combustible cigarettes require their suppliers to deliver unprecedented levels of efficiency, while producers of next-generation products often demand different technologies altogether. Tobacco Reporter asked several makers of tobacco adhesives how they are responding to changing industry needs.

H.B. Fuller—Anticipating Customer Demand

When it comes to volume sales of adhesives to the tobacco industry, it is clearly the combustible products and packaging sector that is at the forefront. But when it comes to buzz, look no further than the next-generation product (NGP) segment.

Asked during an email exchange in January whether there were any emerging applications for tobacco adhesives, Jude Liddle, marketing manager for the Europe, India, Middle East and Africa region (EIMEA) for H.B. Fuller, said NGPs remained at the forefront of innovation for the major tobacco companies. H.B. Fuller was therefore dedicating R&D efforts in this area to support the production efficiencies of tobacco companies and machine manufacturers and to ensure product performance kept pace with the growing demand. “In 2018, we introduced a new range of adhesives that are performance optimized for NGPs,” she said. “In this relatively new area, machines and production methods are being reviewed and improved, and we are working closely with customers and OEMs to ensure the adhesive products continue to deliver the high performance required as this growing market develops.”

Meanwhile, Andrzej Dabrowski, business manager for tobacco in EIMEA, said the NGP segment was growing, fueled by frequent new product launches, and nobody was able to predict how it would develop over the coming years. Although the new cigarette sticks for NGP devices looked similar to traditional cigarette sticks, he said, there were two main areas of difference: the design of the stick and, in particular, its filter, as well as the way the stick was used by the consumer. NGP sticks were heated and not burned, and this posed different challenges in respect of ensuring adhesives remained functional while the cigarette stick was being used. In addition, the filters had a more complex construction than those of traditional cigarettes, and this created new challenges related to adhesive performance requirements.

But the challenges posed by NGPs are by no means the only ones faced by adhesive suppliers. Dabrowski said that even in respect of traditional cigarettes, new filter designs and functionality were being developed, such as those used in respect of recessed or capsule filters. This resulted in these filters becoming more complex in their construction, and this, in turn, raised further challenges for the adhesives used.

In addition, there are even the complexities involved in making things simpler. Liddle said that customers wanted to buy and stock-manage fewer adhesive products, so complexity reduction was important. “We already have proven products on the market that are successfully used across multiple applications, such as side seam, tow anchor and packaging,” she said. “For example, we have one customer who buys only three adhesives products from H.B. Fuller and successfully produces all their cigarette and filter products with just these three adhesive solutions.”

To some extent, complexity varies according to the geographic destination of tobacco products. Parallel to the trend toward standardized packaging in some areas of the world, which was simplifying adhesive demands, said Dabrowski, companies in many regions were utilizing the wide variety of carton finishes available to differentiate their products. These finishes often included more difficult to bond surfaces, such as transfer-metalized or laminated hinge lid blanks, which required manufacturers to adapt their machine speeds or change their adhesive. “At H.B. Fuller, our global range of specialized water-based packaging adhesives enables customers to operate their machines efficiently whilst achieving secure bonds on the packaging,” he said. “Our close collaboration with carton board suppliers ensures we stay up to speed with the latest developments in this dynamic market.”

Liddle added that H.B. Fuller was excited about its new Ipacoll 2900 packaging adhesive that was launched late last year. This high-performance adhesive, she said, enabled customers to achieve fast production speeds of up to 1,000 packs per minute, even on challenging packaging materials, such as lacquered and varnished surfaces.

“And we achieved this high performance level without using boric acid,” Liddle added. “This is a substance listed as one of very high concern by the ECHA [European Chemicals Agency], and we no longer use it in our development work. It made the challenge of achieving the very high wet tack required for fast production speeds in combination with strong adhesion more difficult to achieve, but our team of scientists based in our technical center in Nienburg, Germany, rose to the challenge.”

In addition to removing ingredients that have been found to be undesirable from adhesive formulas, there are the challenges of maintaining supplies of needed ingredients, of identifying possible new ingredients and keeping down the costs of both. H.B. Fuller said adhesive raw materials were currently readily available and that it was committed to ensuring continuity of supply to its customers. At the same time, the company worked closely with its raw material suppliers and was always evaluating new raw material products to assess their potential use in new adhesives. Raw material costs, meanwhile, were said to have been rising steadily over the past couple of years, and this trend was expected to continue, though the company said that it leveraged its global scale to manage these costs as well as those to do with freight and inventory management.

