System Overload

- Also in TR Print Edition

- March 1, 2024

- 0

- 11 minutes read

The broken U.S. new tobacco product application process revealed by the numbers

By Steven McDonald

“How long will it take?” is a question often raised by project managers and executives alike. Typically, a reasonable estimate can be generated, but when it comes to predicting the time it will take for a review of a tobacco product application with the U.S. Food and Drug Administration’s Center for Tobacco Products (CTP), any time estimate is met with skepticism.

The CTP provides performance metrics for new tobacco product applications, which were evaluated for this article to determine if the time an application meanders through the regulatory pathways could be deduced. The backlog of applications brings into question the agency’s capabilities of managing its processes and ability to conduct timely reviews. Unfortunately, the backlog distorts the CTP’s internal process data for reviews and obfuscates the time estimation for a submission. In addition, significant gaps in the data do not allow for robust deductions.

Following is an overview of the steps for the different regulatory pathways, the collection and evaluation of the CTP’s (performance) metrics and reporting data, and the ramifications thereof for future submissions. Readers should be aware that the CTP’s past performance may not be an indicator of future results.

Application Process and Performance Metrics

In 2009, Congress passed the Family Smoking Prevention and Tobacco Control Act, which gave the FDA broad authority to regulate the manufacturing, distribution and marketing of tobacco products. This includes decisions on whether new tobacco products can be marketed and evaluation of new tobacco product applications.

New tobacco products can be submitted for review through three pathways: substantial equivalence (SE), exempt from SE (EX), or premarket tobacco product application (PMTA). A fourth submission type, modified-risk tobacco product application, is not a pathway for new tobacco products but a pathway to obtain permission to make advertising “claims” specific to a particular product.

Historically, the applications accepted through the SE and EX pathways have been for cigarettes, smokeless tobacco and roll-your-own products. In August 2016, the FDA’s tobacco authority was extended to all “deemed” tobacco products, including electronic nicotine-delivery systems (ENDS), cigars, hookah and pipe tobaccos. In addition, in 2022, Congress passed a law clarifying the FDA’s authority to regulate tobacco products containing nicotine from any source (nontobacco-derived nicotine (NTN)). The vast majority of applications in the PMTA pathway have been for ENDS. Both the deeming rule and the NTN law led to a crushing number of new product applications submitted to the FDA in 2020 and 2022, respectively.

The CTP posts the estimated number of submissions that are currently at each step on a somewhat regular basis and then publishes the totals for the fiscal year. Unfortunately, the level of detail provided and the frequency for the updates has not been consistent. However, by making use of the currently available information (through fiscal year 2023), annual values for the process steps can be estimated. The data and information, primarily gathered from the Tobacco Product Applications: Metrics and Reporting webpage was collected and compiled for SE, EX and PMTA submissions. For new tobacco product applications, the procedures for the SE and EX pathways are identical, and the PMTA pathway includes an additional step: acceptance review, filing review (PMTA only), scientific cycle reviews and determination.

The enormous number of submissions from fiscal years 2020 and 2022 is working its way through the system, evident from the data, but the backlog indicates that the review process may have overwhelmed the CTP’s capabilities and distorts the internal process data.

