Tobacco manufacturers see potential in the herbal heat sticks market.

By Stefanie Rossel

Only months after the newly emerged, highly fragmented niche of herbal heated products (HHPs) was deemed important enough to be covered by market analysts, Big Tobacco entered the scene. As it did with vaping, its arrival is expected to change the market significantly.

At the InterTabac exhibition in September, BAT introduced Veo sticks. The tobacco-free consumables, compatible with the company’s Glo Hyper Series induction heating device, are based on processed rooibos tea substrate that contains 1.6 percent nicotine. They come in five flavor variants, among them two minty and three fruity tastes. The flavor is released through a capsule in the filter. According to BAT, the sticks generate 90 percent less harmful substances than a standard reference cigarette. Veo sticks were first launched in nine European countries, among them Czechia, Germany and Italy. The company plans to roll out the product worldwide.

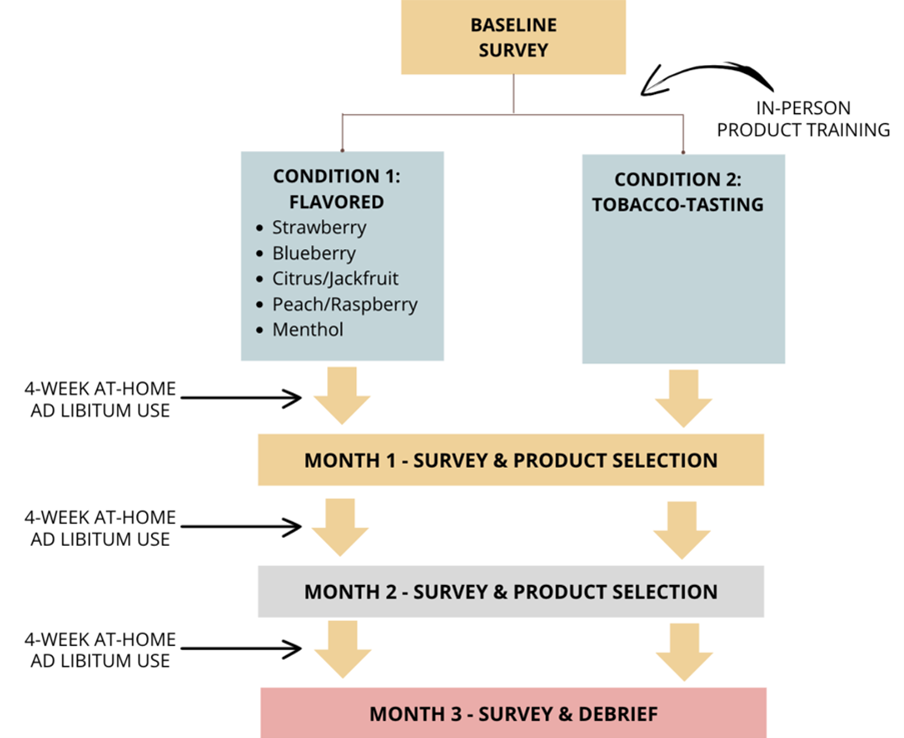

Also in September, Philip Morris International CEO Jacez Olczak presented his company’s new Levia product. Levia uses cellulose as its carrier material, a natural plant fiber that is also found in tobacco leaves. As Gizelle Baker, PMI’s vice president of global scientific engagement, explained in an interview, the product does not contain tobacco but contains nicotine and propylene glycol, thus creating an aerosolized nicotine similar to e-cigarettes. PMI claims that Levia emits on average 99 percent fewer harmful chemicals than combustible cigarettes—less even than e-cigarettes, which are said to be 95 percent less harmful than traditional smokes. The product has been designed for use with IQOS Iluma, a heated-tobacco device that uses induction technology to heat tobacco-based Terea consumables. Baker said that after an update of its firmware, the device is able to recognize the consumable used and adjust the settings to give users the best experience for that product. She added that the company would start to conduct “people usage” studies once Levia was put on the market.

According to eliquids.ie, Levia was introduced in the Czech Republic in November, with a retail price of €4.90 ($5.32) per pack—the same price as Terea. The product was initially available only in online shops and dedicated IQOS stores. It is marketed in two flavor variants in Czechia—“Electro Rouge,” a combination of blueberries, flower and menthol, and “Island Beat,” which the website describes as a creamy menthol and peppermint taste.

