The entire tobacco value chain in South Africa is under threat from illicit traders; a threat that could increase if a proposal to increase excise taxes again is accepted, according to a story in The Business Day quoting the recently-launched Black Tobacco Farmers Association (BTFA).

The story said it was estimated that close to 50 percent of South Africa’s tobacco-products market was controlled by illicit players, making it one of the world’s biggest markets for illicit tobacco products.

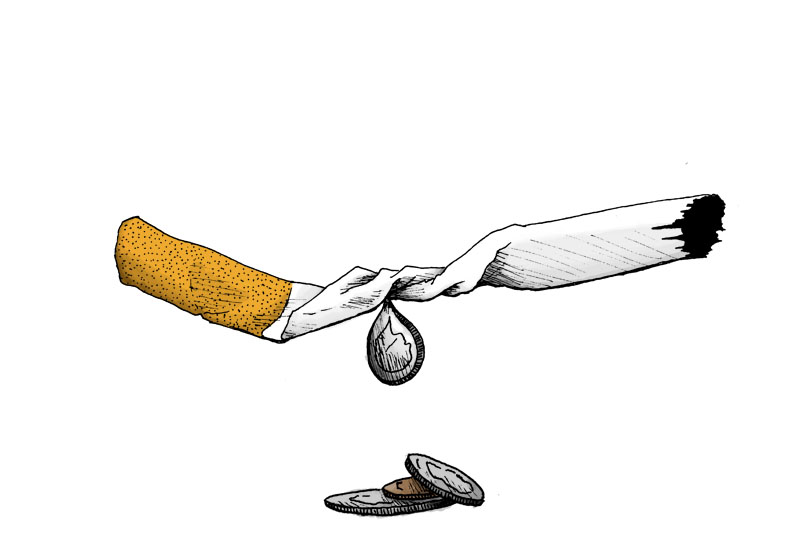

The illegal trade in tobacco products was said to be costing the fiscus up to R9 billion a year in uncollected tax.

The BTFA yesterday called on the government to keep tobacco excise taxes at their current level to protect jobs on farms.

Last year, the Government increased excise duties by between six percent and 10 percent in a move that was expected to bring in an additional R1.33 billion in revenue in the 2018/19 financial year.

The BTFA chairperson Ntando Sibisi said that his organization was asking the Finance Minister to ensure that the South Africa Revenue Service tackled the illegal trade in cigarettes more seriously before excise taxes were increased further.

“At this stage more excise duties will do nothing but cause the illicit economy to grow even more,” said Sibisi. “Under the current economic conditions, an excise increase will force more consumers to go for cheaper, untaxed cigarettes.”

Sibisi said the illegal trade was partly caused by high excise taxes and was “killing any progress that we have made over the years to create jobs and maintain jobs that have uplifted our communities”.

“The illicit cigarette trade places more than 10,000 jobs at risk and deprives SA taxpayers of R25 million in lost taxes daily,” he said. “We call on law enforcement agencies to act and actually clamp down on illicit cigarette trade and hope that this will be reflected in the budget.

“The future of tobacco farming, which provides a sustainable income for thousands of families, rests upon whether our concerns are taken seriously.”