Enduring Demand

Malawi burley remains popular even as global smoking rates stagnate

Even as cigarette sales stagnate in many markets, demand for Malawi burley remains robust. An important component in the toolbox of the tobacco blender, burley is a key ingredient not only in the popular American blend cigarettes but also in roll-your-own and make-your-own products along with pipe tobaccos.

Due to last year’s short crop, leaf merchants are anticipating strong interest this season. In 2022, the country produced only 69.2 million kg of burley—against an estimated demand of 150 million kg. This year, the Tobacco Commission is expecting 106 million kg.

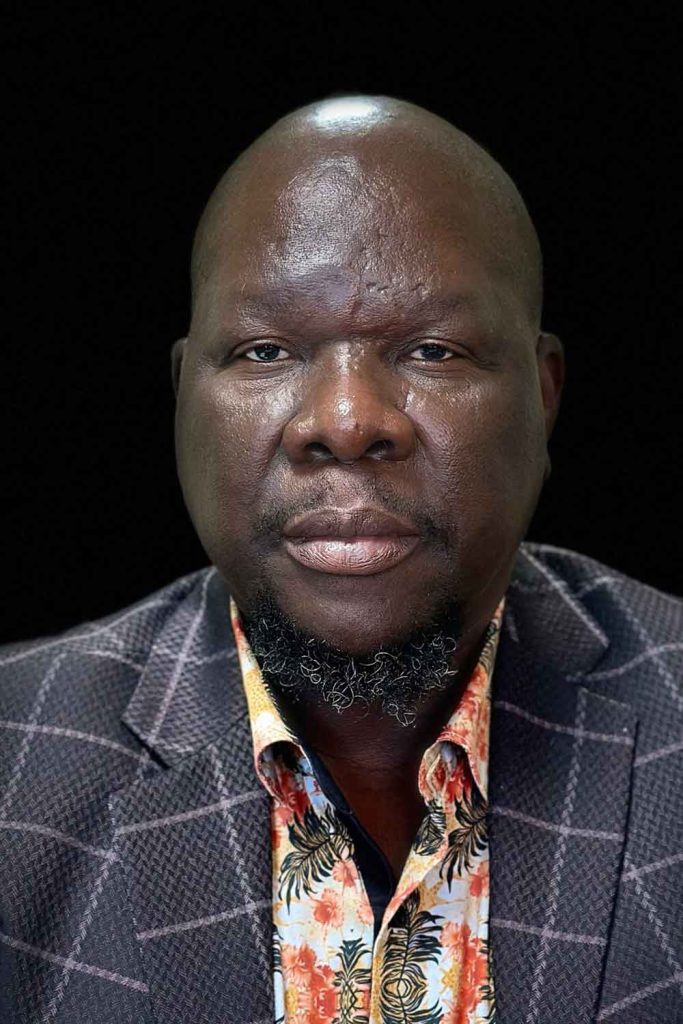

While burley is produced in several countries, including in southeastern Africa, industry representatives are confident that Malawi can hold its own against other suppliers. “Malawi is still a preferred origin of burley,” says Joseph Malunga, chief executive of the Tobacco Commission. “Even regionally, our burley is better than that from other origins.”

Malunga suspects that demand for Malawi burley will increase as the country tackles concerns raised by customers about agricultural labor methods. Traditional rural African practices, such as tenancy, in which a farmer provides workers with food and housing during the season but pays them only after the harvest, or requiring children to help out on the family farm, are frowned upon in Western countries where many tobacco buyers are headquartered.

The commission has done a lot to communicate what customers want, but some farmers will get the message very late. It will be a gradual transition.

Tobacco companies have been pressuring their suppliers to abandon these habits, and in 2019 the Malawi government banned tenancy. Leading buyers of Malawi leaf have systems in place that not only prohibit their contracted growers from deploying children or tenants but also include elaborate verification mechanisms. In 2020, such systems helped Limbe Leaf, Alliance One International and Premium Tobacco Malawi quickly convince U.S. Customs and Border Protection (CPB) that their supply chains were free of forced labor when the agency temporarily prevented Malawi tobacco from entering the United States based on concerns about forced labor. Impressed by the leaf merchants’ responsible supply chain management, CPB swiftly lifted its ban on tobacco imported by those companies.

Recognizing the progress made, some customers who left due to compliance issues are now coming back, according to Malunga. “They see that we have been doing our homework.”

But while the tobacco produced under contract with leaf merchants generally complies with the standards expected by Western governments and customers, the picture is less clear for the independently cultivated tobacco sold at auction, which accounts for approximately 10 percent of Malawi tobacco production.

The country’s tobacco industry is dominated by smallholder farming. With nearly half a million individuals cultivating leaf in Malawi, many of them living in remote areas and many of them illiterate, it will take a while for the message to reach everybody. “We have made big strides—to the extent of having laws,” says Malunga. “But you cannot expect these practices to stop overnight. The commission has done a lot to communicate what customers want, but some farmers will get the message very late. It will be a gradual transition.”

Don McAlpin, managing director of Limbe Leaf Tobacco Co., which is affiliated with Universal Corp., hopes the change will come sooner than later. For Malawi to maintain its appeal on the global market, it will be essential for the noncontracted growers to meet ESG targets, he says. “Any perceived concerns about sustainability or ESG issues in Malawi create a reputational risk to the Malawi brand and could impact Malawi tobacco regardless of the percentage that is contracted and compliant.” –T.T.