Versatile Verification

- Also in TR Print Edition

- March 1, 2024

- 0

- 11 minutes read

Fluxcode’s solution has been designed to be flexible so that both small and large companies can comfortably operate it.

German software supplier Fluxcode has developed a track-and-trace solution for all needs.

By Stefanie Rossel

The illicit cigarette trade has reached a disturbing level: According to Euromonitor International, it accounted for just under 12 percent of global cigarette sales, excluding China, in 2022. Driven by higher taxes and consumers’ greater price sensitivity, it is expected to increase to just below 14 percent by 2027. The World Bank estimates that illicit tobacco trade causes tax collectors to miss out on $40 billion to $50 billion in revenues per year. Authorities have also identified it as a primary source of revenue for organized crime and terrorism.

Among the strategies aimed at combatting the problem are track-and-trace (T&T) protocols. Using serialization technology, these systems monitor the manufacturing and distribution of tobacco products.

The governing body of the World Health Organization Framework Convention on Tobacco Control (FCTC) adopted the Protocol to Eliminate Illicit Trade of Tobacco Products in 2012. Having entered into force in 2018, the treaty mandated the creation of a global tracking and tracing regime within five years to closely control and monitor the legal supply chain of tobacco products.

By September 2023, all 68 parties to the protocol had to have their T&T systems deployed. The required global information exchange mechanism, however, had not been established at that time, and the deadline for implementation is likely to be postponed further as such a global system requires international standards and guaranteed interoperability, and solutions to technical and regulatory challenges. The current generation of T&T systems hence remains limited to national or regional jurisdictions.

In the EU, which was the first to officially introduce a track-and-trace system, T&T has been mandatory for cigarettes and fine-cut tobacco under the Tobacco Products Directive (TPD2) since May 2019. As of May this year, other tobacco products such as pipe tobacco, chewing tobacco or nasal snuff must also be tracked and traced.

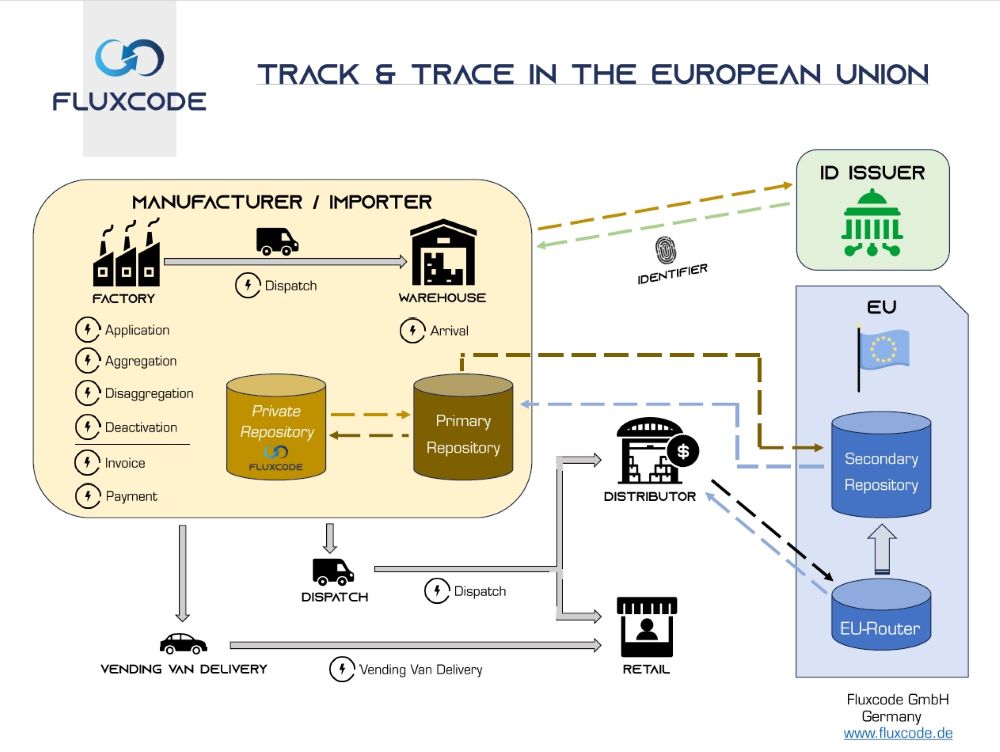

The process requires a highly developed IT infrastructure, as the example of the EU experience has demonstrated. The system mandates that each tobacco package carry a unique identifier (UI) code that has to be requested by European manufacturers or importers of tobacco products for each individual pack from an independent organization appointed by EU member state authorities.

The UI code must be scanned and recorded all along the distribution chain and transmitted to both the manufacturer’s and the EU database, thus enabling authorities to trace and authenticate tobacco products. Manufacturers and importers must install and integrate a database, a so-called primary repository, to store all data related to each individual package. This information is copied into a secondary repository that is operated by another independent third party appointed by the European Commission.

Outside the tobacco sector, T&T has long been used by many other highly regulated industries. The scope of functions offered by T&T solution providers is generally quite similar, according to Mitja Carstensen, managing director of Fluxcode. Unlike other companies in this field, however, his Lubeck, Germany-based business has more than 30 years of experience in the tobacco industry. “We are acquainted with many of the problems or pitfalls of technology a tobacco company may encounter when implementing and conducting track and trace and can support them in advance with our experience,” says Carstensen. “In addition, we always keep production staff in mind when developing the software—it must be easy and intuitive to use for all users and work reliably. We are very close to our customers during the entire implementation process and also help with marginal issues, such as the registration for ID Issuers or the optimization of processes.”