Substantial Equivalence

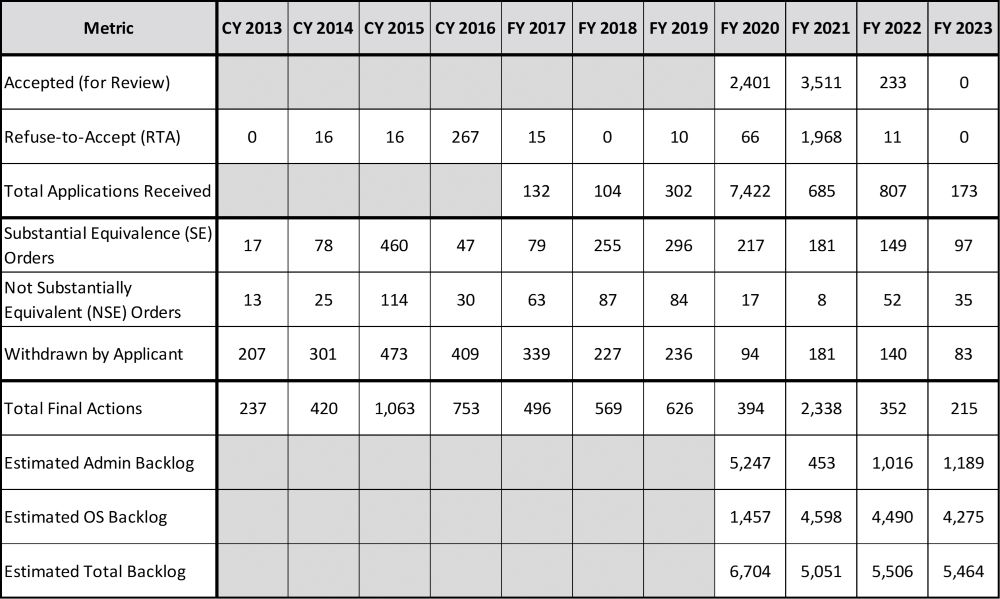

The data for SE is provided in Table 1 for the calendar years 2013–2016 and the federal fiscal years (October to September) hence. It is assumed that these values for SE, in particular, marketing orders, Not Substantially Equivalent (NSE) Orders and Withdrawn, include the provisional SE report applications. Briefly, a “provisional tobacco product” is one that was introduced between Feb. 15, 2007, and March 22, 2011, and for which a provisional SE report had been submitted on or before March 23, 2011. The final three rows, Estimated Administrative (Admin) Backlog, Estimated Office of Science (OS) Backlog and Estimated Total Backlog, are calculated values derived from the data provided. Since there may be additional (unreported) applications, these estimates should be considered conservative.

Table 1: Annual Data for Substantial Equivalence

The metrics are divided into the different phases of the regulatory process: administrative review of the submissions (Accepted, Refuse-to-Accept, Total Received), determinations (Marketing Orders, NSE Orders, Withdrawns) and the calculated values (Total Final Actions, Estimated Admin Backlog, Estimated OS Backlog, Estimated Total Backlog).

The calculated values for Total Final Actions are annual determinations: the sum of RTA, SE, NSE and Withdrawn. The remainder of the calculated values (Backlogs) should be considered estimates as the data missing from prior years may impact the accuracy of the results.

The Estimated Administrative Backlog is a cumulative value, the difference between those applications received and those processed (Accepted or Refused). For example, the Estimated Administrative Backlog for fiscal year 2021 includes the values from fiscal years 2020 and 2021. The Estimated OS Backlog is calculated similarly, beginning in fiscal year 2020, as the difference between those applications accepted to be reviewed and those with determinations (SE, NSE or Withdrawn).

Of note is the over 7,000 applications received by the CTP in 2020, which was likely due to the court-ordered submission deadline for newly deemed products such as cigars, pipe tobacco and waterpipe tobacco. Yet at the end of fiscal year 2021, the backlog of applications (neither accepted nor refused to accept) is less than 500. That number has since swelled to over 1,000, including over 100 submissions in fiscal year 2023 that remained unopened. In fact, during the October 2023 stakeholder engagement meeting, the CTP admitted that none of the SE reports submitted after Sept. 8, 2020, have undergone even an acceptance review.

The thousands of applications from the Estimated OS Backlog and Estimated Total Backlog is staggering. This is in stark contrast to the few hundred Total Final Actions, interrupted only by a spike of Refuse-to-Accept determinations in fiscal year 2021.

Using the historical CTP data and calculated estimates, projections for the CTP’s future throughput can be made. For example, it will take more than six years for the backlog of applications to work through the system with a 20 percent increase in staff and an insignificant number of future SE report submissions. In addition, if one considers a “first in, first out” application process, the time delay for a marketing order for any new SE report applications will be significant.

Exempt from SE

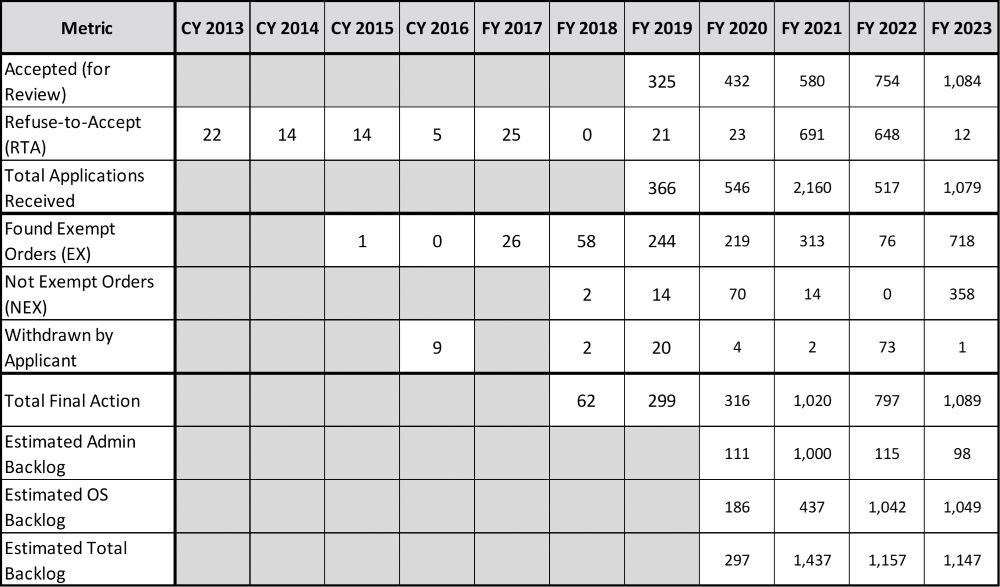

The annual data for Exempt from SE is provided in Table 2. The table structure and calculations are the same as Table 1. Similar to SE applications, the calculated Backlog values should be considered estimates as the data missing from prior years may impact the accuracy of the results.

