Thoughtful Reflection

- GTNF Print Edition

- November 1, 2020

- 0

- 1

- 33 minutes read

The first virtual GTNF was a resounding success. More than 1,650 delegates from at least 51 countries logged in to participate in the conference. Over the course of four days, and in three times zones, regulators, public health officials and industry representatives shared their views on “Sustainable change through innovation and regulation.” Following is a sampling of the keynotes and panel discussions.

Kingsley Wheaton: “A whole of society approach to policymaking”

British American Tobacco’s (BAT) Chief Marketing Officer Kingsley Wheaton called for meaningful change in the way that global tobacco and nicotine policies are developed. He stressed the need for a United Nations-style “whole of society” approach to policy development and emphasized the benefits that this more inclusive tobacco harm reduction approach could deliver. BAT’s purpose, he said, is to build “a better tomorrow” by reducing the health impacts of its business.

Earlier this year, the company announced a bold aim: to have 50 million consumers of noncombustible products by 2030. To this end, BAT has invested substantially in “a range of vibrant new noncombustible categories for adult consumers,” according to Wheaton. Its portfolio of potentially reduced-risk products now comprises vapor, tobacco-heating and modern oral offerings.

Innovation is focused not only on products but also on how BAT engages with consumers. Wheaton said the company has rapidly adopted new technologies and digital capabilities in consumer markets. In the U.S., for example, BAT recently launched a vapor subscription service. After just three months, subscribers accounted for half of the company’s U.S. e-commerce revenue.

BAT’s new products have clearly resonated with consumers. In 2019, noncombustibles reached 10 percent of group revenues, with the growth in volume and value shares continuing to accelerate in all three categories. Just five years after launching Vype in the U.K., nearly a third of BAT’s revenue in that market is now from vapor products. In Japan, Glo now accounts for nearly half of the group’s business.

However, said Wheaton, growth would have been even more dramatic had more policymakers around the world supported the company’s new category development with proportionate, risk-based regulation. “Many significant markets remain in ‘regulatory lock,’” he said.

The central question, according to Wheaton, is how to accelerate acceptance of tobacco harm reduction as a genuine public health policy—just as it is recognized within the WHO Framework Convention on Tobacco Control (FCTC) and by the U.S. Food and Drug Administration (FDA). “This is not a debate of us versus them but rather about evidence, education and the science underpinning tobacco harm reduction,” he said.

Wheaton insisted the industry should be part of the debate. Worldwide, 1.1 billion people consume tobacco and nicotine products. “To exclude manufacturers from that conversation is like cutting off one’s nose to spite one’s face,” he said.

Yet the WHO continues to believe that the tobacco industry cannot be a partner in effective tobacco control, advocating for tobacco companies to be excluded from any dialogue with government. Wheaton called this a paradox. “How can this approach and Article 5.3 of the FCTC realistically be implemented when the largest cigarette manufacturer on earth is wholly owned by a WHO member state?” he said, referring to the treaty’s provision against tobacco industry influence on policymaking and the fact that the China National Tobacco Corp. is a state monopoly.

“We need a system that acknowledges the expertise and the ambition of companies like BAT to deliver a better tomorrow—one that is clear about harm caused by smoking yet recognizes more holistically and consistently where the real public health gains can be made, by actively supporting consumer choice and the role of tobacco harm reduction,” said Wheaton.

Despite the challenges, Wheaton was confident that role of combustible products in BAT’s business would continue to decline. “People will gradually forget what the ‘t’ in BAT stands for,” he predicted. The company’s goal is to meet the consumer needs that combustible cigarettes historically satisfied—socialization, connectivity, concentration and relaxation. “Those needs can be met by alternative nicotine solutions in many ways, so we’ll see a burgeoning of innovation and categories as we grasp how to meet those underlying consumer needs that smoking has historically met.”

Panel: The future of nicotine

There are several reasons why people use nicotine. According to Neal Benowitz, professor of medicine, biopharmaceutical sciences, psychiatry and clinical pharmacy at the University of California San Francisco, those reasons include pleasure, stimulation and mood modulation. However, many users don’t understand the adverse effects and risks associated with different delivery mechanisms.

