An exclusive tour of PMI’s state-of-the-art heated-tobacco units plant in Bologna

By Stefanie Rossel

A traditional cigarette factory gone sci-fi—that’s the impression Philip Morris International’s manufacturing site in Crespellano, near Bologna, is likely to leave on new visitors. Philip Morris Manufacturing and Technology Bologna (PMMTB), which is the company’s first factory dedicated exclusively to mass producing reduced-risk products (RRPs), provides a glimpse into the future of nicotine-delivery systems manufacturing. Presently, the facility focuses on consumables for the company’s IQOS heated-tobacco product (HTP).

From the outside, the elongated structure with its glass facade and fountains framing the entrance, which was built in only 33 months and began production in 2016, could double as a modern congress facility. Measuring 110,000 square meters, the building hosts production, logistics, quality control and administration facilities, however. It has also been designed as an agreeable place to work. In addition to offices and a conference center, the building features a kitchen with a free-flow restaurant, modern changing rooms and a gym.

To visitors, the site may seem more like a pharmaceutical facility than a traditional factory. To prevent contamination, no one is allowed to enter the shop floor without protective gear. A visitor center showcases the product ingredients and details the specifications of various IQOS consumables. Heets, the consumables of IQOS Original, comprise a tobacco plug, a hollow acetate tube, a polymer-film filter and a cellulose-acetate mouthpiece filter. In addition, there are outer papers and mouth-end papers.

