Where next?

Illicit cigarette trade causes an annual worldwide revenue loss that is estimated at $40 billion to $50 billion, which means that about 600 billion cigarettes, or 10 percent of global consumption, comprises illegal product.

The European Union (EU) is one of the major targets, with illicit cigarette consumption in 2019 amounting to 38.9 billion cigarettes, or 7.9 percent of all cigarettes smoked in the region. With €7.8 billion to €10.5 billion per year, the profit of illicit cigarette trade is comparable to that of the cocaine or heroin markets, making it a “crime enabler” and financer of organized crime and terrorism.

Over the past years, the nature of illicit cigarette trade has changed: The countries of origin are increasingly located in the Middle East. Today, the fakes are primarily cheap whites manufactured closer to their destination markets, with the number of illicit factories in the middle of Europe having risen significantly.

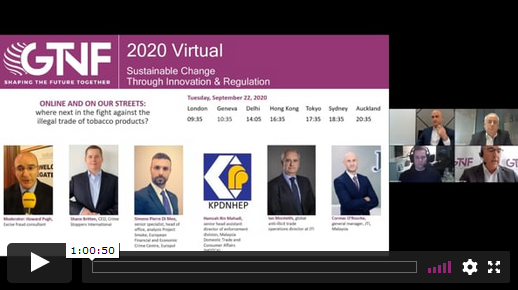

In response to this trend, Europol has adapted its structure. The EU law enforcement agency now works closely with liaison bureaus in all EU member states, according to Simone Pierre di Meo, senior specialist, head of office and project manager of Analysis Project Smoke at the European Financial and Economic Crime Centre for Europol.

As the cash flow generated by illicit trade activities is huge, Europol has come to focus on tracking the money. In June, the agency launched a European economic and financial crime center that is aimed at strengthening the cooperation between EU member states to promote the consistent use of financial investigations to combat illicit crime.

In the fight against contraband cigarettes, getting the support from the public is essential. The nongovernmental organization (NGO) Crime Stoppers International supports law enforcement efforts to prevent and solve crime by mobilizing citizens to anonymously share information about suspected illegal activity. According to CEO Shane Britten, the organization will, over the next 12 months, focus on raising governments’ awareness of the links between illicit trade syndicates and groups involved in criminal activities, such as human trafficking, wildlife smuggling or terrorism.

Attempts to curb smoking through disproportionate tax increases has provided fertile ground for illicit trade. Malaysia provides a cautionary tale: As of August 2020, 65 percent of the country’s tobacco market was illegal, according to Cormac O’Rourke, general manager of Japan Tobacco International (JTI) Malaysia.

Before a significant tax hike in 2015, contraband cigarettes accounted for around 35 percent of the market; since then, the country has become the country with the world’s least affordable legal cigarettes. A sophisticated system of illegal syndicates, which have been able to infiltrate state agencies, has made it difficult to tackle the problem. Illicit cigarette trade costs the Malaysian government approximately $1 billion in lost tax revenues annually. The country has a coastline of almost 4,700 kilometers. Most illegal cigarettes are brought into Malaysia on container ships from countries such as Indonesia, China and Vietnam.

Declared as nontaxable transshipment goods destined for a third country, they are not examined by customs. Instead of being shipped to their destinations, however, the smokes are smuggled into Malaysia. The practice is called transshipment. To address the long-standing issue, Royal Malaysian Customs in January 2020 established a multi-agency task force, which has paved the way for a public-private sector partnership.

The Covid-19 pandemic is likely to further aggravate the global cigarette contraband situation. A report commissioned by JTI, which was conducted across 50 countries where tobacco smugglers currently have a strong presence, found that the global public health crisis and financial downturn has contributed to a “perfect storm” where organized criminal groups will further exploit public demand for cheap goods and capitalize on dwindling buying power in the impending global recession, particularly in countries with high tax regimes.

As Ian Monteith, JTI’s global anti-illicit trade operations director, pointed out, criminal gangs were biding their time in readiness for an anticipated boom in illegal tobacco sales. They then quickly exploited the inconsistent approach to travel and lockdown rules and found alternative routes from production to distribution, and they used the limited supply in legal cigarettes brought about by changed law enforcement priorities and border restrictions.