Marlboro remains the world’s most valuable tobacco brand, but smokeless alternatives are gaining ground.

Contributed

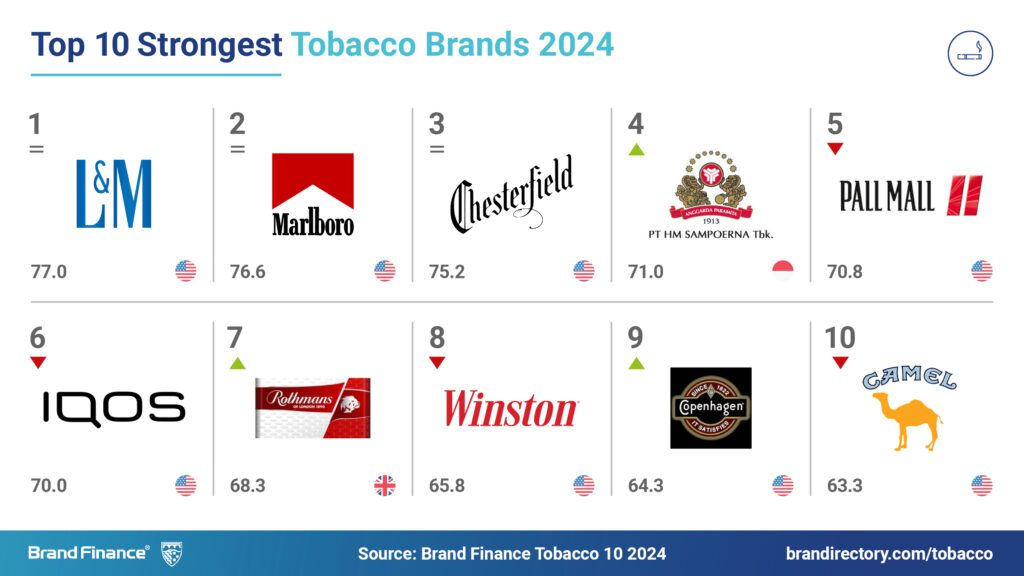

The total value of the world’s top 10 most valuable tobacco brands has decreased by 6 percent, with eight out of 10 brands experiencing a decline in brand value this year, according to the latest ranking by Brand Finance, a leading brand valuation consultancy. The ranking reveals a significant shift in the industry toward smokeless alternatives, driven by changing consumer preferences and increasing regulatory pressures. Despite these changes, traditional combustible tobacco brands remain the most valuable, supported by loyal customer bases and effective pricing strategies.

IQOS (brand value up 8 percent to $3.5 billion) is the fastest-growing tobacco brand, driven by rising revenue from smoke-free products. Philip Morris International reported smoke-free products reached nearly 40 percent of total net revenues in the fourth quarter of 2023. This was driven by the continued growth of IQOS, which has now surpassed Marlboro in net revenues, solidifying its position as the leading premium nicotine brand less than 10 years after its launch.

Despite a 6 percent drop in brand value to $32.6 billion, Marlboro retains its position as the world’s most valuable tobacco brand for the 10th consecutive year. It leads the sector by a significant margin, with a brand value more than five times that of L&M, which holds the second spot.

Altria Group, which owns Marlboro in the United States, and PMI, which owns the brand elsewhere, have both faced declining revenue from combustible products. Altria has struggled with lower shipment volumes and increased promotional investments, including a recent $0.17 per pack price increase on Marlboro and other brands in the U.S. Similarly, PMI has reported a drop in revenue from combustible tobacco. Nevertheless, Marlboro retains its top position due to its loyal customer base and strong promotional strategies.

L&M (brand value $6.2 billion) has climbed to second in the ranking, despite recording a 2 percent decline in brand value. It has overtaken Pall Mall, which now sits in third following a 9 percent loss in brand value to $5.9 billion. L&M’s brand value has taken a hit as shipment volumes have declined. L&M is the sector’s strongest brand with a Brand Strength Index score of 77 out of 100.

“While Marlboro continues to lead as the most valuable tobacco brand for the 10th consecutive year, the industry is undergoing significant transformation,” said Richard Haigh, global managing director at Brand Finance.

“The rise of smokeless alternatives like IQOS highlights shifting consumer preferences and changing market dynamics. Earlier this year, BAT’s announcement of a $31.5 billion impairment on the value of some of its U.S. cigarette brands marked the first significant write-down in a major market.

“Acknowledging the reality that the market for traditional cigarettes is shrinking and taking action should be seen both as a bold and an important step in addressing an existential problem for the company. With eight out of the top 10 brands experiencing declines in value, tobacco giants must be brave in admitting market shifts and strategically planning their next moves to sustain global dominance and relevance.”

Chesterfield (brand value $3.1 billion) has maintained its brand value year-on-year and advanced one position to seventh place. The brand has seen a rise in shipment volume, with an 8 percent increase in the fourth quarter of 2022 and a 14 percent increase for the full year, which has contributed to its stable brand value this year.

The latest rankings highlight the dominance of U.S. tobacco brands, which make up a remarkable 92 percent of the total brand value in the ranking, totaling $61 billion. Only two brands in the ranking are from outside the U.S., the U.K.’s Rothmans (brand value down 8 percent to $2.9 billion) and Indonesia’s Sampoerna (brand value down 12 percent to $2.7 billion).