The 2021 GTNF would have been impossible without the support of these generous sponsors.

TR Staff Report

Founded in 2009 and headquartered in Shenzhen, China, ALD Group Limited is an innovation-driven enterprise specializing in a full range of next-generation products, including electronic nicotine-delivery systems, CBD vaporizers and heated-tobacco devices. As one of the leading vape manufacturers, ALD is capitalizing on years of R&D know-how and manufacturing experience to provide global one-stop service. With a powerful intellectual property system, high-quality assurance, fast delivery service and a strong commitment to social responsibility, ALD serves worldwide clients with the most cutting-edge products.

Alliance One International is a tobacco leaf supplier that offers customers high-quality leaf they can trust. With more than 145 years of agricultural experience and customers in approximately 90 countries, Alliance One International purchases tobacco from a network of more than 300,000 farmers worldwide to produce products that are sustainable and traceable.

Altria’s tobacco companies have a long history of leading the industry. Today, adult tobacco consumers are increasingly seeking new options, including those that reduce risk, and their preferences are evolving rapidly. Altria’s vision by 2030 is to responsibly lead the transition of adult smokers to a smoke-free future. To that end, it will work within the framework that government, public health and regulatory bodies have established to communicate about reduced-harm choices. And for any tobacco consumer who wants to quit, Altria offers access to a breadth of information from experts on how to do so successfully. The actions the company is taking will create a different Altria—and a different landscape that the company believes will benefit today’s adult tobacco consumers.

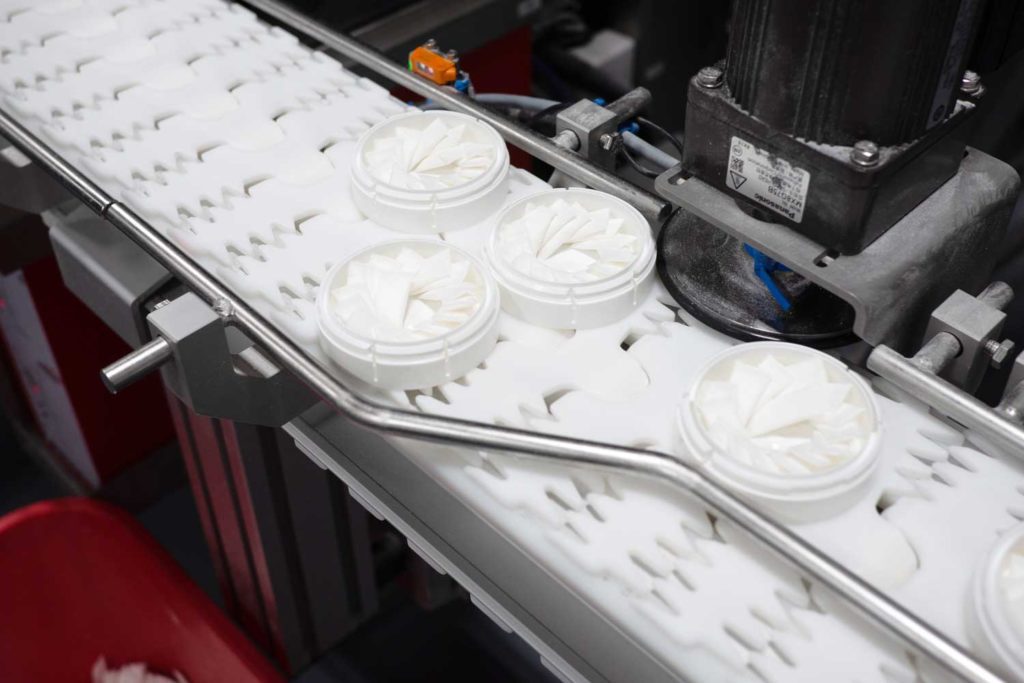

Barrettine Environmental Health has worked with the tobacco industry to develop a combined insect monitoring trap that functions as an early warning detection system for both tobacco beetles and tobacco moths. The MoBe Combo trap is an all-in-one hygiene control system for use during tobacco storage, shipment, processing and manufacture.

When using the MoBe Combo Mk. 2, there is only one trap to check, which can significantly reduce both product and labor cost. Since the launch of the MoBe Combo trap, the company has introduced several enhancements.

The tobacco beetle is often seen as the most significant tobacco pest; however, tobacco moth infestations can also contribute to significant damage to stored tobacco as well as processed and finished stock. With climate control used in many areas of tobacco processing sites, both species have the potential to thrive in all regions of the world. The MoBe Combo trap is effective in monitoring both species or either of the species in isolation.

