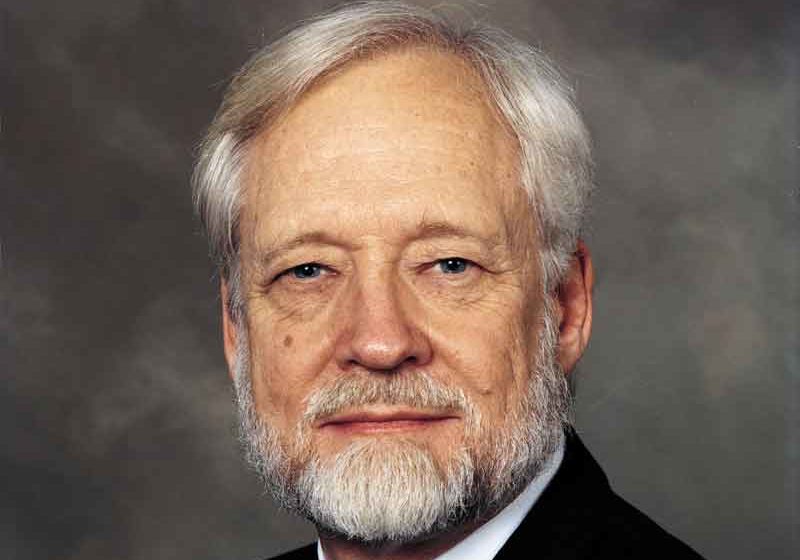

Dayton Harris Matlick, who devoted more than 80 years of his life to working in tobacco, passed away in February at the age of 88. Dayton founded a publishing company in Raleigh, North Carolina, that produced Tobacco Reporter for nearly 40 years. His company also published Vapor Voice, Tobacconist, Flue-Cured Tobacco Farmer, Tobacco Farm Quarterly, Tobacco Science, Burley Farmer and Pipes and Tobaccos. Other topics his company’s magazines covered included golf, firefighting, emergency rescue, truck driving and a support magazine for those dealing with cancer.

Dayton was raised in Louisville, Kentucky, on a burley tobacco and beef farm. His most reliable (and favorite) mode of transportation to get to town was by foot—his running talent helped him gain a spot on the track team at the University of Kentucky, where he earned his bachelor’s degree in journalism. He then earned a master’s degree in communications from Michigan State University, where he also taught.

Dayton’s father, J.O. Matlick, who had little formal education, became a local extension agent and then commissioner of Natural Resources for the Commonwealth of Kentucky. Along the way, he began distributing regular newsletters that eventually turned into magazines. Dayton began writing and editing for his father’s Kentucky Farmer’s Home Journal in 1959. When J.O. suffered serious health problems, the magazines were sold to Harvest Publishing in Michigan. Dayton moved with the publications and became an award-winning journalist.

In 1981, Harvest decided to divest its agricultural division, which Dayton bought and moved to North Carolina under the name Specialized Agricultural Communications, which eventually got shortened to SpecComm. Tobacco Reporter was a natural fit to the existing titles and was added to the company’s catalog.

As chairman of SpecComm, Dayton traveled the world and made friends on virtually all continents. He had a particular affinity for the art of pipemaking and thanks to his travels (and the magazine he created dedicated to the hobby) was able to amass one of the greatest pipe collections in the world. He was a tobacco Renaissance man, friends with important tobacco people around the world and interested in every detail about the leaf that captivates so many. In 1994, Dayton set up TabExpo, the most respected global exposition for tobacco manufacturers that continues to this day, which also led to the creation of the GTNF. In 2019, Dayton sold SpecComm to TMA.

Dayton mentored far too many people in the publishing industry to count and created a legacy that will continue to endure. Dayton was a 10th-degree black belt in Taekwondo and continued to practice the art well into his 70s. He was also a voracious reader, loved science fiction and named several of his beloved dogs after characters from Star Wars.