There are several reasons why people use nicotine. According to Neal Benowitz, professor of medicine, biopharmaceutical sciences, psychiatry and clinical pharmacy at the University of California San Francisco, those reasons include pleasure, stimulation and mood modulation. However, many users don’t understand the adverse effects and risks associated with different delivery mechanisms.

“Clearly, the decision involving long-term use of the drug for individuals or society depends, at least in part, on adverse health effects. For example, the casual use of cocaine or heroin are discouraged by society because they are hazardous to health,” explains Benowitz. “We know nicotine, per se, is much less hazardous than cigarette smoking, regardless of potential health concerns. That’s a successful argument for electronic nicotine-delivery systems [ENDS].”

Benowitz said that one of the major questions surrounding tobacco control is whether society can accept nicotine use if the harms were reduced. He says that possibility exists. “The FDA can be a big part of making this happen … there is a misconception surrounding the harm of nicotine compared to combustible products,” which are more deadly than ENDS.

While acknowledging the validity of Benowitz’ point, Michael Cummings, professor of psychiatry and behavioral sciences at the Medical University of South Carolina, cautioned against the unintended consequences of regulation. Banning a specific delivery mechanism for nicotine, he said, presents a risk. Cummings referred to the FDA’s vision, formulated in 2017, of a world where cigarettes would no longer create and sustain addiction and where adults who need or want nicotine could get it from less harmful alternative sources.

“But it seems like we’re going the wrong direction … If we adopt regulations to ban the sale of vaping products as some states and many countries around the world have done, what would be the effect? Well, the effect is that cigarette sales will go up,” said Cummings. “That’s a bad thing. Regulating vaping products like they’re cigarettes—which they’re not—banning flavors, banning internet sales … [these actions] would have a detrimental effect of actually driving up cigarette sales to the detriment of the lower risk products.”

Also speaking during the GTNF panel, Clifford E. Douglas, director of the Tobacco Research Network and an adjunct professor of health management and policy at the University of Michigan School of Public Health, said that consumers clearly need a much better understanding of the true nature, including the relative risk, of different tobacco and nicotine products.

“This includes the fact that nicotine is the root cause of the epidemic of tobacco-related illness and death because it hooks in smokers and keeps many smoking who otherwise would quit,” he explained. “While complete information on all the potential risks and benefits of [vapor products] is not yet available, there is sufficient information … to end deadly combustible tobacco use, [which is] responsible for approximately half a million deaths a year and 30 percent of all cancer deaths in the United States.”

Asked by moderator Clive Bates, director of Counterfactual Consulting, whether there was a regulatory environment possible that incorporated the relative risk of the different types of nicotine-delivery systems, Stefanie Miller, managing director of FiscalNote Markets, said, “no.”

“[There is] no trust among the general public for companies that produce a product containing nicotine, and that is largely based on a misconception around the difference between nicotine and combustible tobacco use,” she said. “After predatory behavior and negligence of tobacco companies in the 20th century, most people see this as very black and white. Tobacco companies are bad, and anti-tobacco efforts are purely good,” said Miller. “I think [everyone] who’s tuned in right now knows that the situation is far more nuanced and … the regulations are not accommodative of that nuance.”

Benowitz says that another major problem with the message on less-risky nicotine products is that there is very little science on the long-term effects of ENDS products. “We have an array of new products, any of which are inhalable,” he said. “We have a lot of short-term data that is promising in terms of reduced exposure in the short term, but we really don’t know about the future long-term consequences.”

Miller added that cigarette manufacturers could help change the misconceptions surrounding nicotine. It’s the large manufacturers who could make it a goal to end combustible nicotine-delivery systems. “If you’re really clear about setting a strategic goal, and then you do everything possible to accomplish it, you’re more likely than not to win,” she said. “I think that this is [an] important enough [goal] to try.”

Benowitz said that regulators need to help consumers better understand that the regulators support a shift to less-risky products. He says that only then can the goal of getting rid of combustible products be accomplished.

