How sensibly will modern oral nicotine products be regulated in the future?

By Stefanie Rossel

Is history repeating itself? The parallels between the development of the vaping sector and that of modern oral nicotine are striking: Quick consumer adoption leads to phenomenal category growth rates. The promising, still-unregulated market lures myriad players and creates an unmanageable number of brands. Leading tobacco manufacturers seek to get their slice of the cake, often by strategic acquisitions. Despite evidence pointing at the reduced harm potential of the product compared to combustible cigarettes, tobacco control activists raise the alarm, urging regulators to crack down. The Wild West, gold-rush atmosphere is then abruptly curbed by the introduction of often-misguided restrictions and even product bans.

It is at these crossroads where modern oral nicotine currently finds itself. The category, still a niche, has grown impressively in the five years since Swedish Match introduced Zyn, the first product of its kind. Market analysts are outdoing each other in their forecasts. 360Research Reports expects the category to increase to $32.77 billion in 2026 from $2.38 billion in 2020. Five key global players jointly hold a 77 percent share of the world market, according to Precision Reports. With 66 percent, Europe is the largest market, followed by North America and Asia-Pacific with more than 30 percent each, the company states.

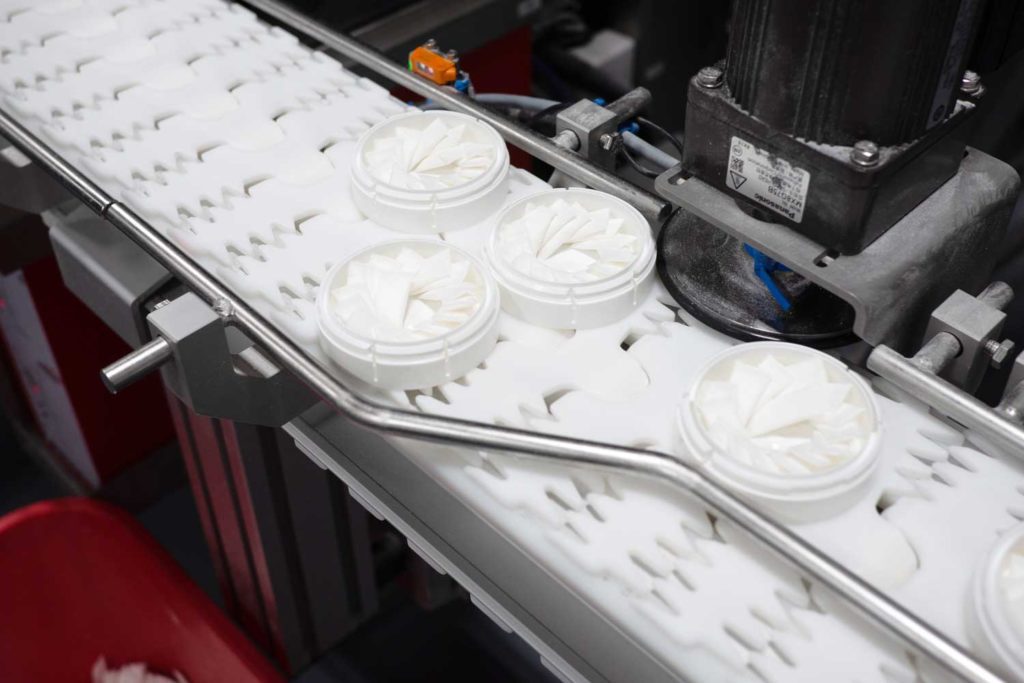

Competition in the market has rapidly heated up. Research and Markets notes the launch of 27 new brands of nicotine pouches in 2020. By now, all major tobacco companies and several smaller players are represented in the category. To cater to the increased demand, many of them had to step up production capacities, among them British American Tobacco, which in September 2020 built a new plant in Hungary that is dedicated to the production of nicotine pouches for export markets.

The most recent company to enter the segment is Philip Morris International. In an investor presentation in February 2021, then-CEO Andre Calantzopoulos announced the development of a respective product through a “combination of partnerships and internal development.” In May, PMI acquired Danish family business AG Snus, a manufacturer of nicotine pouches. The deal was followed by PMI’s takeover of Danish firm Fertin Pharma on July 1, a company specializing in nicotine-replacement therapy (NRT) type products such as gums, pouches, liquefiable tablets and other solid oral systems for the delivery of active ingredients, including nicotine.