BAT is a leading consumer-centric, multi-category consumer goods company that provides tobacco and nicotine products to millions of adult consumers around the world. Its purpose is to build “a better tomorrow.” It will achieve this by reducing the health impact of its business through a multi-category portfolio of noncombustible products tailored to meet the preferences of adult consumers.

BAT is investing in building a portfolio of reduced-risk tobacco and nicotine products*† alongside its traditional tobacco business—including vapor products, tobacco-heating products and modern oral products, which are collectively termed New Categories, as well as traditional oral products.

BAT’s ambition is to increasingly transition revenues from combustible products to its New Category products over time. The company employs more than 55,000 people, operates in more than 180 markets and has 79 owned manufacturing facilities in countries around the world. In 2020, the BAT Group generated revenue of £25.8 billion and profit from operations of £10 billion.

BMJ is the world’s No. 1 partner for specialty paper and packaging materials in the cigarette industry. BMJ produces cigarette paper, plugwrap paper, base tipping paper and printed tipping paper with standard weights of 18 grams to 40 grams per square meter. As a printing packaging company, BMJ represents high-quality packaging utilizing both rotogravure and offset.

Boegli-Gravures designs, develops and manufactures state-of-the-art embossing tools and solutions for an exacting worldwide clientele. The company’s combination of artistic vision and engineering excellence has brought it recognition as a world leader in high-precision embossing and as an original equipment manufacturer supplier. The secret of Boegli-Gravures’ success lies in the company’s vision and passion for innovation.

Broughton is a privately owned global contract research organization (CRO) offering fully integrated end-to-end services to deliver U.S. premarket tobacco product applications, EU medicinal product applications and EU Tobacco Products Directive notifications for next-generation nicotine products. Our business culture is to continue to invest in new science and innovations aligned with global regulatory requirements. By partnering with Broughton, clients will know they have access to some of the most experienced consultants in the world with deep industry knowledge combined with regulatory compliant CRO laboratory facilities. Broughton is committed to supporting clients in their development of safer nicotine products.

CNT is the world’s largest supplier of highly purified nicotine to the pharmaceutical and next-generation products (NGP) industries. With pure nicotine and nicotine polacrilex resin manufacturing capabilities in Switzerland and Northern Ireland, CNT offers 100 percent contingency in supply of these key products. In addition, CNT has now developed an array of new nicotine-containing formulations for use in a broad spectrum of NGP applications, including modern oral (pouch) products. CNT is actively developing new product categories in its “beyond nicotine” strategy, utilizing its knowledge learned in nicotine to explore additional active substances of interest to our customers. CNT is one of the world’s leading suppliers of sustainably produced tobacco leaf.

Headquartered in Austria, Delfort is a global leader in tailor-made specialty papers. In addition to thin print paper, release base paper, food packaging paper and electrical applications paper, the company manufactures a complete portfolio of top-quality cigarette paper, plugwrap paper, tipping base paper and printed papers. By utilizing pure and certified raw materials with the most advanced equipment, Delfort ensures that its products meet the most stringent quality requirements.

FEELM is a high-end atomization technology brand belonging to SMOORE, a world leader in atomization. Focused on cutting-edge atomization technology research, FEELM specializes in the development and manufacturing of high-quality atomization devices driven by the FEELM ceramic coil.

As the research engine of the global electronic atomization industry, FEELM delivers premium experience. Ever since the successful development of the FEELM black ceramic coil in 2016, FEELM has a significant impact on the research and manufacturing of closed vaping products, changing the whole competitive landscape.

FEELM won a Golden Leaf Award at GTNF 2018, the China Patent Excellence Award and the iF Design Award 2020. Vaping devices loaded with FEELM atomizer have been exported to Europe, America, East Asia, Africa, Oceania and many other countries and regions. Its accumulated sales volume has surpassed 3 billion pieces, becoming more and more popular among worldwide consumers.

The Foundation for a Smoke-Free World is an independent, U.S. nonprofit private organization that was formed in 2017 to reduce the 8 million annual deaths caused by tobacco use and address the consequences of reduced demand for tobacco farmers. The Foundation’s mission to end smoking in this generation is supported through three core pillars: Health, Science, and Technology; Agriculture and Livelihoods; and Industry Transformation. To achieve its mission on a truly global scale, the Foundation strives to identify and address the unique needs of the developing world as they relate to tobacco cessation and harm reduction. The Foundation is led by Derek Yach, a global health expert and anti-smoking advocate for more than 30 years.

