Even in challenging times, filter and tow suppliers find new business opportunities in innovative nicotine products.

By Stefanie Rossel

Over the past years, manufacturers of acetate filter tow and cigarette filters have come to learn how to best cope with challenges. The continuous decline in global cigarette consumption since 2013, which also resulted in lower demand for tow and filters, has been one such issue.

In 2020, tobacco companies sold 5.06 trillion cigarettes worldwide, representing a decline of 3.7 percent compared to 2019, according to Euromonitor. Increasing restrictions on tobacco products as well as the rise of reduced-risk alternatives contributed to this development. “Philip Morris International’s conventional cigarette-free world mission is a big challenge to filter makers,” notes Hyunyoung Park, sales and business development manager at Taeyoung Industry Corp. of South Korea, a supplier of mono, dual and triple filters to multinational cigarette manufacturers.

The year 2020 added more trials for the tobacco industry, most notably the Covid-19 pandemic. At the ITGA’s Issues Day in November 2020, Shane MacGuill, Euromonitor’s senior head of tobacco research, said he expected combustible cigarette volume to decline further in the next five years, aided by a pandemic that left many governments scrambling to refill their coffers.

For the time being, the most tangible effect of the pandemic for suppliers of acetate tow is logistic in nature, says Harald Bruggeman, vice president of commercial acetate tow at Celanese in the U.S. “A challenge for the entire industry is that the global liner market remains tight with lower performance and higher freight rates that continue to climb,” he says. “To ensure supply chain security, Celanese has a global warehouse network and healthy inventory levels.”

Bruggeman notes that pandemic-related travel restrictions continue to impact business. To provide best possible service, he explains, Celanese provides remote sales and technical customer support by offering video conferences, online training, webinars, web-based software for item selection, filter and cigarette design calculations and RealWear devices, such as hands-free, voice activated, head-mounted tablets, for remote assistance.

The pandemic follows a period during which tow manufacturers were busy preparing for tighter regulation. In February 2018, the European Commission published the classification of titanium dioxide (TiO2), a delustering agent that had been used in paints and varnish, plastics, paper, printing inks and many other applications for about 100 years, as a suspicious carcinogen for inhalation. Although many scientific studies show that TiO2 does not cause cancer in humans, the classification will take effect Oct. 1, 2021. “The filter tow manufacturers are transitioning to acetate tow without added TiO2, which increases complexity in manufacturing, portfolio and supply chain,” Bruggeman says. “Celanese has completed all necessary preparations for the commercial production of acetate tow without added TiO2 at both manufacturing sites, i.e., Narrows, Virginia, USA, and Lanaken, Belgium.”

Jens Ebinghaus, CEO of Swiss-based acetate tow manufacturer Cerdia, formerly Rhodia Acetow, stresses the positive side of this challenge. In November 2018, the company launched DE-Tow, a tow made of cellulose acetate that is free from TiO2. “Most of our customers have already switched to TiO2-free filter tow while others still use tow with TiO2,” he says. “Supplying both customer groups adds complexity to the manufacturing process and creates opportunities to the most flexible suppliers.” In 2019, Cerdia’s Freiburg, Germany, plant committed to invest close to $100 to strengthen its competitiveness, to foster the growing market share of specialty filters produced in Freiburg and to focus on product innovation as well as diversification.