“We’re not doing this because nicotine is bad,” he said. “We’re doing this because nicotine sustains harmful cigarette smoking … there are other products that [can deliver] nicotine that are much less harmful.”

Suzanne Wise: Achieving sustainable growth

Suzanne Wise, senior vice president of corporate affairs and communications at Japan Tobacco International (JTI), considered the question of how to achieve sustainable growth.

Understanding consumers is the key to success, she said—but the way people consume is changing rapidly and accelerated by the Covid-19 crisis. To meet the challenge, JTI has been moving from a highly centralized model to a more decentralized one. This allows the company not only to increase speed to market but also helps it put the consumer at the center of its transformation.

She cited the example of Germany, where JTI sells Winston-branded tobacco in buckets for make-your-own (MYO) consumers. Mindful of consumers’ increasing sensitivity about plastic waste, JTI reengineered its packaging. The Winston bucket now uses 16 percent less plastic than before without comprising on convenience or consumer appeal.

While 16 percent may not sound impressive, it translates into 78 tons of plastic that has been taken out of the packaging of one product line in one country every year, according to Wise. “It’s a big deal,” she said.

Wise noted that JTI’s ability to achieve meaningful and sustainable growth relies on three pillars: its ability to innovate, a sensible regulatory environment and consumer acceptance of new products. Data and behavioral insights confirm that while some consumers are interested in reduced-risk products (RRPs), the majority still want to buy traditional tobacco products. Despite the rapid growth of next-generations products, cigarettes still accounted for 86 percent of total global tobacco sales by value in 2019. “That means we must innovate for both RRPs and combustibles,” said Wise.

In 2019, JTI ranked among the Top 100 companies for European patent applications filed. While many filings were for RRPs, 60 filings focused on combustibles, covering areas such as packaging, filters and flavorings. The company has also invested in agronomy, developing new seed varieties to increase crop productivity, lower the levels of certain undesirable constituents and benefit growers, for example.

Wise then stressed the importance of a balanced regulatory framework, one that protects consumer choice, encourages rigorous quality standards while maintaining a level and competitive playing field. “Less regulation can lead to more innovation but also encourages inappropriate risk-taking,” she said. “When that comes at the cost of quality and safety, the negatives outweigh the positives.”

She cautioned that in the absence of a robust regulatory framework, there was no place for short-term opportunism. “Otherwise, we risk putting off consumers, destabilizing the industry and attracting knee-jerk regulation to counterbalance the actions of those looking for a quick return,” she said. Wise pointed to California, which recently became the second U.S. state to ban flavored tobacco and vapor products—a political decision with no scientific basis that risks fueling illegality, she said.

The industry’s ability to innovate is tempered by consumer acceptance of new products, Wise noted. She cited several innovations, including early smokeless cigarettes in the late 1980s, which, for a variety of reasons, failed to take off. She stressed the importance of consumer choice and the ability of adult consumers to make informed decisions. “It is counterproductive for government to prevent the industry from sharing information about their products and then making decisions on behalf of consumers and not treating them like adults,” she said.

Last year’s Evali crisis in the United States demonstrated how vulnerable the industry is to misinformation, according to Wise. A mysterious outbreak of lung illness spawned a media frenzy—“cat nip for the media,” as Wise put it—and a severe regulatory backlash, with authorities restricting vaping before the cause had been determined. Evali was later attributed to vitamin E acetate in THC products sold through informal channels, but by that time, the damage had been done. Nielsen figures showed a staggering 25 percent drop in global retail vapor sales in the months following the crisis.

While acknowledging that standing up for smokers and consumer choice might be perceived as bold in some quarters, Wise insisted it was the right thing to do. “We don’t encourage smoking; we know that it is bad for health,” she said. “We believe in freedom of choice: the right to choose cigarettes or RRPs or to quit. That’s what we mean by a consumer-centric approach; it reflects reality.”

K.C. Crosthwaite: Seizing the historical harm reduction opportunity

K.C. Crosthwaite, chairman and CEO of Juul Labs, described the historic opportunity provided by new technologies for tobacco harm reduction and the barriers that need to be overcome to realize it. “We have today what was never available before: the tools and technology to end the era of smoking,” he said.