Less Harmful Than Snus

Nicotine pouches or “modern oral,” as manufacturers have termed the novel segment, are considered a subcategory of the smokeless tobacco segment. They are an evolution of traditional Swedish snus, a pasteurized oral tobacco that is available as loose products or in pouches and has been consumed in the Nordic country for 200 years. Unlike snus, however, modern oral nicotine contains no tobacco. In some brands, the nicotine used is not even derived from tobacco but produced synthetically. The nicotine pouches are white, pre-portioned little bags comprising nicotine applied to a carrier material, such as food-grade fillers. They come in a variety of flavors and nicotine strengths and even as nicotine-free variants. Like snus, they are discreet and spit-free and can be disposed of in household trash after use.

For years, Sweden has had the lowest smoking rate in the European Union. According to Statista, the share of daily smokers in the country stood at 7 percent in 2019 (if the rate were to drop below 5 percent, Sweden would be considered “smoke-free” by some definitions). This compares to an average smoking prevalence of 23 percent throughout the EU. Sweden’s low smoking incidence is largely attributed to snus, which is used by 1 million Swedes. Decades of scientific research have confirmed the product’s efficiency as a smoking cessation tool. Snus use is estimated to be about 90 percent to 95 percent safer than smoking combustible cigarettes, which puts the product on par with e-cigarettes on the continuum of risk scale. A 2020 survey conducted by the European Tobacco Harm Reduction Advocates found that 43.3 percent of Swedish ex-smokers had used snus and/or nicotine pouches to quit smoking whereas more than 31 percent of current European smokers would be interested in trying snus if it was legalized.

However, snus sales have been banned in the EU since 1992 except in Sweden, which negotiated an exemption from the ban when it became part of the trading bloc in 1995. The EU prohibition has survived two lawsuits, and few expect it to be lifted in the foreseeable future. Modern oral products, which offer non-Swedish EU users an alternative to snus, may rank even lower than snus on the risk continuum, according to a recent BAT study published in Drug and Chemical Toxicology. The research found that the company’s nicotine pouches had a toxicant profile comparable to that of NRTs, which are currently considered the least risky of all nicotine products.

In a Gray Zone

Given the EU’s attitude toward tobacco harm reduction, such an acknowledgement appears unlikely, however. Because modern oral products don’t contain tobacco, they cannot be regulated under the current EU Tobacco Products Directive (TPD); their status will be reconsidered during in the next TPD revision.

In Germany, this has recently led to confusion over the legality of nicotine pouches. Several courts at the federal level have ruled that modern oral products are to be classified as foodstuff. As such, they would have to meet the requirements of European food legislation, which does not permit nicotine as food, food ingredient, food additive or flavor. Furthermore, food must not be hazardous to consumers’ health, according to the legislation. However, toxicological studies have shown that the nicotine dose that is taken up even by moderate users of modern oral is linked to health damage, courts argued. The rulings led to local sales bans. Due to this legal uncertainty, BAT in July 2021 suspended sales of its Velo nicotine pouches in Germany. The company called for legislation to set advertising standards for tobacco-free nicotine pouches and to limit nicotine concentration to 20 mg/mL.

In the absence of EU legislation, several countries have tried to regulate nicotine pouches at the national level. In May, the Czech Republic amended its food and tobacco products act, obliging manufacturers, importers, retailers and distributors of nicotine pouches to ensure that these products meet the requirements for the composition, appearance, quality and characteristics stipulated by the decree of the Ministry of Health under similar conditions as those for e-cigarettes. In addition, they will have to inform the ministry, on a regular basis, on the nicotine pouches that they intend to launch on the EU/European Economic Area market. Manufacturers will also have to collect information on the suspected adverse effects of these products on human health. Tobacco-free nicotine pouches that do not comply with the amendment and that were produced or marketed before May 12, 2021, will have to come off the market in 2022.

Italy, where nicotine pouches are considered consumer products, will reportedly consider modern oral products when it revises its anti-smoking law by the end of the year. Estonia’s parliament announced in July that it might relax its snus regulations to help reduce smoking.

The U.K., no longer an EU member and therefore not bound to the common market’s regulation, is expected to follow Sweden’s example. To achieve its goal of a smoke-free society by 2030, the British government is presently shaping a tobacco control plan, which may very well include stronger promotion of cigarette alternatives, such as heated-tobacco products and nicotine pouches.