Famous for its resilience in times of crisis, the tobacco industry may be facing its toughest challenge yet in the coronavirus pandemic.

By Stefanie Rossel

During past major global crises, the tobacco industry gained a reputation for being recession-proof or at least recession resilient. From the financial meltdown of 2008, which led to a worldwide economic recession, the three leading international cigarette manufacturers, Philip Morris International (PMI), British American Tobacco (BAT) and Japan Tobacco (JT) emerged as winners; while companies in other sectors were struggling, they achieved record sales.

This time, as the coronavirus pandemic progresses and the outcome of the crisis remains uncertain, confidence appears to prevail too. In a research note quoted by Business Insider in late March, Jefferies analysts said that the outbreak could even encourage smoking as people confined to their homes struggle with boredom and depression.

They may have a point—witness the reports on panic buying of tobacco products in various countries. During its capital markets day on March 18, BAT declared it had seen no material impact from the Covid-19 crisis yet as consumers continue to make purchases even in harder hit countries. The company maintained its forecast of 3 percent to 5 percent constant currency adjusted revenue growth.

The forecast robustness may persist for the big players and their core business of combustible cigarettes. Even temporary production stops, such as those at Altria’s cigarette factory in Richmond, Virginia, USA, and PMI’s facility in Bologna, Italy, which makes 50 percent of the company’s IQOS heat-not-burn units, may end up merely denting the companies’ annual results. For other stakeholders in the tobacco industry, however, things may turn out differently as the coronavirus spreads. It’s difficult to imagine that smaller players will be able to weather extended factory closures as well as their bigger counterparts

A different animal

Unlike the 2008 crisis, which was limited to the financial sphere, the outbreak of Covid-19 has reached into every aspect of life, affecting health, personal freedoms and the ability to travel, regardless of geographical location or social status. The total economic damage is yet to be determined.

In the light of the unprecedented dimensions of the outbreak, companies such as Scandinavian Tobacco Group (STG) have become cautious. In mid-March, the Danish manufacturer of cigars and pipe tobacco suspended its full-year guidance for 2020, arguing that the measures to fight the coronavirus had disrupted tobacco purchase and consumption patterns.

“This leads to a situation where we have significantly less transparency on consumer behavior and consumption, and retail customers are changing behavior as they try to respond to the constantly changing environment,” STG said in a press release. “As the situation develops from day to day in countries around the world, we are currently unable to accurately assess the short-term impact of these developments on our business.”

Like its competitors, STG may experience supply issues at some point. In mid-March, several Central American countries, including Honduras and the Dominican Republic where many cigar companies have factories, closed all “nonessential” businesses, shutting down all industries except health and food. Closures were announced as temporary, and cigar companies emphasized their large inventories, but what makes the current crisis so extraordinary is that no one can predict when it will be over.

Impact on supplying industries

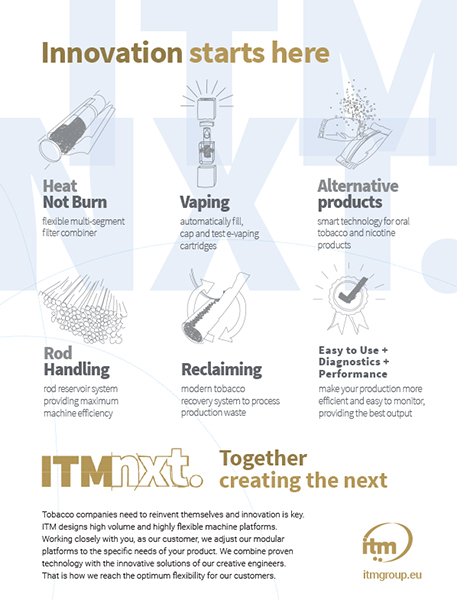

With shutdowns in most countries, suppliers of nontobacco materials and tobacco manufacturing equipment are likely to be hit too. One of the hardest hit countries, Italy, is home to several prominent tobacco machinery manufacturers. In late March, the government expanded the mandatory closure of nonessential commercial activities to heavy industry.

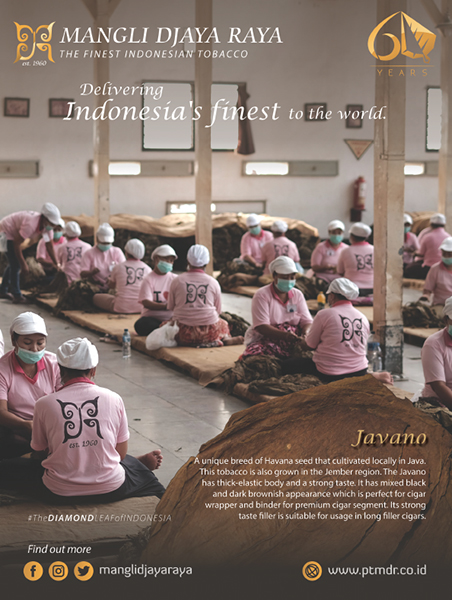

What the coronavirus crisis will do to the livelihoods of tobacco farmers, many of whom live in developing countries, is anyone’s guess. Growers who sell at auction are likely to be hit harder than their counterparts who contract with buyers directly. Because auction floors are crowded places that don’t lend themselves to “social distancing,” several tobacco-cultivating countries have delayed the marketing season.

In the Indian state of Andhra Pradesh, thousands of farmers were worried as an ongoing tobacco purchase auction in Prakasam was suspended for 10 days. They feared that their tobacco bales might spoil in the meantime. Many of the district’s tobacco farmers had hoped to export their produce to China, but most buyers didn’t show up. India is expected to be hit exceptionally hard by the coronavirus crisis. In early April, the World Bank approved a fast-track $1 billion Covid-19 emergency response and health systems preparedness project.