Table 2: Annual Data for Exempt from Substantial Equivalence (EX)

The Estimated Administrative Backlog for fiscal year 2023 is less than 100 (during the October 2023 stakeholder engagement meeting, the CTP asserted that the EX backlog had been cleared). The Estimated OS Backlog and Total Backlog has been consistently over 1,000. This is in stark contrast to the few hundred Found Exempt Orders averaged annually.

Calculated similarly as that of the SE report throughput (a 20 percent increase in staff and an insignificant number of future Exempt submissions), it will take 16 months for these applications to work through the system if the same rate for reviews is maintained. As with the SE applications, the large number from the Total Backlog suggests that the time delay for marketing orders for any new EX applications will be more than a year (but significantly less than an SE submission) if one considers a “first in, first out” application process.

Premarket Tobacco Product Application

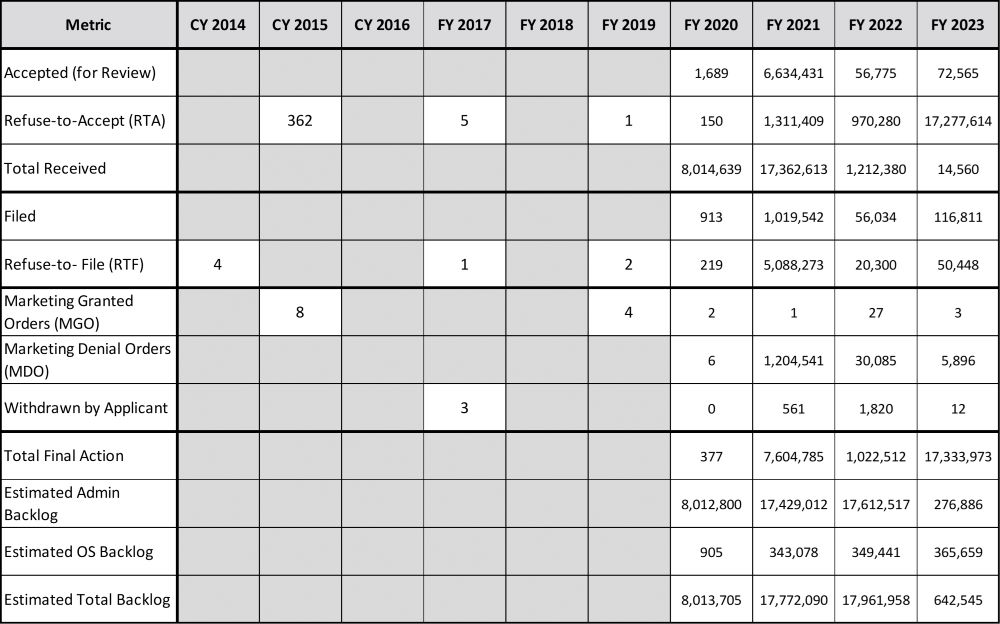

The annual data for PMTAs is provided in Table 3. Again, the final three rows are estimates, calculated values derived from the data provided, and since there may be additional (unreported) applications, these estimates should be considered conservative.

Table 3: Annual Data for Premarket Tobacco Product Application

The metrics provided by the CTP are divided into the different phases of the regulatory process: administrative, filing and determination. A staggering number of applications were received in the fiscal year 2020 through 2022 time frame, and to date, nearly 25 million applications have been rejected without substantive review. The calculated values in the table are generated similarly as for the SE and EX tables.

As the CTP has stated on several occasions (most recently on Jan. 22, 2024, in the press release announcing the marketing denial order (MDO) for flavored Blu e-cigarette products), the “FDA has received applications for more than 26 million deemed products and has made determinations on 99 percent of these applications.” The Estimated Admin Backlog at the end of fiscal year 2023 is over 60,000, and the Estimated OS Backlog is over 300,000. It is difficult to estimate the time for these applications to receive substantive review; however, if one considers the Marketing Granted Order (MGO) and MDO values from fiscal year 2022 as a guideline, values can be determined.

Based on these estimated values, a modest 20 percent increase in staff, and a limited number of future PMTA submissions, it will take more than 16 years for the applications under scientific review (Estimated OS Backlog) to receive a determination. If one considers the Estimated Total Backlog of applications calculated with the same parameters, it will take nearly 30 years for all the currently submitted applications to receive a determination.

Finally, the substantive review of the PMTAs for specific “covered applications” (brand names of Juul, Vuse, Njoy, Logic, Blu, Smok, Suorin or Puff Bar, and those that have a 2 percent or more sales volume as determined by Nielsen) is under a Maryland Federal District Court order (Am. Acad. of Pediatrics v. FDA (AAP), 379 F.Supp.3d 461, 492 (D. Md. 2019)). The original court-imposed deadline to complete the reviews was Sept. 9, 2021, which the agency was unable to meet. Based on the most recent (Jan. 24, 2024) status report filed with the district court, the CTP will take action on 100 percent of these applications by June 2024. This date has been pushed back on several occasions, indicating that even the CTP cannot predict how long it will take.