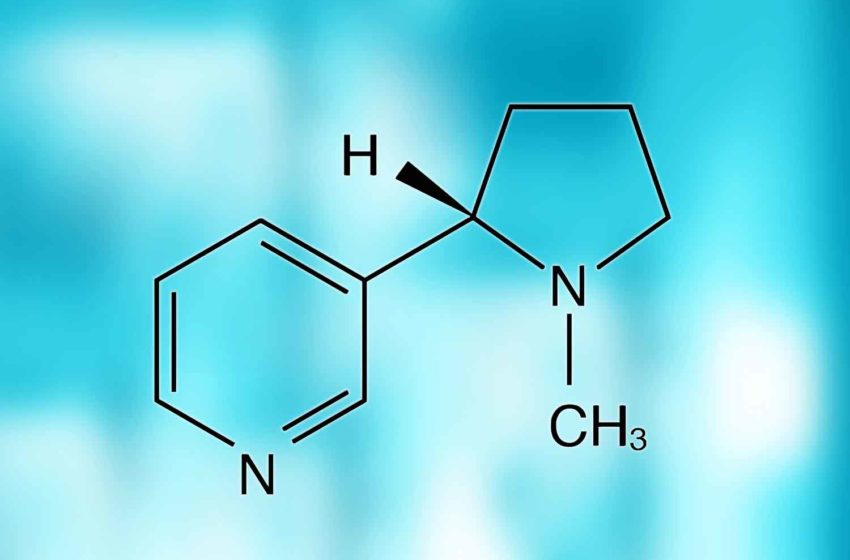

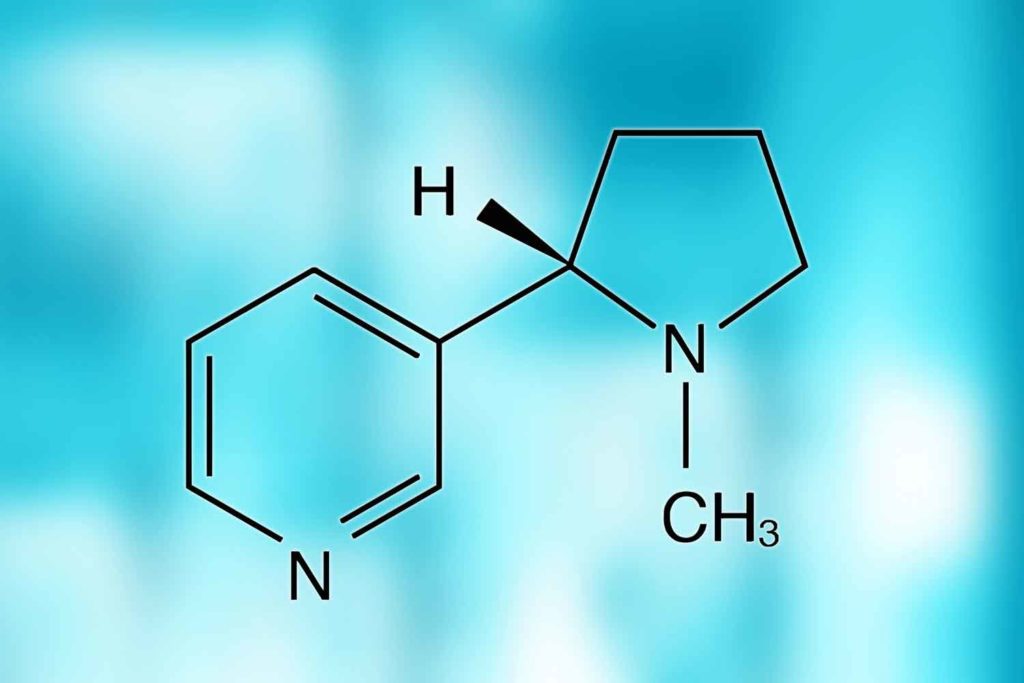

The tobacco part, visible at the end of each Heets, is made from fine tobacco powder mixed with fibers, such as cotton, glycerin and guar gum, and then cast into a sheet and rolled onto bobbins. The tobacco rods are manufactured by crimping the tobacco cast leaf in a patented process, which enables the heating blade to be inserted into the consumables.

Terea Sticks, the consumables for IQOS Iluma, use Smartcore Induction System technology. Iluma, which does not need to be cleaned, is an induction heated device, hence the Terea sticks are equipped with a metal heating element, a thin solid metal thread that is coated with stainless steel and heats the tobacco from within. While with 4.5 cm it is as long as a Heets stick, the Terea consumable contains a fifth component: a front plug at the end of the stick behind the tobacco element to prevent contamination of the device. According to a PMMTB employee, the most challenging part in the production process is to put the metal stick into the center of the tobacco rod and allow eleven holes of filtration in the right place.

Share the Learnings

The highly automated shop floor comprises a series of halls that are arranged on both sides of a long corridor aptly called “the spine.” Among other things, they house the primary with the cast sheet production and the secondary with the filter-making division. The latter is divided into so-called cells, production lines that each comprise a crimper for turning the leaf sheets into the sticks’ tobacco elements, a filter combiner that assembles the consumables’ components and a packer. A web of buffer systems below the hall ceiling supplies individual cells with filter segments.

Each part of the secondary has been designed to respond quickly to changing consumer needs and allow for future expansion. For instance, several of the cells that used to be dedicated to making Heets are currently being converted to manufacture Terea sticks, which Crespellano started producing in 2021. The cells’ new configuration reduces the space required for each production line from 1,200 square meters to 900 square meters. As it gained experience, PMMTB has been able to carry out such conversions quicker. While it took the company more than a year to refurbish the first line, it completed the fourth in four months.

With more than 1,700 employees, the Crespellano site exports its products to about 40 countries where IQOS is presently marketed. In terms of value, the factory exports exceed Italy’s exports of olive oil and parmigiano cheese. To date, PMI has invested more than €1 billion ($1.06 billion) in PMMTB, which has become the company’s center of excellence for staff training, prototyping and large-scale production of smoke-free tobacco products.

The plant is the largest factory in Italy to be built from scratch in 20 years and has made PMI one of the largest investors in the country. It is also the biggest facility dedicated to smoke-free products within PMI. PMMTB establishes the manufacturing processes for PMI’s HTP products worldwide. The learnings gathered in Bologna are then exported to PMI’s 38 manufacturing affiliates in 28 countries. Over the past five years, PMI has transformed several of its combustible cigarette factories into heat stick production facilities, including in Aspropyrgos in Greece, where it invested €300 million, Otopeni (Romania, €490 million) and Yangsan (South Korea, €420 million). Today, the company has seven smoke-free product manufacturing plants.

In addition to the consumables manufacturing facility, the Crespellano site also houses PMI’s new Center for Industrial Excellence, which was inaugurated in the autumn of 2021 and is the largest within the company for industrialization, process innovation, engineering and sustainability. The center is part of a plan to invest approximately €600 million in smoke-free products in Italy over three years. The project is anticipated to create 8,000 direct and indirect jobs.

The most recent addition to PMMTB has been the Institute for Manufacturing Competences (IMC), which opened in 2022. The company’s aims are to create a skills development center for continuous training and technology transfer, with a focus on manufacturing digital, sustainability, talent development and managerial competences. PMI wants the IMC to benefit not only employees but also suppliers and other stakeholders. The academy, which also finances scholarships, carries out applied research projects with the University of Bologna, the Polytech of Bari and various competence centers.