K.C. Crosthwaite, chairman and CEO of Juul Labs, described the historic opportunity provided by new technologies for tobacco harm reduction and the barriers that need to be overcome to realize it. “We have today what was never available before: the tools and technology to end the era of smoking,” he said.

It is by now widely accepted that smokers smoke for the nicotine but get sick from the “tar”—the byproducts of combustion. Nicotine is delivered on a continuum of risk, explained Crosthwaite. Traditional cigarettes are by far the most dangerous delivery device because of the tobacco smoke, which is associated with cancer, respiratory illnesses and other diseases. On the other end of the scale are nicotine replacement products that supply “clean” nicotine.

Juul Labs’ Juul system delivers nicotine without burning tobacco, which puts it at the lower end of the risk continuum. This summer, Juul Labs submitted a premarket tobacco product application for its Juul system to the FDA, which, if approved, would allow the company to continue marketing the product in the United States.

Crosthwaite believes the Juul system is “appropriate for the protection of the public health” as required by the FDA. Over the past five years, he said, 2 million U.S. adults have switched completely away from combustible cigarettes using Juul products. At the same time, Crosthwaite acknowledged that harm reduction for adult smokers cannot come at the cost of underage use. Juul Labs has been criticized for contributing to an increase in teen vaping in the U.S. Upon becoming CEO about a year ago, Crosthwaite vowed to “reset” the company. “Juul has learned lessons of past,” he said. “We are now more disciplined and focused on responsible stewardship of products.”

While the possibilities offered by reduced-risk products for tobacco harm reduction are considerable, Crosthwaite warned that the world is at risk of losing the opportunity due in part to the precarious regulatory landscape. Around the globe, regulatory frameworks tip the balance in favor of cigarettes. “One-third of the world population lives in countries that ban nicotine vapor products,” he said. “As a result of these restrictions, and despite being available for more than a decade, vapor products account for 3 percent of cigarette sales worldwide.”

Meanwhile, cigarettes—the riskiest category—are readily available everywhere.

On top of that, many smokers are confused about the risks compared to cigarettes. Misconceptions about these products are at an all-time high, according to Crosthwaite. In some surveys, 80 percent of respondents incorrectly indicated that nicotine causes cancer.

Crosthwaite called for risk-proportionate regulation that would allow reduced-risk products to compete with cigarettes. Among other things, that means they must be able to deliver nicotine levels that are sufficiently satisfying. In that context, Crosthwaite criticized the EU cap on nicotine levels in e-liquids, which he said may inhibit smokers from switching by making e-cigarettes a less appealing option.

Regulatory pathways must include minimum quality and safety standards, he said. But they cannot be so burdensome that they become de facto barriers to market. Crosthwaite called for collaborative action by governments, civil society, public health bodies and industry to realize a risk-proportionate system. “If we get this right, we can accelerate the end of the age of the cigarette,” he said.

Panel: Comparative Regulations: Who is getting it right and ‘WHO’ could be doing better?

The first panel discussion in the GTNF’s Asia time zone compared nicotine regulations around the world. Chris Allen, chief scientific officer at Broughton Nicotine Services, noted that regulation should be driven by sound science, not politics. “That is not always the case,” he said. Regulations, he added, should also be progressive. “They should allow innovation and have the ability to evolve,” he said. “If today’s aviation regulations were in place 100 years ago, air travel as we know it now may not have been possible.”

The first panel discussion in the GTNF’s Asia time zone compared nicotine regulations around the world. Chris Allen, chief scientific officer at Broughton Nicotine Services, noted that regulation should be driven by sound science, not politics. “That is not always the case,” he said. Regulations, he added, should also be progressive. “They should allow innovation and have the ability to evolve,” he said. “If today’s aviation regulations were in place 100 years ago, air travel as we know it now may not have been possible.”

Moderated by RAI Services’ senior vice president of scientific and regulatory affairs, Mike Odgen, the panel explored the question of who is getting regulation right and who could do better. A consensus emerged that while no one was doing everything correctly, some regulatory bodies were doing a better job than others.

