The US Food and Drug Administration will step up its crackdown on electronic cigarette sales to teens, according to a story by Robert King for the Washington Examiner quoting the head of the agency.

Lawmakers on a House Appropriations subcommittee were said to have grilled FDA Commissioner Scott Gottlieb about ‘excessive’ use of e-cigarettes among young people.

The FDA has the authority ‘to go after’ e-cigarette makers and retailers if they violate a ban on sales to people under 18, but lawmakers questioned if the agency was doing enough.

“I am concerned that FDA’s silence on e-cigarettes could open the door to the next public health emergency,” said Rep. Nita Lowey, D-N.Y.

Gottlieb replied that the FDA would crack down on young people’s use of e-cigarettes in the coming weeks.

The agency has several avenues for targeting retailers that are selling to minors. Those include a warning letter, massive fines, or banning the retailer from selling any tobacco or e-cigarettes.

Gottlieb said e-cigarettes could offer fewer health risks than traditional cigarettes, but the soaring use among minors was worrisome. A recent study had found that e-cigarette use grew by 900 percent among high school students from 2011 to 2015 [there was no mention of the level of use in 2011].

“We can’t just addict a whole generation of young people onto nicotine,” Gottlieb reportedly said.

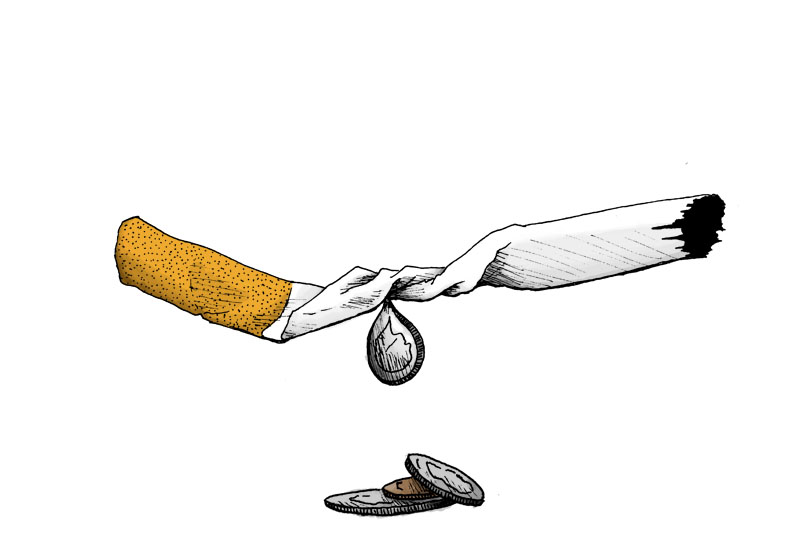

Category: Taxation

E-cig crackdown coming

Meaty enterprise

A retail butcher who was caught stocking and selling more than 13,000 counterfeit cigarettes at his shop in Greenock, Scotland, was raided three times in two months, according to an exclusive story by David Goodwin for the Greenock Telegraph.

The 71-year-old Adam Johnstone-Smith was said to have hidden part of his cigarette stock in a vat of sausage spice mix in a possible bid to throw sniffer dogs off the scent.

Johnstone-Smith – who had 13,360 counterfeit cigarettes seized – said he’d resorted to the illegal side-line because his business was in “dire straits”.

But a sheriff said that Johnstone-Smith “must have made significant money” from dealing in the inferior-quality tobacco.

HM Revenue and Customs and Trading Standards teams visited the shop on June 16 last year and confiscated 8,400 cigarettes and 1.7 kg of hand-rolling tobacco.

The shop was searched again on July 7 and 4,300 cigarettes were seized.

A third visit with dogs on August 17 yielded yet more cigarettes and packs of hand-rolling tobacco concealed within a plastic bin containing the spice mix.

Johnstone-Smith pleaded guilty to being knowingly concerned in carrying, harbouring, concealing or in any other manner dealing goods which were chargeable with duty and did this with intent to ‘defraud Her Majesty’ of £4,548.

The court heard that he had paid the duty prior to his sentencing hearing.

Smith was ordered to complete 150 hours of unpaid work within six months as an alternative to prison.