Funded by annual gifts from PMI Global Services, the Foundation is independent from PMI and operates in a manner that ensures its independence from the influence of any commercial entity. Under the Foundation’s pledge agreement with PMI and bylaws, PMI and the tobacco industry are precluded from having any control or influence over how the Foundation spends its funds or focuses its activities.

Founded in the mid-1980s, Hall Analytical is a globally respected analytical laboratory based in Manchester, U.K., which specializes in complex trace analytical chemistry.

The company’s mission is to deliver innovative and high-quality analytical expertise to strengthen its clients’ ability to improve product safety and reduce harm to patients and consumers. To that end, Hall Analytical partners with clients in the pharmaceutical, biopharmaceutical, medical device and consumer sectors to ensure their products are safe and compliant with appropriate regulatory frameworks.

To support the nicotine reduced-risk product industry, Hall Analytical offers clients a wealth of experience in the analysis of vapor products and heated-tobacco products, supporting their core strategic objective to deliver less harmful, smoke-free alternatives for nicotine consumers.

Imperial Brands is a global consumer organization and the world’s fourth-largest international tobacco company. Its products include JPS, West and Davidoff cigarettes, Rizla rolling papers and the vapor brand Blu. Imperial Brands operates in 120 markets, including the U.S. where its ITG Brands subsidiary offers a broad portfolio of cigarette and mass market cigar brands, including Winston and Backwoods.

Driven by insights and data, Imperial seeks to meet the expectations of adult smokers by putting the consumer at the center of everything it does. It is also refining its ways of working and its culture to foster a strong challenger mindset among its 27,000 employees worldwide.

Imperial is focused on leveraging its tobacco assets in its five priority markets and on building a successful and sustainable next-generation product (NGP) business. This year, it has refocused its NGP strategy behind heated-tobacco and oral nicotine opportunities in Europe and in selective market opportunities in vapor.

Japan Tobacco International is a leading international tobacco and vaping company, with headquarters in Geneva, Switzerland. JTI began 22 years ago when Japan Tobacco acquired the non-U.S. operations of R.J. Reynolds. Since then, its international workforce of over 40,000 employees has driven two decades of growth. JTI owns some of the world’s best-known brands, including Winston, the No. 2 global cigarette brand, and Camel. Other major international brands are Mevius and LD. The company’s portfolio brings together the rich heritage of traditional tobacco as well as the latest technical and scientific innovation in reduced-risk products.

Juul Labs’ mission is to transition the world’s billion adult smokers away from combustible cigarettes, eliminate their use and combat underage usage of its products. The company believes that vapor products can offer adult smokers an alternative to combustible cigarettes and, in so doing, reduce the harm associated with tobacco. Nicotine is addictive and can potentially be harmful. It would be best if no one used any nicotine product. Anyone who smokes should quit. Adult smokers who have not successfully quit should completely switch to potentially less harmful alternative nicotine products. Juul Labs does not want any non-nicotine users, especially those underage, to try its products, as they exist only to transition adult smokers away from combustible cigarettes. Juul products are not intended to be used for smoking cessation or other therapeutic purposes.

Kure operates more than 130 retail locations across the United States and several more in Europe. The company is a recognized leader in the vape industry. Kure’s e-liquid line and bar offers custom, bespoke liquids made with the highest quality ingredients to cater to the tastes of every guest. Its tailored in-store service is designed to provide the best support possible to transition from smoking to vaping. Kure offers the latest and greatest hardware to ensure its guests receive only the best.

Kure has submitted its thorough premarket tobacco product applications to the U.S. Food and Drug Administration. These applications detail the high standards the company adheres to in all aspects of its business. Moreover, Kure takes its responsibility to its guests and the community it serves seriously and has thus designed and implemented measures to ensure its products never end up in the hands of minors. Kure uses tools such as electronic point-of-service age verification software, secret shopper programs and extensive employee training programs to keep this commitment.

Philip Morris International is leading a transformation in the tobacco industry to create a smoke-free future and ultimately replace cigarettes with smoke-free products to the benefit of adults who would otherwise continue to smoke. PMI is a leading international tobacco company engaged in the manufacture and sale of cigarettes as well as smoke-free products, associated electronic devices and accessories and other nicotine-containing products in markets outside the U.S.

In addition, PMI ships versions of its IQOS Platform 1 device and consumables to Altria Group for sale under license in the U.S., where these products have received marketing authorizations from the Food and Drug Administration under the

premarket tobacco product application pathway; the FDA has also authorized the marketing of a version of IQOS and its consumables as a modified-risk tobacco product, finding that an exposure modification order for these products is appropriate to promote the public health.