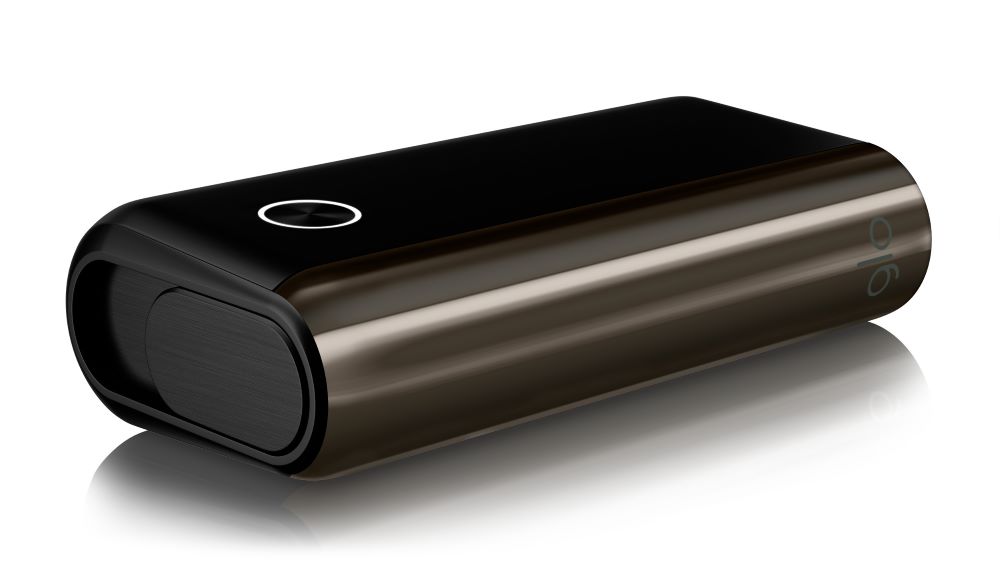

In November, Imperial Brands launched iSenzia heat sticks, which are formulated from Oolong and green tea leaves infused with nicotine and have been developed for the company’s Pulze 2.0 heating device. The product, which also features capsule technology, was introduced to the Czech market in four fruity flavors and one menthol flavor at a price of €4.30 per pack, according to Tobacco Insider.

Preserving Flavor Options

HHPs gained momentum ahead of the EU’s Oct. 23, 2023, ban on flavored heated-tobacco products (HTPs) (see “Teatime,” Tobacco Reporter, August 2023). Many observers expected the market to be short-lived. The entry of the leading tobacco companies surprised some, given the lengthy and costly process of product development that went into HTPs, says Eva Antal, director of market analysis at Tamarind Intelligence, parent of market research firm TobaccoIntelligence, which in November launched an Herbal Heated Sticks Tracker. “We don’t have information on how long these products were in the pipeline, but it is surprising how little information has been shared at launch about the scientific background of health impacts of HHPs,” she says. “Manufacturers’ motivation was to continue their offer of flavored products.”

Before the product launches by BAT, PMI and IB, all HHPs were targeting non-Iluma IQOS users and therefore were also compatible with KT&G’s Lil and IB’s Pulze devices. “No HHPs targeted Glo devices, as IQOS had and still has the highest market share in EU markets,” says Antal. “At that time, our estimate was that between 1 percent and 9 percent of heated-tobacco users were regularly using such products—mostly along with other tobacco-containing sticks—which was relatively low still. We observed an increasing offer in nicotine-containing HHPs in the past year as products not containing nicotine had been the main shortcoming of the category. With the main players launching their HHPs, this segment is bound for fast growth mainly driven by the fact that only these consumables will be able to have flavors and large companies’ distribution advantage to make these products widely available in their regular HTP sales channels.”

While many EU countries are starting to regulate the category, plenty of opportunity remains. “Eastern European markets with strong HTP markets are attractive due to a lower price point and consumers’ predilection of flavors,” says Antal. “Asia, where herbal smoking products have a long history, is strong, especially Japan.”

Amended Tax Laws

HHPs became popular not only due to their flavors but also because they initially avoided the taxes levied on their tobacco-containing counterparts. In the meantime, however, several countries have expanded their fiscal definitions to include HHPs. In December 2023, Greece changed its laws to fiscally equate tobacco-free electrically heated products with tobacco products. In Germany, tobacco-free Veo sticks are sold with a tax stamp stating, “heated tobacco” because it is being taxed as such.

Its price hasn’t changed, though. Since its introduction in Germany, a pack of Veo sticks has retailed for €5.80, the same price as BAT’s tobacco-based Neo sticks. “Large companies’ HHPs were launched on the same price as their tobacco-containing counterparts even in countries where they were not taxed,” explains Antal. “This was probably to avoid the cannibalization of tobacco sticks of the company. The price differential may not solely come from the tax. Price of raw materials, manufacturing costs and other margins may play into it as well, which is probably why we still see smaller companies’ HHPs being cheaper than HTPs even in countries with tax.”

Distribution and Scale

She predicts further growth in nicotine-containing HHPs, a category that started from zero nicotine options only, as well as a widening flavor offer. “PMI only launched HHP for IIuma, which is probably forward thinking as PMI is replacing heritage models with Iluma in an increasing number of markets,” she says. “But there are still a lot of users of heritage models that use Heets, which in the short term could be an opportunity for smaller companies. Imperial Brands’ Pulze HHP iSenzia is compatible with IQOS. Will there be a HHP launched for Fiit, which is the Lil consumable? PMI has a distribution relationship with KT&G, and their consumables are compatible with their devices. A Lil-compatible HHP may cannibalize PMI’s tobacco-containing Heets consumables, so this probably is not likely to be favored by PMI.”

The question, according to Antal, is whether these large company HHPs will remain in EU Tobacco Products Directive (TPD) markets or whether they will become part of a larger strategic change in direction away from tobacco.

Small players could be more agile to develop new products and respond quicker to consumer feedback. “However, they are not likely to have a huge advantage, as distribution and scale is key where larger players are better positioned,” says Antal. “Probably not a lot of questions will be asked by consumers if an HHP is made by the same company they know from their tobacco-containing consumables is displayed in the same place as their old product and has a flavor they like or are used to.”

She thinks that the Big Tobacco takeovers that happened in the vapor business are unlikely to occur in the HHP category. “As the HHP phenomenon started with zero nicotine, it has not become very popular before large companies launched, and smaller manufacturers did not have enough time to build significant market share. There is not a large amount of technical IP going into these products; they are easy to manufacture, and there currently is no brand with significant market share or brand strength, so I don’t see any acquisitions unfolding in this space.”

Observers agree that it is only a matter of time before governments start regulating HHPs. “The basis of such regulation could be that these products are used in a similar way or for a similar purpose to a tobacco product, hence they imitate the consumption of tobacco products or replace tobacco products, but this is subject to the existing definitions of individual countries,” says Antal. “HHPs are expected to be part of the revised TPD3, if not before.”