Scandinavian Tobacco Group has agreed on the terms and conditions for the acquisition of substantially all assets of Alec Bradley Cigar Distributors Inc. and associated companies, according to a company press release.

The transaction is valued at $72.5 million (DKK500 million) on a debt and cash-free basis (the enterprise value) and is expected to be closed shortly. The acquisition will be fully financed by cash at hand and debt.

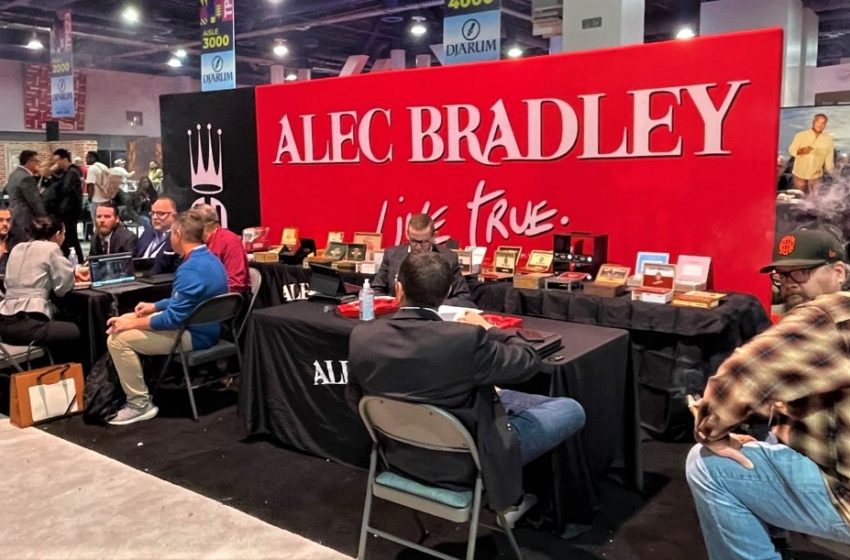

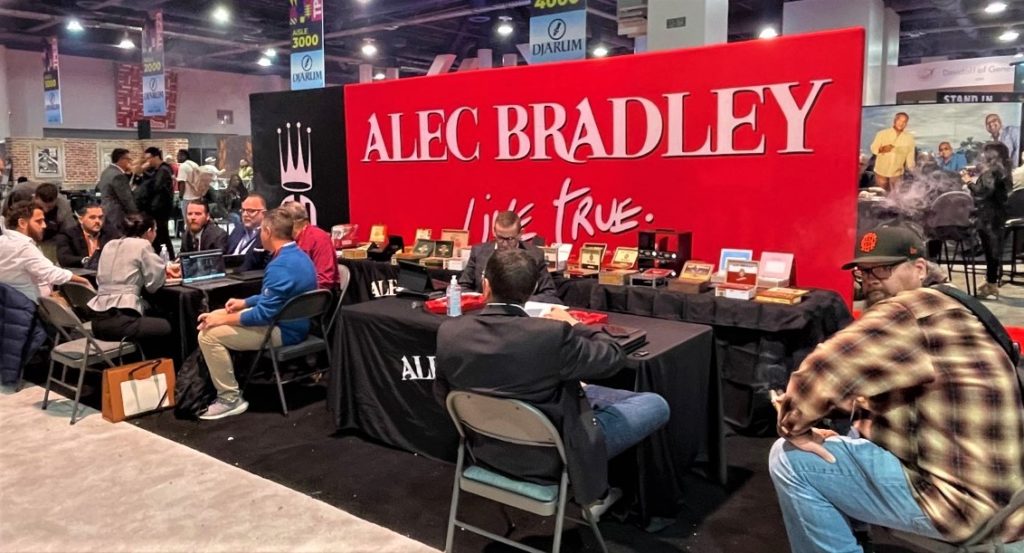

The Alec Bradley brand is a material addition to the company’s portfolio of premium cigars.

Based in Fort Lauderdale, Florida, Alec Bradley reported annual net sales in 2021 of $25 million and an EBITDA margin before special items of 24 percent. Both net sales and EBITDA margin improved during 2022.

CEO of Scandinavian Tobacco Group Niels Frederiksen said, “The acquisition of the Alec Bradley cigar business is another important step toward our ambition of becoming the undisputed and sustainable global leader in cigars.

Through this bolt-on acquisition, we will expand our portfolio of highly regarded premium cigars in the U.S. and international markets, delivering material value to our shareholders. We will also leverage the Alec Bradley brand portfolio to deliver increased excitement to the handmade cigar category through product innovation and brand activations, benefitting both the cigar enthusiasts and our trade partners.”

The transaction is expected to be margin accretive, EPS accretive and ROIC accretive when fully integrated. The company leverage ratio (net interest-bearing debt/EBITDA) will, when the transaction proceeds to completion, increase by less than 0.2x.

At the end of the third quarter of 2022, the company’s leverage ratio was 1.9x. Further details of the expected financial impact of the acquisition will be communicated in connection with the announcement of Scandinavian Tobacco Group’s full-year 2022 results on March 8, 2023.