PMI Biggest Beneficiary of HTP Tax Cuts: Critics

- Featured Heat-Not-Burn News This Week Taxation

- September 30, 2024

- 0

- 2 minutes read

Philip Morris International would be the biggest beneficiary of New Zealand’s tax cuts for heated-tobacco products (HTPs), critics told Associate Health Minister Casey Costello, according to RNZ.

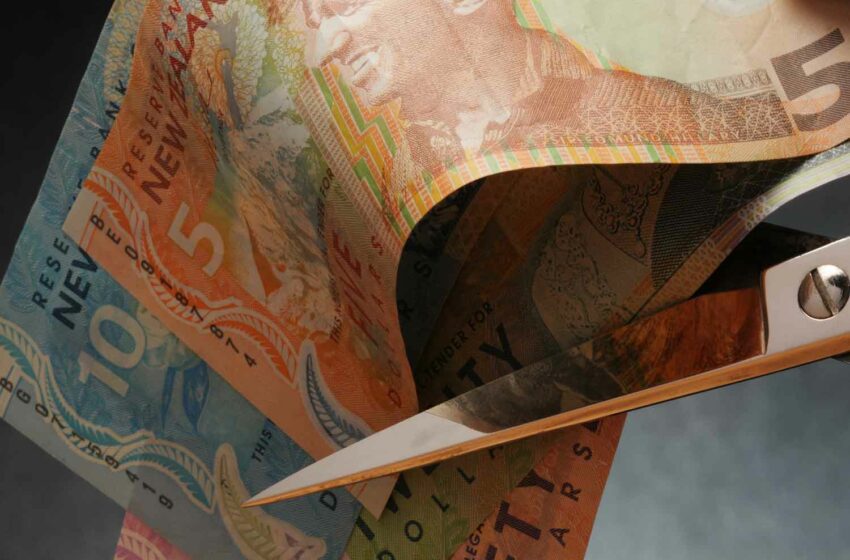

In July, Costello announced a 50 percent cut to HTP excise taxes, arguing that doing so would encourage cigarette smokers to migrate to less unhealthy nicotine products.

The government of New Zealand will set aside NZD216 million ($127.39 million) to pay for the tax reductions.

According to critics, the only commercial beneficiary of the tobacco tax cuts is PMI, which is the sole supplier of HTPs in New Zealand.

In briefings to Costello, treasury officials questioned whether PMI would pass on the excise cut to consumers given its dominance in the market, according to documents obtained by RNZ under the Official Information Act.

“It may be that the reduction in excise taxes is not passed through to consumers in price reductions but rather is retained by the sole importer,” the officials warned.

In response to questions about her motivations, Costello stated that she had no connections to the tobacco business. “It’s completely wrong to suggest that the tobacco industry has anything to do with these policies, which are aimed at helping people quit smoking,” she was quoted as saying.

Costello has repeatedly said the excise tax cut for HTPs is designed to lower smoking rates by offering alternatives for people struggling to quit. She has claimed that “HTPs have a similar risk profile to vapes.”

Treasury officials reportedly cited evidence that HTPs are more harmful than vaping.