Tipping papers are becoming ever more sophisticated.

TR Staff Report

As consumption of combustible cigarettes continues to slide, demand for cigarette components has dropped accordingly. The global market for tipping base papers is about 4.2 billion square meters today, compared with 4.7 billion square meters in 2013, according to the Tann Group, a leading supplier headquartered in Austria.

Yet, even as volumes shrink, the outlook for tipping papers in terms of value is more positive. Cigarette manufacturers’ increased focus on product differentiation, branding and innovation has shifted demand within the segment toward more sophisticated solutions. Tipping paper suppliers may ship less product overall, but what they sell tends to carry higher margins.

Part of this development is driven by cigarette manufacturers’ product innovation. The rise of heat-not-burn (HnB) products, such as iQOS, Glo and Lil, has generated demand for new types of tipping paper. These papers must meet different technical specifications than those designed for conventional cigarettes, but their role in product differentiation is the same. “As with conventional cigarettes, it all comes down to branding and making the product somehow unique,” says Michael Lindner, technical service manager at the Tann Group.

Fierce competition in the category of next-generation products has prompted customers to demand high levels of confidentiality from their suppliers, however. Bound by strict nondisclosure agreements, the suppliers that contributed to this article were not at liberty to reveal details of their HnB tipping papers.

The move toward more sophisticated tipping papers is also driven by regulation. Greater restrictions on tobacco packaging, in the shape of plain packaging, for example, have left the cigarette as the only platform for consumer communications in many markets. “As regulations for packaging are changing, tipping papers have become the medium for differentiation and marketing,” says Michaela Ehrmann, sales manager at Glatz Feinpapiere, a prominent tobacco paper supplier based in Germany. “It becomes more and more evident that the product is not the pack but the cigarette as such,” echoes Florian Elsigan, sales manager at the Tann Group.

Indeed, suppliers today offer customers a great variety of tipping papers to differentiate their cigarettes. Whereas plain cork used to be pretty much the only option, tobacco companies can now choose logo cork, cork-on-white designs, multicolored tippings, half-tone tippings, metallic/pearlescent coatings, hot-foil tippings and printed designs on colored base papers, among other varieties. There are even products that deliver multisensory experiences, with special surfaces appealing to the sense of touch and pleasant aromas catering to the sense of smell, for example.

Together, these options allow cigarette makers to create truly unique products in a crowded marketplace. “In the end, it is down to the combination of colors, varnishes, logos and other design features of the brand,” says Elsigan.

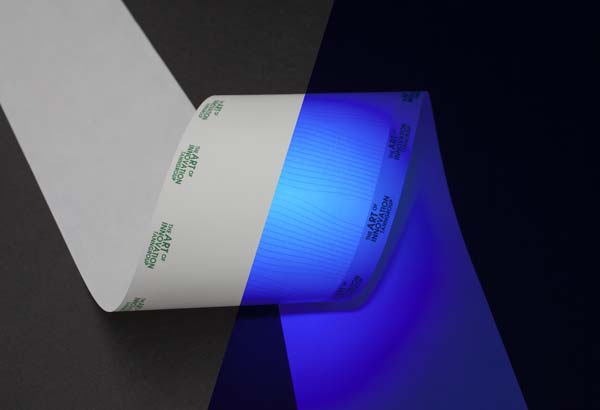

Increasingly, tipping papers are also used to protect the product against brand piracy. “We are regularly asked by cigarette manufacturers whether we can offer superior security features,” says Elsigan. Commercially well-established examples of such technologies include special-effect printing featuring color changes/shifts; thermo-chromic and UV active (fluorescence) functionalities; complex hot-foil stamping elements with micro-embossing; haptic and tactile tipping; and tipping variants comprising extraordinary substrates such as biodegradable transparent and translucent materials. Often, it’s a combination of such features that offers the best protection.

Rising cost

In the meantime, suppliers of tipping papers have been wrestling with rising energy prices and expensive raw materials. The cost of pulp—paper manufacturers’ most important input—has exploded over the past two years, reaching historical peaks. Driven by unforeseen stoppages at some large suppliers and ferocious demand from China, the price of pulp has risen by some 40 percent since the beginning of 2017, according to Glatz Feinpapiere. While the rapid increases appeared to have leveled off in early January 2019, market experts expect them to remain high for the foreseeable future.

Needless to say, this development has had a significant impact on tipping paper manufacturers’ businesses. Unable to fully pass on the increased cost of production to their customers, they have been forced to critically review their operations, identifying possibilities for efficiency increases through automation and effective supply chain management, for example. While acknowledging the challenges, the Tann Group believes the current environment also presents an opportunity: to dig deep and question established ways of doing things. Such probing can lead to new, valuable insights.

Tipping paper suppliers in Europe were also affected by drought in 2018, according to Glatz Feinpapiere. Low water levels in major rivers meant shipments that normally went by boat had to be diverted to trucks, which is more expensive. (Glatz is fortunate in that it receives pulp by rail on its own tracks.) The drought also caused crop failures, leading to a shortage of starch, a natural additive in the papermaking process. Multiyear contracts with customers meant the suppliers had to largely absorb such unexpected expenses.

Climate change means manufacturers may have to cope with extreme weather patterns more frequently in the future. Eager to minimize their environmental impact, tipping paper manufacturers place strong emphasis on the sustainability of their operations. “We truly believe that you can only act long term if you act sustainably,” says CSR Responsible Helena Macku from the Tann Group. Both the Tann Group and Glatz Feinpapiere hold various certifications recognizing the sustainability of their industrial and forestry operations. The Tann Group says it was one of the first tobacco paper suppliers to report on its activities following the guidelines of the Global Reporting Initiative. Glatz Feinpapiere is especially proud of its ISO 50001 certification, given that paper production is an energy- and water-intensive process.

In the meantime, the industry continues to invest to increase productivity and provide customers with cutting-edge solutions. Over the past three years, the Tann Group has invested almost €20 million ($22.8 million) in new machinery and upgrades to existing equipment. It has been replacing printing presses and slitting machines while installing new web inspection systems. The company has also built a state-of-the art factory in China to further strengthen its position as a leading supplier of tipping paper to the world’s largest tobacco market. Going forward, the Tann Group plans to optimize internal logistics and packaging as well.

Glatz Feinpapiere, meanwhile, has been implementing a new enterprise resource planning system, which was scheduled to go live in January. It has been streamlining its processes and evaluating its production flows to improve efficiencies. The company has also equipped its tipping base paper production line with a new press section so as to improve the processability and printability of its paper rolls. Over the past year alone, Glatz Feinpapiere has invested about €10 million into its operations.