PMI is building a future on a new category of smoke-free products that, while not risk-free, are a much better choice than continuing to smoke. Through multidisciplinary capabilities in product development, state-of-the-art facilities and scientific substantiation, PMI aims to ensure that its smoke-free products meet adult consumer preferences and rigorous regulatory requirements.

PMI’s smoke-free product portfolio includes heat-not-burn and nicotine-containing vapor products. As of June 30, 2021, PMI’s smoke-free products are available for sale in 67 markets in key cities or nationwide. PMI estimates that approximately 14.7 million adults around the world have already switched to IQOS and stopped smoking. For more information, please visit www.pmi.com and www.pmiscience.com.

Quartz Business Media is the owner and organizer of the largest network of tobacco-related exhibitions and conferences in the world. These include the market-leading series of World Tobacco events, WT Middle East, TABEXPO and World Shisha Dubai.

Founded in January 2018, Relx is Asia’s leading e-cigarette brand. Relx’s mission is to empower adult smokers through technology, product and science ethically. Relx independently develops its e-cigarette products at its CNAS-standard R&D center and continues to make significant investments in R&D, e-liquid testing and new product development to deliver the best possible experience to its adult users. To protect minors from accessing e-cigarette products, Relx developed the guardian program, a companywide initiative that stretches from product development to sales and marketing, leveraging cutting-edge facial recognition technologies, GPS data and cloud technologies. The company has attracted global talent from Uber, Proctor and Gamble, Huawei, Beats and L’Oreal.

Reynolds American Inc. (RAI) is an indirect, wholly owned subsidiary of BAT and is the parent company of R.J. Reynolds Tobacco Co., American Snuff Co., Santa Fe Natural Tobacco Co., R.J. Reynolds Vapor Co. and Modoral Brands. RAI’s vision is to build “A Better Tomorrow” by reducing the health impact of its business through offering a greater choice of innovative products for adult tobacco consumers.

SMOORE is a global leader in offering vaping technology solutions, including manufacturing vaping devices and vaping components for heat-not-burn products on an ODM basis, with advanced R&D technology, a strong manufacturing capacity, wide-spectrum product portfolio and a diverse customer base. According to Frost & Sullivan, SMOORE is the world’s largest vaping device manufacturer in terms of revenue, accounting for 18.9 percent of the total global market in 2020.

Through its innovative and pioneering vaping technology solutions, SMOORE operates two principal business segments: research, design and manufacturing of closed system vaping devices and vaping components for leading global tobacco companies and independent vaping companies; and research, design, manufacturing and sale of self-branded open system vaping devices, or APV, for retail clients.

SMOORE owns a series of tech brands, including FEELM, CCELL and METEX, and the product brand Vaporesso.

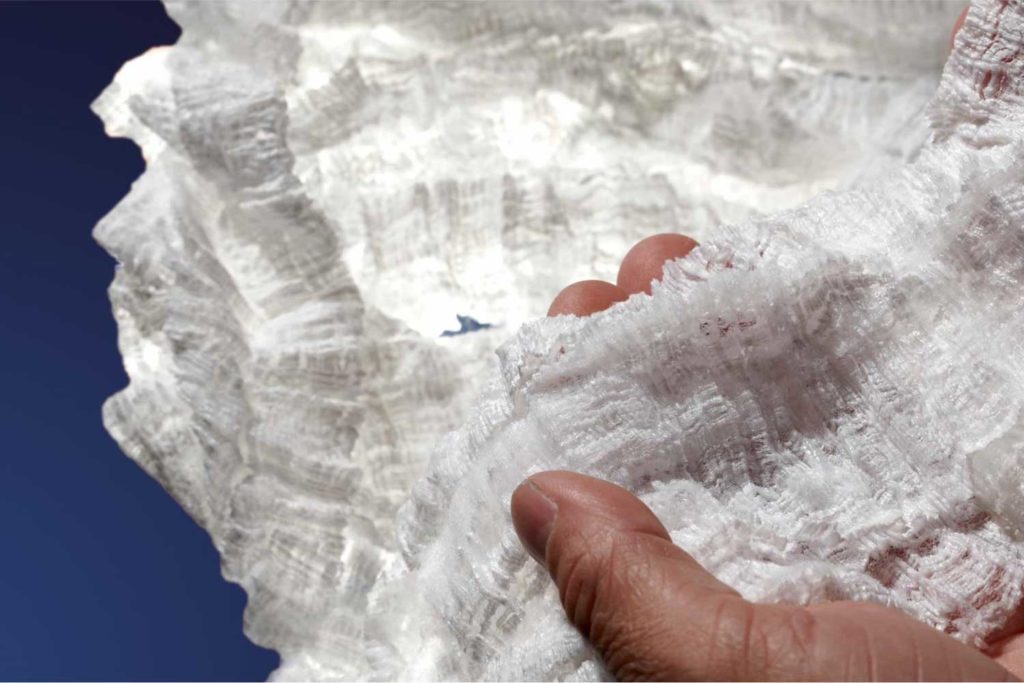

SWM is a leading global provider of highly engineered papers, films, nets and nonwovens for a variety of applications and industries. As an expert in manufacturing materials made from fibers, resin and polymers, the company provides critical components that enhance the performance of their end products.