Citing 7 million tobacco-related deaths annually worldwide, Derick Yach, president of the Foundation for a Smoke-Free World (FSFW), said the goal of regulators should be to reduce the harm caused by tobacco as quickly as possible. “Governments are failing us,” he said, before singling out some “green shoots” of decent policy decisions. Yach pointed to the EU’s decision to exclude tobacco harm reduction (THR) products from its recently enacted ban on menthol cigarettes; the U.K.’s integration of THR into cessation at the clinical setting and the U.S. FDA’s decision to grant modified-risk orders to IQOS and general snus.

“Yet the World Health Organization, which should be putting it all together, is making little progress,” he noted. According to Yach, THR is part of the definition of tobacco control. The concept featured prominently when work started on the Framework Convention for Tobacco Control (FCTC). “Instead, we are hearing calls for bans on THR products in low-[income] and middle-income countries where the health consequences of combustible products are the harshest,” he lamented.

Trade law consultant Abrie Du Plessis urged tobacco and vapor companies to share their input as the EU starts evaluating novel tobacco products in preparation for its next Tobacco Products Directive (TPD). By May 2021, the EU is required to publish a report on novel tobacco products and propose amendments to the TPD. Enacted in 2014, the current directive does not address the harm reduction potential of such products. The rapporteurs will be looking into the impact of novel products on uptake among young people and nonsmokers and their contribution to cessation, among other issues.

Whatever new regulations the EU adopts may reverberate beyond the single market. According to Du Plessis, the upcoming report is required to consider rules at the international level. However, the Conference of the Parties to the FCTC, which was scheduled to take place this month in the Netherlands, has been postponed to November 2021. As a result, the sequence of events has been overturned; the FCTC will meet after the EU report. “This means the EU may lead the FCTC rather than the other way around,” says Du Plessis.

The panelists agreed that the regulatory processes around the world were too sluggish considering the tobacco-related mortality and morbidity. “If smoking wasn’t killing the number of people it is, it would probably be justified to go about this rulemaking in a very leisurely way,” said Yach. He contrasted the glacial pace for tobacco to the Covid-19 response where “every rule in the book is stripped because this is a fast-moving pandemic.”

“Yet there is no difference between the two except in timing,” said Yach, referring to the death tolls extracted by tobacco use and the coronavirus. “If we took the Covid-19 approach, the goal should be to strip away the regulatory nonsense to get lifesaving products into the hands of people in the quickest, safest possible way. Then we would see progress at lightning speed rather than what is now a trickle.”

Panel: Scientists Talk

The second panel discussion during the 2020 GTNF in the Asia time zone featured top scientists from the leading tobacco companies discussing the role of science in the tobacco and nicotine business.

Moderated by Teo Forcht-Dagi, honorary professor at Queens University, the panel included Maria Gogova, vice president of regulatory sciences and regulatory affairs at Altria Client Services; Ian Jones, R&D principal scientist at Japan Tobacco International; David O’Reilly, director of scientific research for British American Tobacco; and Joe Thompson, chief scientific officer at Imperial Brands.

Asked to identify the most salient scientific issues facing the tobacco and nicotine industries, the panelists named the communication of science and data gaps, among other topics.

Today’s alternatives to combustible products represent an unprecedented opportunity to reduce the risks of smoking, but without consumer trust in the product, the opportunity will not live up to its potential.

Jones summarized the challenge by quoting Anne Roe. “Nothing in science has any value to society if it is not communicated,” the American psychologist reportedly said. “It helps if it’s understandable too,” Jones added, quoting a coworker this time.

Despite the substantial and growing body of evidence that vaping is less harmful than smoking, an increasing number of consumers believes the opposite. Between 2014 and 2016, the share of U.S. adult smokers who perceived vaping as being equally or more harmful than smoking increased from 44 percent to 68.4 percent, according to the PATH study.

Such misconceptions are fueled by flawed studies and sloppy media coverage, according to Thompson. For example, a 2019 research paper erroneously linked e-cigarette usage among adults to heart attacks, generating sensationalist headlines. Its authors were later forced to retract the study, but by that time, the damage in terms of public perception had been done.

