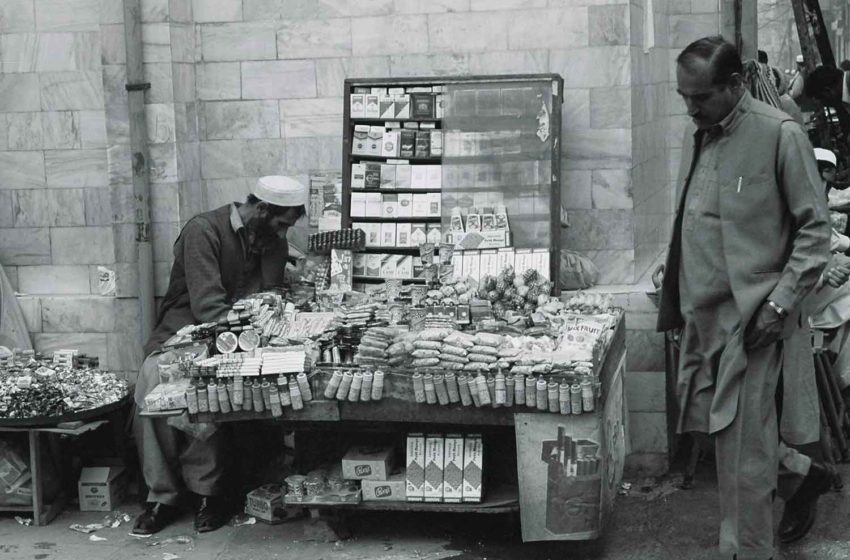

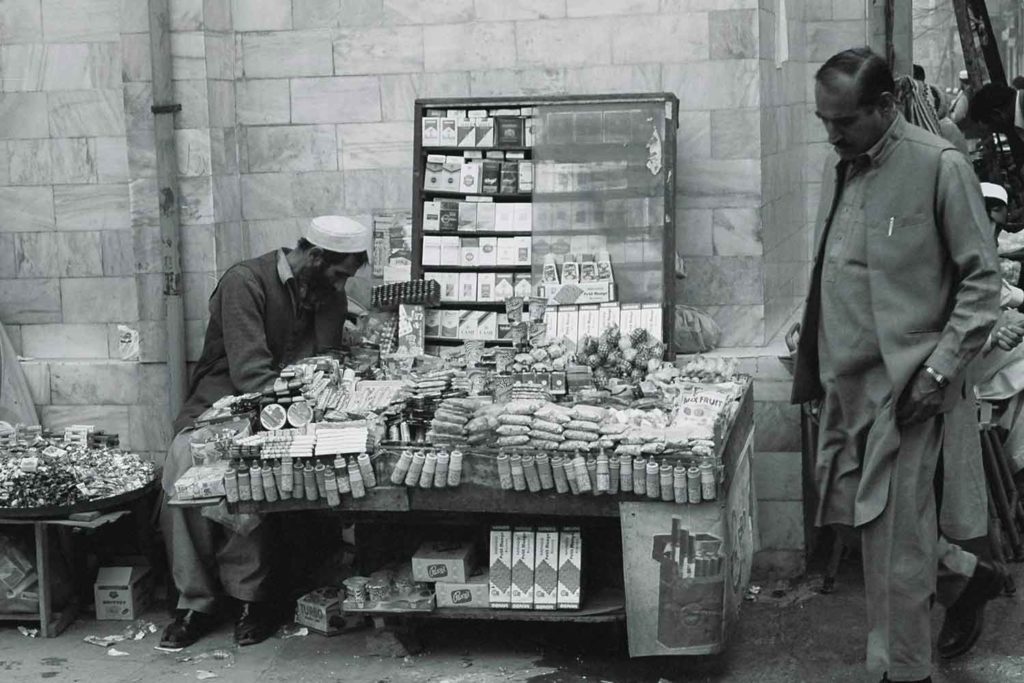

Pakistan Tobacco Co. (PTC) is scaling back production as it struggles to compete with illicit tobacco sales, report Pakistan Today and The Express Tribune.

In a letter to the Federal Board of Revenue, the company stated its intention to re-export four cigarette making machines due to a decline in sales volume. The company has reportedly already shut down eight of 10 production lines at its Jhelum facility.

The move comes in the wake of a steep tobacco tax hike. In February, Pakistan increased the federal excise duty by more than 200 percent, driving smokers to cheaper untaxed locally manufactured tobacco products and smuggled cigarettes. In March, production of duty-paid tobacco products plunged 50 percent, according to the Pakistan Bureau of Statistics. The overall large-scale industry, by contrast, suffered only a decline of 25 percent in the production of duty-paid products.

According to PTC representatives, volumes of duty-not-paid cigarettes and smuggled cigarettes have shot up 32.5 percent and 67 percent, respectively since January. This has bumped the illicit sector’s share to more than 42.5 percent of Pakistan’s total tobacco market.

In 2022-2023, the share of legitimate tobacco sector was 41.4 billion sticks while the illicit sector sold 41.6 billion sticks. Observers expect the February tax hike to hand an additional 11.8 billion sticks to the black market in 2023-2024.

PTC Senior Business Development Manager Qasim Tariq said that, as a result of the tax hike, the government would for the first time in Pakistan’s history lose more tax income to the illicit sector than it earned in revenue from legitimate companies.

“If the current fiscal regime prevails, damage to the national exchequer as well as the legitimate industry will be immense and tough decisions will have to be taken,” he cautioned.

A track-and-trace system to help combat illegal tobacco sales has been delayed by legal challenges and other setbacks.