Malawi and Zimbabwe postponed the opening of their tobacco marketing seasons, which normally kick off in spring. Malawi banned gatherings of more than 100 people and closed auction floors on March 26. The country’s Tobacco Control Commission (TCC) and the tobacco industry agreed to observe the situation for at least one month before deciding whether to resume sales. The Tama Farmers Trust cautioned that rescheduling the marketing season would be disastrous for the local economy, and on April 6, Malawi President Peter Mutharika ordered tobacco markets to be opened and allowed to operate without disruption.

According to the Foundation for a Smoke-Free World, Malawi is the world’s most tobacco dependent country, despite being only the 13th producer by weight in 2016. In 2019, the country earned an estimated $345.5 million in foreign exchange from leaf exports. In 2017, raw tobacco represented 71.3 percent of the country’s total exports, according to the Observatory of Economic Complexity. Zimbabwe also relies heavily on tobacco, with leaf exports representing 5.5 of its gross domestic product. At the time of writing, the country’s Tobacco Industry Marketing Board planned to open auction floors on April 22.

Vaping in times of Covid-19

The impact of the current pandemic will also differ from that of the financial crisis because the tobacco industry has changed significantly since 2008. As global cigarette volumes have fallen, reduced-risk products such as e-cigarettes and heated-tobacco products have gained traction. Adult smokers have taken to vapor devices in large numbers in order to wean themselves off combustible cigarettes, thus creating large vapor markets in the U.S. and Europe. While scientists, meanwhile, more or less agree that e-cigarettes are safer than combustible cigarettes, the sector’s image suffered a blow last year when the U.S. saw an outbreak of vaping-related diseases. Sales of e-cigarettes contracted worldwide although it was quickly determined that the illness was caused by illegal e-liquids containing tetrahydrocannabinol (THC) and there were no similar incidents in other markets where vapor products are subject to stricter regulations.

The coronavirus pandemic could similarly deter sales as governments are forcing retail outlets to close to prevent the spread of Covid-19. The definition of an “essential business” differs from country to country.

Interestingly, New Zealand, a country with strict tobacco control measures and the intention to become smoke-free by 2025, permitted Imperial Brands’ cigarette factory to continue production even as it forced vape shops, bakers and butchers to close. The prime minister justified the decision by arguing that Imperial Brands supplied supermarkets, which were allowed to remain open.

Even the U.K., normally a beacon of tolerance when it comes to vapor products, treats vape shops as nonessential in the current crisis. In Germany and the United States, the decision to close or open vape shops is made at the state level.

Italy, which initially also forced vapor stores to close, revised its decision. In some European countries, including Austria, Belgium, Bulgaria, Hungary, Poland and Portugal, buying vapor products online is no longer possible as distance sales have been banned, Ecigintelligence reports. Consumer rights organizations and trade associations have urged governments to exempt vape shops from lockdowns, fearing a relapse to smoking as vapers will not be able to meet their basic needs and have access to specialist advice. Vapor advocates argue that vape shops offer a valuable public health service at a time of stress and uncertainty.

While sales channels are partly affected, supply shortage may become another issue for the global vapor sector. China manufactures about 90 percent of the world’s vapor hardware. Most of production takes place in Shenzhen and was disrupted when China restricted worker movement in February. By March 25, factories had resumed most of their operations, saying they were implementing new standards and processes to keep employees and customers safe.

Tobacco’s untapped potential

Meanwhile, the coronavirus crisis has presented tobacco control activists with another stick to bash the industry. When Greece’s leading cigarette manufacturer Papastratos donated 50 ventilators to a hospital, the move was criticized as “a shameful publicity stunt” by the U.K. anti-smoking organization Action on Smoking and Health (ASH).

Several studies were released that found that smokers and vapers were at a higher risk of contracting Covid-19 than nonsmokers. Although the correlation between vaping and the course of coronavirus infections was refuted by Konstantinos Farsalinos and others, the studies were reproduced by media all over the world and prompted a group of doctors in the state of New York to ask for a temporary ban on the sale of tobacco and vapor products. Apparently unaware of the low chances of smokers successfully quitting cold turkey, the doctors hoped that acting quickly to reduce smoking would significantly reduce the number of patients who contract the virus and need to stay in a hospital or breathe with the help of a ventilator.

South Africa went even further and banned the sale of cigarettes during its 21-day lockdown. Drug policy nongovernmental organizations and BAT have urged the government to lift the ban, saying it would force smokers to leave their neighborhood in search of outlets willing to defy the ban, thereby bringing about greater movement of people and more interactions apart from possibly boosting illicit trade.

The pandemic, however, also presents an opportunity for the tobacco industry. Two biopharmaceutical firms associated with leading cigarette companies have entered the race to create a Covid-19 vaccine.

Medicago, which is partially owned by PMI, is using a virus-like particle grown in Nicotiana benthamiana, a close relative of the tobacco plant, to develop a vaccine against the coronavirus. In late March, Medicago announced that it was ready to begin preclinical testing for safety and efficacy. The company estimated that human trials would begin this summer.

BAT subsidiary Kentucky BioProcessing (KBP) is involved in a similar effort. To produce the potential vaccine, KBP cloned a portion of Covid-19’s genetic sequence and injected it into tobacco plants, which developed a potential antigen, the company stated in a press release. The antigen was then inserted into tobacco plants for reproduction, and once the plants were harvested, the antigen was purified.

BAT is exploring partnerships with government agencies to start clinical studies as soon as possible. Through partnerships with third-party manufacturers, the company envisages to manufacture between 1 million and 3 million doses per week. While KBP remains a commercial operation, BAT stated, the intention is that its work around the Covid-19 vaccine project will be carried out on a not-for-profit basis.