Serving the tobacco market involves managing a number of issues not directly concerned with adhesives. “Like many companies active in the tobacco industry, we are monitoring the impact of plain packaging and the expected increase in illicit trade,” H.B. Fuller said. “As always, we properly vet any new potential tobacco customer to ensure we only supply adhesive to genuine tobacco product customers and not those producing counterfeit products.”

And what is the range of tobacco industry adhesives that manufacturers look for? H.B. Fuller said it supplied the full range of adhesives required to manufacture cigarettes and their packaging as well as other products, such as those for tube making and tobacco pouch sealing. Its tobacco adhesive products included thermoplastic hot melts and synthetic and natural, water-based adhesives.

Finally, the ultimate question management must ask how the worldwide market for tobacco adhesives is holding up given that cigarette volumes are falling. “Even within a declining market, there is still opportunity for successful companies to grow,” said H.B. Fuller. “The important thing is to understand changing customer and market needs and have the desired products available when they’re needed—if not before. Our relationships and collaboration with the major tobacco companies, machine suppliers and paper suppliers ensure we are best placed to make the most of the opportunities within this challenging market.”

CB Kaymich—Helping Manufacturers Control Costs

If you were to research the issues that cigarette manufacturers have regarded as priorities since the 1970s, when C.B. Kaymich introduced the industry’s first gravity-fed polyvinyl acetate (PVA) side-seam application system, one of those that would turn up consistently would be cost control.

So it was no surprise when, in January, Kaymich, which specializes in adhesive application and fluid-control systems, said, in answer to a question from Tobacco Reporter, that one of the major issues currently affecting its customers was their need for a level of cost reduction that would allow them to remain competitive.

Of course, what is not mentioned here is that these customers are having to remain competitive against companies that are also working on cost reduction, which at least explains why this issue remains a constant at the top of the issues table.

Rona Treeby, Kaymich’s sales and marketing executive, said her company understood the pressures that its customers were facing, so reducing costs while maintaining the quality of Kaymich’s equipment and service was a key goal.

“We continue to work with our customers to achieve this and know that our Gemini product already offers customers significant cost savings when compared to other units,” said Treeby, before adding that the Gemini’s superior uptime could provide payback in less than 30 shifts.

The Gemini is a flavors application unit, but Kaymich says, too, that the company is enabling cost savings to be made in respect of its adhesive application equipment. “Kaymich’s adhesive side-seam products offer customers the opportunity to standardize parts across a wide variety of application systems,” said Treeby. “This reduces their spares investment as Kaymich parts can then be used across their different machines. As well as providing cost savings, this also gives customers the additional practical benefit that running with one type of parts means operators only have to become familiar with one type of technology.”

At the same time, Kaymich says that it continues to develop innovative equipment for the application of hot and cold adhesives while striving to help manufacturers in their quest for cost reductions. And it offers customized and bespoke products and systems when off-the-shelf products do not match specific needs.

It offers too what it describes as a cost-efficient way to apply adhesives through its cigarette side-seam application systems that are said to be suitable for installation on most cigarette makers. “These are designed to apply PVA fed by either gravity or pump and give an accurate application of adhesive with no stoppages for cleaning purposes, making this a low-maintenance and cost-efficient way to apply adhesive,” said Treeby.

Among other equipment, Kaymich offers filter tow spray retention systems designed to apply adhesive over a wide area to anchor the tow to the paper, and spray valves designed to apply PVA to board within cigarette packing.

Interestingly, it is worth noting that, amid all the innovation, some things remain, even if they are now presented in updated forms. The industry’s first gravity-fed PVA side-seam application system mentioned at the start of this piece is still available today, a testament, Treeby said, “to the quality of the product and its ability to meet customer requirements within the competitive 2019 marketplace.”

SPI Developments—pushing boundaries

Until recently, the tobacco industry was correctly known as being conservative. Over the years, the outward appearance of its products stayed much the same, and even though those products became better engineered, that engineering was carried out in a manner so closely controlled that changes often went undetected by outsiders and even by some smokers.

Not any longer. Things are changing fast—to the point where the chairman of SPI Developments, Paul Leverick, who has been in the industry for more than 40 years, can enthuse about an “explosion” of new, radical products having resulted in formidable challenges for the adhesives application systems that his company supplies.

Of course, the difference in mood has been created almost entirely by the rise of noncombustible products and by the fact that the tobacco industry has become the tobacco and nicotine industry. As Leverick said, every major tobacco manufacturer now has a vapor product and a heat-not-burn product or is in the process of developing such products. Every time a manufacturer came up with a new product initiative, there was a scramble by others to match or better that initiative. “It’s a massive market,” he said.