Industry Independent

Carstensen founded Fluxcode together with his former colleague, Rene Petton. The two met when they were working as software developers at the IT department of a medium-sized German tobacco products manufacturer.

“In general, we always tried to develop all production-relevant software for our former employer ourselves, particularly because a medium-sized enterprise can’t be handled according to the book and because history has shown that there are various special cases for which standard solutions would have become difficult,” Carstensen explains.

At that time, in 2016, the only T&T solution available for tobacco products was Codentify, a system developed by Philip Morris International and licensed to BAT, Imperial Tobacco Group and Japan Tobacco International. Today the product is marketed by Inexto. “There were no other providers,” says Carstensen. “Since the Codentify solution would also have been very cost intensive, we decided to develop the required software ourselves. With a project scope like TPD2, this was of course a complex endeavor. After we had completed our software solution and it became known within the tobacco industry that we had a functioning alternative to Codentify, we were approached by several smaller and mid-sized companies who acquired the solution we had then, which was called Red Carpet.”

As T&T gained importance, Carstensen and Petton decided to take their software to a broader, more professional level, and in 2020, they established Fluxcode. The Red Carpet software was resigned to history. In its place, Carstensen and his team developed a completely new solution in such a way that it can also be used to track products in other sectors. The company is already negotiating with manufacturers of drinks and tires.

Fluxcode developed the Fluxcode Suite, which is independent from the tobacco industry and divided into five core modules—one for ordering and downloading of the UI, one to create a globally unique identifier with included additional customer information, one to provide the correct UI to the production line printers, one to connect to the aggregation system and one for sending previously elaborately processed data to a repository. Modules can be purchased individually, depending on the requirements of the customer. Security against piracy is provided by encryption of the most important Fluxcode Suite codes, which users can only access by deploying a license key to unlock them.

Fluxcode also provides storage for the considerable amount of data generated, says Carstensen. “Many of our competitors rely on cloud hosting of the database. This means that the track-and- trace data of a manufacturer are being stored on the server of a service provider, to which the manufacturer himself potentially has no access. He will be able to retrieve a part of the data through various sighting processes but won’t have administrative sovereignty over the data. We don’t think that this is very practicable, as from our point of view, the data belong to the customer.”

Therefore, Fluxcode offers data storage on the manufacturer’s server. “This goes down well with our customers,” says Carstensen. “We have optimized the amount of data so that a small enterprise can produce several years with our software, and its data storage will remain in the low double-digit gigabyte zone.”

The company supplies only the software part of the track-and-trace system, but it has long-term partners from the respective hardware areas, including aggregation systems, printer manufacturers or external repositories. “At the request of the customer, there is also the option that one party acts as the general contractor,” says Carstensen. “This way, the customer has only one contact person and one contracting party without having to negotiate with each provider individually.”

Flexibility is Key

Fluxcode’s solution has been designed to be flexible so that a small manufacturer of handmade cigars can use it just as well as a multinational company, says Carstensen. Most of the company’s clients are medium-sized companies with between five and 50 production lines. They are highly diverse, ranging from cigarette and roll-your-own manufacturers to moist snuff, cigar and cigarillo makers. With T&T becoming mandatory for other tobacco products in the EU starting this May, the company has witnessed increased demand for its offerings. “Many companies, especially smaller ones, are very insecure and have no concrete idea what this obligation will mean for them,” says Carstensen. “Apart from software, this requires a lot of educational work.”

Despite its complexity, Fluxcode is easy to use and stable, according to Carstensen. “Principally, there are very few cases where support is needed since our software enables the customer to solve many issues himself with a simple click. Besides, it runs reliably and provides the user with information before a potential data error occurs.”

Should support be required, response times are low compared to other companies, stresses Carstensen. “In most cases, issues can be solved within hours.”

Currently, the majority of Fluxcode’s customers have their manufacturing sites inside the EU, but the company is in advanced talks with clients in Asia and South America. The system is highly compatible with the various T&T requirements of individual regions, according to Fluxcode. Differences can be found not only in international tobacco markets but even within the EU. “Registration with an EU ID issuer is not standardized, hence each country has its own system and interface for this,” says Carstensen. “Registration can be more or less demanding—in Italy, for example, the process takes several weeks. In other countries, registration takes place with a few mouse clicks.”

Production outside the EU may require other parameters, such as the obligation to print two codes on the packaging. The different product categories also present different challenges. “Cigarettes have a faster production speed than cigars or shisha tobacco, hence there is more motion along the entire production line,” says Carstensen. “This can cause print images to blur or smudge. This requires precise interaction of speed adjustment, production line design and print control. Cigars, on the [other] hand, will have to be printed and labeled individually. If sold in wooden boxes and stored, they require a label that will stick to the box for years and a code that will still be legible [after that time].”

With a majority of countries committed to tracking and tracing tobacco products in accordance with FCTC requirements but only a few having introduced T&T products yet, Carstensen sees vast potential for his solution. “Tobacco products are only the beginning. In Russia alone, several sectors are required to track and trace, such as milk, baby food or alcohol. Here, new markets will emerge in the future.”