In designing PMMTB, PMI paid considerable attention to its ecological footprint. The facility purchases 100 percent certified renewable electricity and features a photovoltaic system, avoiding emissions of about 2,000 tons of carbon dioxide per year. Between 2017 and 2020, the site reduced its emissions by 17.1 percent. Those of its supply chain declined by 56 percent from 2012 to 2020. Built in accordance with sustainability standards, the IMC is completely self-sufficient in energy.

Longtime Player in Italy

Italy is an important market for PMI. Statista expects tobacco products revenue to reach $24.73 billion in 2023. The market is expected to expand at a compound annual growth rate of 0.57 percent between 2023 and 2027. While cigarettes still account for the lion’s share of the domestic market, sales of novel products are growing quickly. In 2021, Italy was the world’s third-largest market for HTPs, with 9 billion sticks sold, behind Japan (45 billion) and Russia (21.7 billion), according to Euromonitor. By February 2023, about 2 million Italian smokers had completely switched to IQOS and stopped smoking, according to PMI.

PMI has been in Italy for more than half a century. In 1963, the company set up Intertaba in Zola Predosa—a 10 minutes’ drive from Crespellano—to supply filters under license of the Italian tobacco monopoly ETI. In 2020, Intertaba became a reference point for the development of new technologies. In 2013, PMI finalized a high-tech filter production facility at the site, which then became the company’s Center of Excellence in Manufacturing and Technology for innovative filters and smoke-free products. With 20 standalone prototyping lines, Intertaba works as a vertical startup by developing new products from concept proof through technology verification. In 2020, the U.S. Food and Drug Administration authorized the marketing of the IQOS tobacco-heating system as a modified-risk tobacco product.

Opened in Rome in 2001, Philip Morris Italia is responsible for the sale and marketing of PMI brands in Italy. In 2020 and 2022, PMI established digital information service centers in Taranto and Marcianise, respectively.

Pipeline of Innovations

To date, PMI has invested more than $10 billion in its transition to smoke-free products. The company employs more than 980 people in R&D and has evolved into the EU’s 45th-largest patent filer. At the 2023 CAGNY Conference, Chief Financial Officer Emmanuel Babeau said PMI was on track to become a majority smoke-free company by 2025. Last year’s acquisition of Swedish Match provided a substantial boost to reaching this target. The smoke-free net revenues of the two companies combined amounted to about $12 billion in 2022, accounting for more than a third of total net revenues.

PMI’s smoke-free business has been profitable for several years. The Swedish Match deal provided the company not only with a strong position in Scandinavia but has also given PMI a rapidly growing modern oral nicotine brand, Zyn. Swedish Match’s nicotine pouch led the U.S. retail category with 75.7 percent in the fourth quarter of 2022.

IQOS continues to grow too. PMI’s shipments of heated-tobacco units grew 14.9 percent in 2022. In the fourth quarter of 2022, 24.9 million smokers worldwide used IQOS. Seventy percent of them had completely converted to the new product. In the fourth quarter of 2022, HTPs accounted for 8.8 percent of the EU market, up from 6.4 percent during the same period in 2021. Ninety percent of HTP users in Europe use IQOS. In Japan, growth of IQOS consumable sales has been driven by Iluma. In the fourth quarter of 2022, PMI’s HTPs had a market share of 24.5 percent.

The company has set ambitious targets for its smoke-free business. By 2025, PMI wants to have a user base of more than 40 million smokers who have switched to one of its smoke-free products and stopped smoking.

The company aims to have its smoke-free products available in 100 markets. More than $1 billion in net revenues is supposed to be generated by the company’s “beyond nicotine” business, which focuses on wellness and healthcare products.

To achieve these goals, PMI is expanding its RRP portfolio. On Jan. 30, 2022, the company turned its 2020 cooperation deal with KT&G into a 15-year contract. The agreement gives PMI exclusive access to KT&G’s smoke-free brands and innovation pipeline. In return, KT&G benefits from PMI’s global commercial infrastructure and experience in commercializing smoke-free products. As a result of the collaboration, KT&G’s Lil HTP, which is considered complementary to PMI’s smoke-free products, is present in 31 countries in Central America, Europe and Central Asia.

PMI aims to provide smokers in low-income and middle-income countries (LMICs) with less hazardous alternatives. About 80 percent of the world’s smokers live in LMICs and often have limited access to affordable RRPs. In November 2022, PMI launched a new HTP device—Bonds by IQOS. Based on IQOS Original’s blade heating technology, the product is marketed as “simple, convenient and affordable without compromising on a reduced-risk profile,” making it a relevant proposition for consumers in LMICs, according to Babeau. The product has shown promise during pilot launches in the Philippines. Further commercialization is anticipated during this year.