O’Reilly noted that most people’s understanding of tobacco and disease is about 30 years out of date, causing them to confuse nicotine with products of combustion. He said it was depressing to see how even many medical and scientific professionals misunderstand the issues, mistakenly attributing cancer and respiratory diseases to nicotine, for example. “It is one thing for the public to struggle with nuances of nicotine toxicology, but the misperceptions of our colleagues in [the] scientific and medical world must be addressed,” he said.

The panelists agreed the industry should step up its science communications and use all available channels (while noting that some channels are off-limits) to get its message across. Jones called on the industry’s communicators to be open, transparent and take the time to understand their audience. “Don’t sit on your pedestal and try to bedazzle everybody,” he said. O’Reilly said the automotive industry provided a good analogy to describe the tobacco industry’s transformation to the public. “Moving away from combustion will benefit public health,” he said.

The panel then turned its attention to data gaps—what we don’t know. A recent review by the Committee on Toxicology that advises the U.K. Department of Health was broadly supportive of vaping but also pointed to the lack of information on the performance of cigarette alternatives over time. This presents a challenge not only because of the sector’s age—many products simply haven’t been around for long enough to conduct epidemiological studies—but also because it is hard to follow people over time. Contrary to the traditional cigarette business where smokers typically stay with the same product and brand for the duration of their smoking “career,” vapers change products frequently, either due to evolving technology or changing preferences. So tracking them is difficult.

While acknowledging the data gap, Gogova said the absence of epidemiology should not be used as an excuse to foreclose tobacco harm reduction opportunity and/or the authorization of modified-risk claims, as doing so would leave the field to combustible cigarettes—the riskiest option.

Despite the relative youthfulness of the vapor sector, O’Reilly said it was time to start considering population-based studies. “We are in a different space today then at the start of the GFNF in terms of science. In a number of countries, the uptake of alternative products has been going on for some time now.”

The panel also pondered the question of how to recruit scientists. Fortunately, the industry’s transformation has made that task easier in recent years. Many scientists are attracted by the opportunity to help reduce the harm caused by smoking. According to O’Reilly, scientists could arguably do more to avoid a billion premature deaths by joining the tobacco industry than by signing up for academia or other sectors. As Jones explained, science is about curiosity, about wanting to learn more, ask questions and pull things to pieces to see how they work. Unlike the situation 20 to 30 years ago when tobacco science had stagnated, the transformation that the industry is undergoing provides all of that.

Encouragingly, all panelists reported that scientists today have a big seat at the table inside tobacco companies’ board rooms. Science is viewed as fundamental, they said. It makes sense: One of the greatest challenges to sustainability for the industry is achieving tobacco harm reduction that is based in sound science. Without science, the industry has no foundation to transform itself and continue its operations.

Panel: One billion voices: Grassroots consumer rights advocacy

The panel discussion “One billion voices” debated the difference consumer advocates can make in promoting harm reduction and risk-proportionate regulatory frameworks. Clarisse Yvette Virgino, member of the Coalition of Asia Pacific Harm Reduction Advocates, provided a powerful example of consumer advocacy in action. The Philippines had originally intended to ban electronic nicotine-delivery systems (ENDS). Through active discussions with lawmakers, consumer groups and their allies managed to avert prohibition.

The panel discussion “One billion voices” debated the difference consumer advocates can make in promoting harm reduction and risk-proportionate regulatory frameworks. Clarisse Yvette Virgino, member of the Coalition of Asia Pacific Harm Reduction Advocates, provided a powerful example of consumer advocacy in action. The Philippines had originally intended to ban electronic nicotine-delivery systems (ENDS). Through active discussions with lawmakers, consumer groups and their allies managed to avert prohibition.

Plenty of challenges remain, however. Philippine law classifies e-cigarettes and tobacco-heating devices as tobacco products, which means they are subject to similarly strict restrictions. What’s more, damaging misperceptions persist, with many inaccurately viewing ENDS as equally or more harmful than cigarettes. The government closely toes the anti-harm reduction line set out by the WHO, and President Rodrigo Duterte has repeatedly made negative comments about vaping.