The company’s engineered papers group has been serving the tobacco industry for decades with highly technical papers and reconstituted tobacco leaf. SWM continues to innovate, with a special focus on heat-not-burn products, using its advanced paper and reconstitution technologies to meet the demands of this emerging product category. SWM’s versatility and portfolio are designed to deliver satisfaction while meeting stringent specifications.

In recent years, SWM has diversified to include films, nets and nonwovens offered through its advanced materials and structures (AMS) segment. The AMS platform serves a variety of industries with the same focus on technical expertise, operational excellence and customer collaboration that have long been SWM’s hallmark traits.

SWM and its subsidiaries manufacture on four continents, conduct business in over 90 countries and employ approximately 5,000 people worldwide.

Founded in 1975, Tobacco Technology Inc. (TTI) exclusively develops and manufactures customized flavors, including casings, for the global tobacco industry: cigarettes, cigars, water pipe, snuff, snus, chew, kretek, roll-your-own, pipe, hemp and dissolvables. TTI also offers consulting services to facilitate flavor, process and product development.

E-LiquiTech (ELT), a TTI subsidiary established in 2016, is dedicated to the development and manufacture of the highest quality e-liquids in addition to offering both bottle and cartomizer filling services. ELT is also the exclusive global distributor to the tobacco industry for Zanoprima, a research-driven, innovation-led life sciences company, offering SyNic high-purity synthetic (S)-nicotine in pure, bitartrate and polacrilex resin form.

TTI Flavors, TTI’s subsidiary in Assisi, Italy, will start production of flavors, casings and e-liquids in the fall of 2021 to offer faster delivery to the company’s customers in Europe, the Middle East, Africa and Russia.

Turning Point Brands continues to grow and evolve to meet changing consumer preferences. Along with a tobacco portfolio that features iconic, historic brands, such as Zig-Zag and Stoker’s, the company has expanded into the vapor and tobacco alternative segments with innovative brands such as VaporBeast, VaporFi and Marley. A highly effective sales force and distribution network ensure that consumers, retailers, partners and shareholders benefit from these products.

For over 100 years, Universal Corp. has been finding innovative solutions to serve its customers and meet their agri-products needs. The company built a global presence, solidified long-term relationships with customers and suppliers, adapted to changing agricultural practices, embraced state-of-the-art technology—and emerged as the recognized industry leader.

Today, Universal Corp. is a global business-to-business agri-products supplier to consumer product manufacturers, operating in over 30 countries on five continents, that sources and processes leaf tobacco and plant-based ingredients. Tobacco has been the company’s principal focus since its founding in 1918, and Universal Corp. is the leading global leaf tobacco supplier. Through its plant-based ingredients platform, Universal provides a variety of value-added manufacturing processes to produce high-quality specialty vegetable-based and fruit-based ingredients for the food and beverage end markets.

Universal Corp. has a long history of operating with integrity, honesty and a focus on quality. It is a vital link in the leaf tobacco supply chain, providing expertise in working with large numbers of farmers, efficiently selling various qualities of leaf to a broad global customer base, adapting to meet evolving customer needs and delivering products that meet stringent quality and regulatory specifications.

Going forward, Universal will build on its history by seeking opportunities in both tobacco and plant-based ingredients to leverage both its assets and expertise. The company will continue its commitment to leadership in setting industry standards, operating with transparency, providing products that are responsibly sourced and investing in and strengthening the communities where it operates.

Zinwi Biotech was founded with the desire to offer the “nature flavor” e-liquid product to its clients. The company is sensitive to new trends. When nicsalt appeared as a game changer, Zinwi became one of the first suppliers with its own formula to meet the market needs.

The merging of cutting-edge technology and boundless creativity, in turn, generates innovative flavoring solutions that serve 400-plus customers worldwide, resulting in a significant share on nicsalt juice used for electronic nicotine-delivery systems.

With heavy investment in R&D, Zinwi in the future won’t limit itself as an e-liquid or nicsalt manufacturer but will also provide flavoring technologies that enrich food, healthcare and medicine products and other products that will help take humans’ lives to the next health level. Visit the company’s website