Toward Increased Sustainability

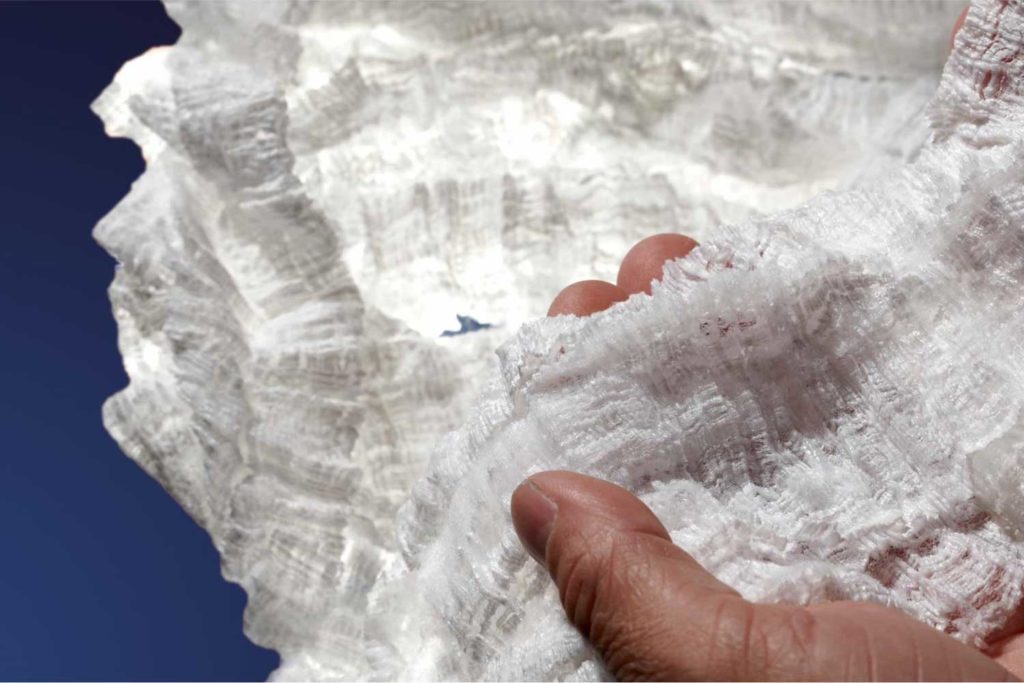

While the pandemic is far from over, this summer brought about new challenges for the sector: On July 3, 2021, more parts of the European Union’s Single-Use Plastics Directive (SUPD) entered into force, banning the sale of items such as plates, cutlery, straws and cotton bud sticks made of plastic as well as food containers and expanded polystyrene cups. The directive was drafted to fight marine pollution. Although cigarette filters are among the 10 single-use plastic products most often found on Europe’s beaches and seas, representing as much as 60 percent of all waste items, they are not among the prohibited products. Worldwide, around 98 percent of cigarette filters are made of cellulose acetate, a bio-based polymer that biodegrades over several months to several years, depending on the conditions of the environment where it has been discarded.

Instead of the originally discussed consumption reduction targets for filter cigarettes, the European Parliament reached a provisional agreement stating that “the huge environmental impact caused by post-consumption waste of tobacco products with filters, discarded directly into the environment, needs to be reduced. Innovation and product development are expected to provide viable alternatives to filters containing plastic, and this development needs to be accelerated.” Through the introduction of extended producer responsibility (EPR), a reinforced application of “the polluter pays” principle, the provisional agreement seeks to further encourage innovation leading to the development of sustainable alternatives to tobacco product filters containing plastic.

More specifically, the directive will require producers to cover the costs of consumer awareness-raising measures and EPR schemes tackling the clean up of litter and its subsequent transport and treatment, the costs of data gathering and reporting, and the costs of collection of waste of tobacco filters discarded in public collection systems. EU member states have until Dec. 5, 2023, to set up ERP schemes for tobacco filters that contain plastic, but to date, there is no available guidance for member states as to how such EPR schemes should be implemented. As of July 3, all packaging of tobacco products with filters are required to be marked with a pictogram warning against littering.

“The most burning concern at the moment is the impact of the SUPD—how to deal with the directive and product solutions that are compatible with the criteria it sets out,” says Ebinghaus. “The role that biodegradability of filters and tow will play in the future depends heavily on littering regulations. Cellulose acetate is based on wood pulp, a renewable raw material. With Cerdia DE-Tow, we have already created a product that is characterized by certified rapid biodegradability. We are convinced that this topic will continue to accompany us in the future and are glad that we can already offer a future-proof solution to our customers.”

“The criteria for biodegradability under the SUP directive are not expected to be established by the EU until 2027,” notes Bruggeman. “The EC is concerned about potential misleading claims around biodegradability of filters as it could likely have an inverse effect on littering behavior. Certifications of biodegradability alone do not resolve the fundamental problem of reducing the impact of ‘littering’—thus, the measures called for in the EU SUP directive remain as important and necessary to be adopted, i.e., contribute to awareness-raising EPR, including cleanup, collection and waste treatment, and labeling requirements for cigarette packs.”

Seeking the Gold Standard

Filter manufacturers are also busy trying to meet changing requirements for an expanding environmentally friendly products market. Taeyoung’s R&D department is working on filter development with non-acetate tow and is carrying out studies on the replacement of conventional filter material. Seng Keong Low (SK), global marketing manager at specialty filter manufacturer Essentra, explains that the greatest challenge now is to find the perfect substitute for cellulose acetate filters—“a gold standard, so to speak. While we have commercially launched paper-based filters from our ECO range, we also acknowledge that there are certain tradeoffs when using these alternative materials. That is why Essentra Filters continues to learn, innovate and improve upon these products to achieve that gold standard.” He relates that his company has several intermediary products within its portfolio of products, such as BiTech, which mixes cellulose acetate and paper, thus increasing the biodegradability of the product.

Sustainability issues aside, filter designers continue to seek innovative solutions beyond the usual range. Filter and tow makers observe an ongoing shift toward slim and superslim formats while capsule filters remain popular. “Outside of the EU, flavors continue to play a role in driving consumer demand, especially in countries like China, Japan and Korea,” says SK.

While cigarette consumption will likely continue to decrease, heated-tobacco products (HTPs) are creating new opportunities for filter and tow manufacturers. Like conventional cigarettes, HTP consumables require a—highly complex—filter. Cellulose acetate tow is found in vape products too; it can be used in e-cigarettes to prevent leakage of e-liquids. “We see great opportunities and great potential in developing and producing a broader spectrum of specialty items for more specific new-generation products and in the advancement, refinement and expansion of the [HTP] segment,” says Ebinghaus.

“We observe continuous innovation and product launches in the strong growing HTP market, e.g., PMI’s IQOS Iluma, BAT’s Glo Hyper plus, JT’s Ploom X or KT&G’s Lil Solid 2.0,” echoes Bruggeman. “Celanese partners with the major players in the HTP segment for the development of new filters for heated-tobacco sticks.”