The situation is worse in India where the government last year banned e-cigarettesand tobacco-heating products, denying the country’s 110 million smokers access to less harmful alternatives. Samrat Chowdhery, president of the International Network of Nicotine Consumer Organizations, bemoaned the exclusion of nicotine consumers from the debate. “Once somebody starts using a tobacco product, their experiences and opinions no longer matter,” he lamented. The ban has spawned a thriving black market—but without the quality controls that were in place previously, according to Chowdhery. It has also driven many vapers back to smoking.

India’s hostility to harm reduction extends to oral products. The country boasts a huge smokeless market with offerings such as gutka and pan masala. As Chowdhery points out, however, not all smokeless tobacco products are created equal; the segment has its own risk continuum, with snus and modern oral products at the low end of the scale and Indian smokeless near the top. “Indian smokeless is extremely deadly,” he says. “It is linked to about 350,000 premature deaths annually.”

The availability of less unhealthy smokeless alternatives should make India ripe for substitution. “Unfortunately, Indian tobacco control is trying to conflate risk, using the example of Indian smokeless to claim that all smokeless tobacco products are bad,” said Chowdhery. The other obstacle is price: Indian smokeless is extremely cheap—cheaper even than bidis, the most used form of smoked tobacco in India. “So if you look at converting gutka and pan masala users, then the price point has to be where consumers can afford it,” he said.

The panel debated the challenge of communicating the benefits of cigarette alternatives. Heneage Mitchell, director of Factasia, said his organization was constantly struggling to counter misinformation. Erroneous headlines depicting vaping and smoking as equally harmful have a huge impact, he said, but it is difficult to get publishers to retract their stories. And unlike their adversaries, vapor advocates have limited resources. “They have billions; we have pennies,” said Mitchell, comparing his finances with those of the WHO and Bloomberg Philanthropies. Lacking budgets, consumer advocates are relying on social media to make their voices heard—but the way those platforms are designed means that activists are often finding themselves in echo chambers, preaching to the choir. “There is no magic bullet,” Mitchell said.

Making matters worse, some 50 percent of the world’s tobacco production is controlled, through whole or partial stakes in tobacco companies, by governments that have signed the treaty. “That makes the FCTC an institutional tobacco trader lobby,” said Chowdhery. Tellingly, when Canada and the EU in 2018 supported making the FCTC proceedings transparent, they were countered by countries such as Thailand and India, which have substantial interests in their tobacco industries.

Despite the formidable obstacles to harm reduction, the panelists took heart from the fact that consumers are becoming more vocal. The personal experience with lifesaving devices has made many eager to speak up. Chowdhery said he was encouraged to see how many so-called experts are now facing pushback from consumers who are “calling bullshit.”

Moderator Alex Clark, CEO of the U.S. Consumer Advocates for Smoke-Free Alternatives Association, and Australian tobacco harm reduction advocate Andrew Thompson urged vapers and their supporters to leverage their power as voters. “Tobacco control needs to get off the tracks and get on the train,” said Thompson.

