The recently passed U.S. federal stimulus plan negates the need for tobacco tax increases, according to Tom Briant, executive director of the National Association of Tobacco Outlets (NATO).

As of March 19, lawmakers in 20 states had introduced bills to raise cigarette and/or tobacco product taxes, according to a Convenience Store News report.

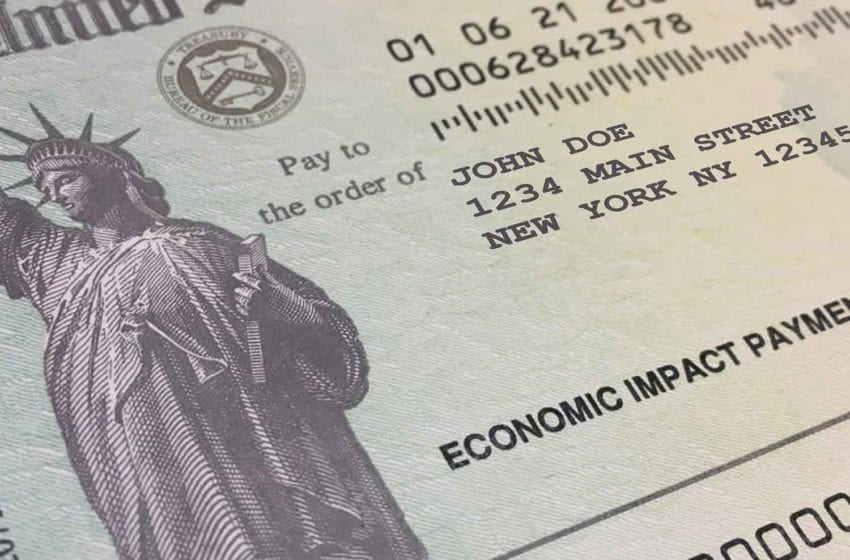

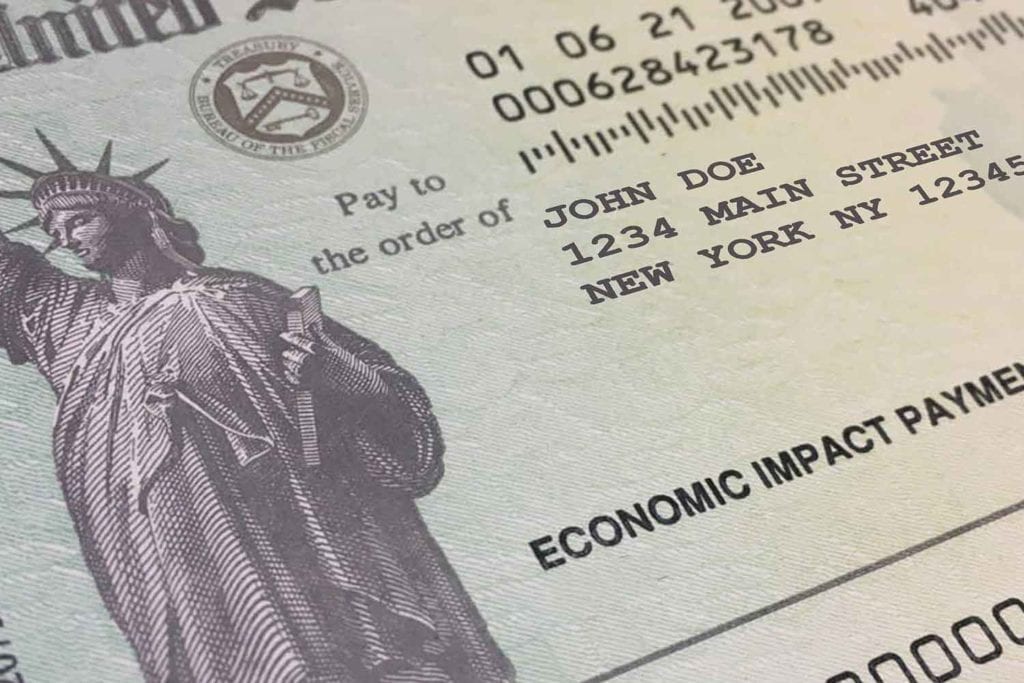

At the same time as states were reviewing tax hike proposals, the U.S. Congress recently passed a $1.9 trillion stimulus bill, and President Joe Biden subsequently signed the American Rescue Plan into law.

There is no reason to raise taxes when they have all this stimulus money coming into their state treasury.

Tom Briant, executive director, NATO

“This stimulus plan may be an important factor in determining whether or not states pass legislation increasing cigarette, tobacco and/or vapor taxes,” Briant said during a virtual education session of the Tobacco Plus Expo 2021 in March.

Along with $1,400 individual stimulus checks, the American Rescue Plan includes $350 billion specifically set aside for direct, unrestricted aid to states, cities and counties.

NATO is reaching out to lawmakers in the states with pending cigarette and tobacco tax increase bills with the message that proceeding is not necessary.

“There is no reason to raise taxes when they have all this stimulus money coming into their state treasury,” Briant pointed out.