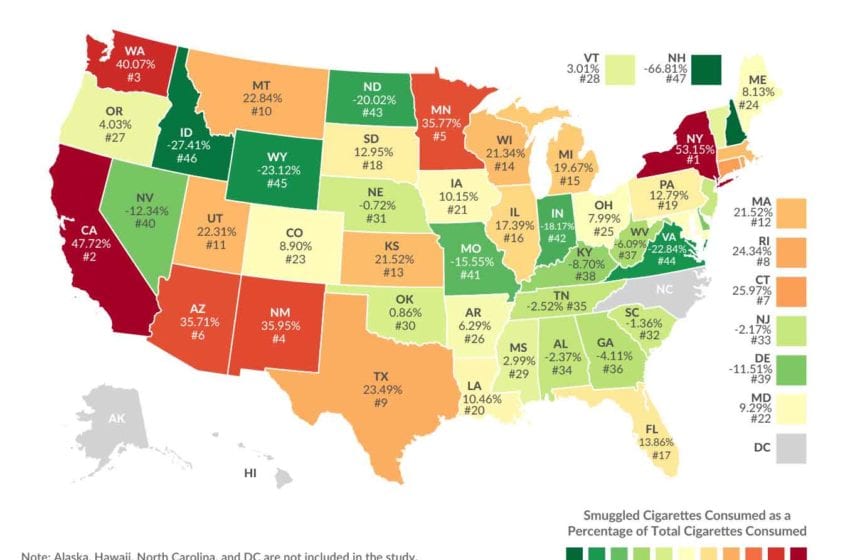

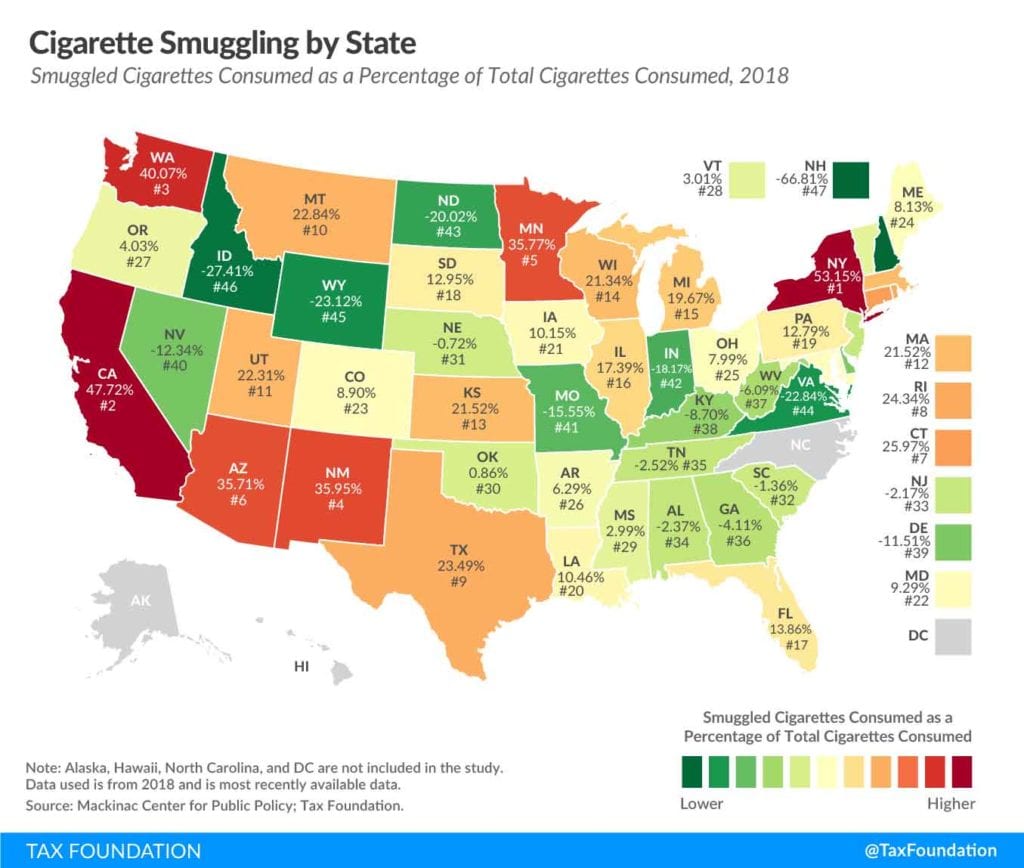

Excessive tax rates on cigarettes in some U.S. states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources, according to a new report by the Tax Foundation.

New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources in 2018. New York is followed by California (47.7 percent of consumption smuggled), Washington (40.1 percent), New Mexico (36 percent), and Minnesota (35.8 percent).

New Hampshire has the highest level of outbound smuggling at 66.8 percent of consumption, likely due to its relatively low tax rates and proximity to high-tax states in the northeastern United States. Following New Hampshire is Idaho (27.4 percent outbound smuggling), Wyoming (23.1 percent), Virginia (22.8 percent), and North Dakota (20 percent).

Rhode Island, following a cigarette tax increase from $3.75 to $4.25 in the Summer of 2017, has seen a significant increase in smuggling into the state, moving it from a ranking of 18th to 8th highest inflow of cigarettes in the U.S.

Cigarette tax rates increased in 39 states and the District of Columbia between 2006 and 2017.

“Lawmakers interested in taxing and regulating electronic cigarettes should understand the policy trade-offs related to high taxation or bans of nicotine products,” the Tax Foundation wrote in its report. “With distribution networks already well-developed, criminal gangs are poised to expand into vapor products.”