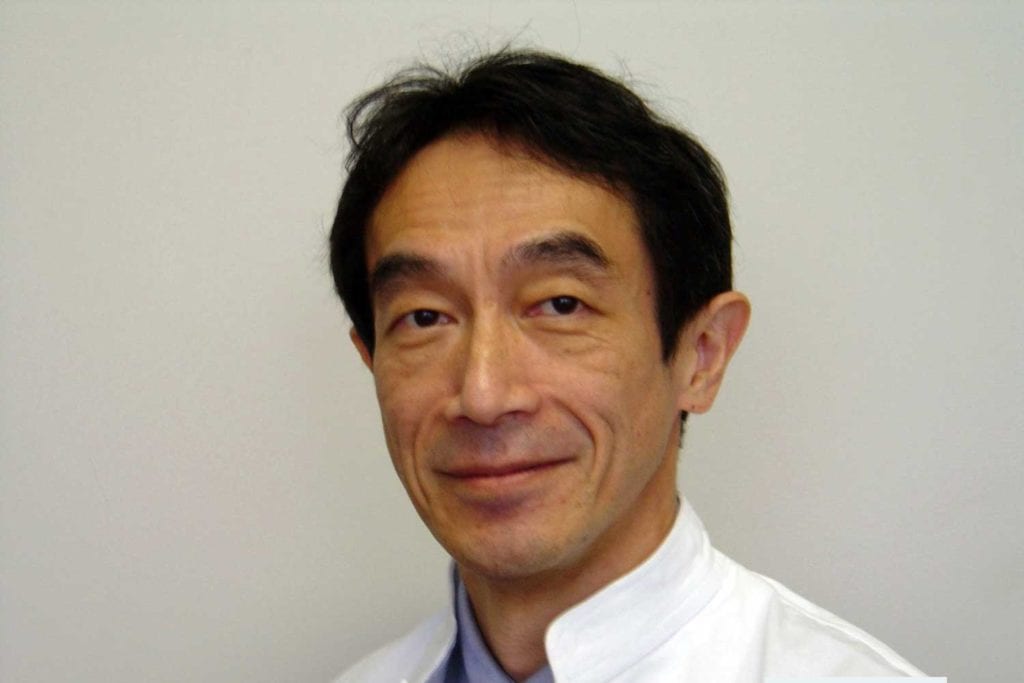

Hiroya Kumamaru: The Japanese experience

Hiroya Kumamaru, a cardiovascular surgeon and vice director of AOI International Hospital in Kawasaki, Japan, discussed the remarkable decline of smoking in Japan following the introduction of heated-tobacco products (HTPs) in 2014.

Smoking is the biggest cause of disease and premature death in Japan, ahead of other prominent causes such as hypertension and diabetes. In 2010, 157,000 people in Japan died from smoking-related diseases, including malignancies and respiratory afflictions.

The economic damage is substantial too. The Japan Health Economics Research Group estimates the annual loss due to smoking at ¥4.3 trillion ($40.81 billion), mainly in the form of lost working hours, cleaning cost, fire safety expense and medical expenditures. This figure far outweighs the positive impact on Japan’s economy of smoking, which the research group puts at ¥2.8 trillion (primarily tax income) per year.

Japan has long struggled with stubbornly high smoking rates. In 1989, more than 50 percent of men and about 10 percent of women smoked, according to the National Health and Nutrition Survey. In recent years, however, the figure has started to come down dramatically. Between 2015 and 2019, domestic cigarette sales decreased from 180 billion sticks to 120 billion sticks—a drop of more than 30 percent. The share of smokers over the age of 20 is now below 18 percent in Japan.

Experts attribute the decline to the introduction of HTPs, which satisfy smokers’ cravings but likely present a lower risk to their health. Kumamaru cited research by Bekki et al. of Philip Morris International’s (PMI) IQOS HTP, which showed that the nicotine concentration in the smoke—the part that provides the satisfaction—was almost the same as that of conventional cigarettes while the concentration of tobacco-specific nitrosamines (TSNAs) and carbon monoxide—components associated with illness—were one-fifth and one-hundredth of those in conventional cigarettes, respectively.

Since their debut in 2014, HTPs have captured 24.3 percent of all tobacco sales in Japan. More than a quarter of Japanese smokers have embraced HTPs, with at least 70 percent using these products exclusively. Among men in their twenties and thirties, more than 50 use HTPs, according to the Japan National Health and Nutrition Survey (2018), which was published in January 2020.

Meanwhile, Japan’s overall smoking rate continues to decline, which suggests the new products are enticing smokers to switch rather than recruiting new users. PMI data show an insignificant share of new smokers started because of its HTP product, IQOS, in 2017. According to Kumamaru, this shows there is no “gateway” effect from having HTPs on the market.

While impressed by the impact of HTPs on smoking rates, Kumamaru said he had even greater expectations of the tobacco harm reduction potential of vapor products. Manufacturers have hesitated to launch e-cigarettes in Japan in part because of regulatory issues, but he nonetheless expected launches in the vapor segment soon.

Click here to read more session summaries from the 2020 GTNF.