And this massive market isn’t boosting only the adhesive application sector; it is also giving a lift to flavor mixing and flavor application, areas where SPI is also active. But whereas the company is involved in what Danielle Roxborough described as a few interesting flavor-related, equipment development projects, a lot of its development activity is currently focused on adhesive equipment.

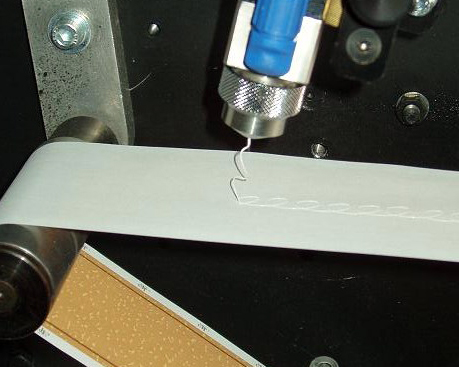

During the past 18 months especially, Roxborough said that SPI has been receiving inquiries that have gone beyond those of the past, as customers and potential customers have sought to access not just the company’s equipment but also its adhesive application expertise. SPI was being asked questions about how adhesive should be applied to new and proposed products, especially heat-not-burn products, where the adhesive should be applied and what type should be used.

These projects aren’t interesting only in a technical sense; they are also interesting in a commercial sense. Roxborough said that demand for adhesive equipment is probably higher now than it was three or four years ago, which is something to hang onto in an age when the tobacco industry is seen by many people as being in the doldrums.

Leverick is not getting carried away, however. He has been around too long for that. He readily pointed out that what was happening could be correctly interpreted as a fragmentation of the market. Nevertheless, he cannot hide his enthusiasm. One or two real gems were emerging from that fragmentation, he added.

Likewise, he is positive even though some of the projects that SPI has been asked to become involved in seem from the outset not to be practical or even possible. He is thankful that customers and potential customers arrive at SPI’s doors with such inquiries, partly, he said, because it means that SPI’s researchers have to think deeply against the background of the company’s long history and understanding of the science and principles behind how adhesive is applied and what happens when it is applied. In doing so, even challenging goals can be achieved, sometimes by approaching the challenge in a different way from that originally proposed by a customer.

SPI has long operated on the basis of equipment modules from which it can build customized systems for different manufacturers. Now it is concentrating on building more intelligence into its equipment to extend the range of customization that it can offer while, at the same time, moving toward the goal of many manufacturers—increasing automation of their processes and decreasing the need for human intervention. Roxborough said that some of these ideas are coming from outside the tobacco industry—from the automobile industry, where sensor technology reports back on the status of an engine, and even from the home, where lights and drapes can be automatically controlled.

SPI has long operated on the basis of equipment modules from which it can build customized systems for different manufacturers. Now it is concentrating on building more intelligence into its equipment to extend the range of customization that it can offer while, at the same time, moving toward the goal of many manufacturers—increasing automation of their processes and decreasing the need for human intervention. Roxborough said that some of these ideas are coming from outside the tobacco industry—from the automobile industry, where sensor technology reports back on the status of an engine, and even from the home, where lights and drapes can be automatically controlled.

Leverick generally welcomes such trends because he believes that progress comes from pushing the boundaries of technology, though he cautions that there are limits to what can or should be done, partly because of the costs involved. He said that part of the latest drive for automation is happening because, with the development of new types of products, designers are starting with a clean sheet of paper; but he added that, inevitably, some of the advances will find their way back into more traditional processes.

If there is a negative side to these developments, it is that it is difficult to predict what will happen in the future. Some of the new products will work, while others will fall by the wayside, and the only way to handle the current situation is to remain flexible, according to Leverick.

But SPI has another advantage beyond its flexibility. Last year, it was acquired by ITM, which Leverick described as a progressive company prepared to plow money back into development, resources and people while allowing SPI to continue to be creative. It is also ethical in its approach to the environment.

Being part of the ITM Group has increased SPI’s exposure and credibility, especially in areas beyond combustible tobacco products, and it has allowed the company to become more closely involved in development projects. Roxborough said that ITM had opened doors, which meant, in part, that SPI was often invited to join a project on the ground floor, from where, knowing what the ultimate goal was, it could help steer the project rather than follow in its wake. The acquisition came at an exciting and opportune time, she added.

The acquisition has also helped SPI widen its horizons so that it is now involved in projects that leverage its tobacco industry-garnered expertise but that have nothing to do with the tobacco industry. One project, which SPI is unable to talk about yet but which it says has been driven by environmental issues, seems particularly interesting. It has used its cigarette industry adhesive application expertise to improve an old, nontobacco industry process for manufacturing products in what is said to be a revolutionary way. SPI has promised more details in the future.