An HMRC spokesman was quoted as saying that the sale of illicit tobacco would not be tolerated.

“Disrupting criminal trade is at the heart of our strategy to clampdown on the illicit tobacco market, which costs the UK around £2.5 billion a year,” he said.

“This is stealing from the taxpayer and undermines legitimate traders.”

The full story is at: http://www.greenocktelegraph.co.uk/news/16161444.Butcher_caught_in_fake_cigarettes_raid_hid_goods_in_sausage_mix/

New taxes opposed

A coalition of business organizations, the Business Renaissance Group (BRG), has called on Nigeria’s government to review recently-announced increases in excise duties on locally produced tobacco products, and wines and spirits, according to a story in The Vanguard.

The federal government announced on March 11 that the duty increases would be spread over the next three years, with the first going into effect on June 4.

The BRG is said to have demanded that the federal government revert to the previous taxes or come up with a compromise based on input from ‘critical stakeholders’.

A new approach was needed that would impact positively on the government, the industry and the general population, and ultimately provide further growth and development for the country.

Briefing journalist in Abuja, the chairman of the BRG, Mazi Omeife Omeife, said increasing excise duties was counterproductive in respect of the government’s job-creation policy. Such increases were going to lead to job losses and the further impoverishment of ordinary Nigerians.

The BRG has said that it will seek judicial redress if the government does not respond within 30 days.

Smuggling proliferating

Cigarette smuggling is on the rise in the Philippines partly due to tax-driven higher retail prices, according to a story in The Philippine Daily Inquirer.

Internal Revenue Commissioner Caesar R. Dulay said yesterday that the country was suffering a “proliferation of smuggling”.

He said the situation had been brought to the attention of the Bureau of Internal Revenue (BIR) by Philip Morris and Japan Tobacco, which had investigated the trade. And the BIR had responded by putting in place a task force charged with addressing the situation.

Although he did not provide figures on the volume of illicit cigarettes entering the country, the BIR chief said it was substantial, “because the tobacco companies were complaining”.

Dulay said it was likely that most of the smuggled cigarettes came from neighboring Asian countries.

“We also have feedback that there are some manufacturers in the provinces producing fake cigarettes; in fact, the NBI [National Bureau of Investigation] and the police have conducted some raids,” Dulay said, citing manufacturing units recently uncovered in Bulacan and Nueva Ecija.

Dulay admitted that smuggling had become rampant after the government raised the excise tax under the Tax Reform for Acceleration and Inclusion (TRAIN) Act. Under the TRAIN Law, cigarette taxes rose to P32.50 per pack effective January 1, from P30.00 a pack last year, and are due to be increased in stages to P40.00 per pack by the end of 2023.

Dulay said that a pack of licit cigarettes retailed at P60-65 per pack, while non-tax-paid products sold for half that price. Given this, it was likely that smokers would buy the illicit cigarettes.

The price of Brexit

One of the negative impacts for the UK economy of leaving the EU will fall on the UK cigarette market, which is now completely reliant on cigarette imports from Europe, according to GlobalData.

‘Without a home supplied product any tariffs applied to imported goods between the UK and EU as a result of Brexit will see massive cigarette retail price increases for UK consumers, leading to volume declines of as much as 21 percent by 2021,’ said GlobalData, which describes itself as a ‘data and analytics company’.

‘The average pack price (20s) is likely to increase by more than £3, from £9.60 to £12.74 based on estimates from the Organisation for Economic Co-operation and Development (OECD). The OECD calculations assume that the UK will introduce tariffs of 70 percent on cigarette imports in line with World Trade Organization (WTO) guidelines.

William Grimwade, consumer analyst at GlobalData said the UK’s top six sources for imported cigarettes were all in the EU: Poland, Germany, Portugal, the Czech Republic, Romania and the Netherlands. “The volume of cigarette imports will likely increase anyway over the next few years as stores of domestically produced cigarettes run out,” he said. “We forecast that the impact of Brexit will see UK cigarette volume sales fall by as much as a fifth by 2021.”

In its note, GlobalData said the decline could be even more significant if the UK Government took further action on public health concerns by forcing prices up even further.

‘A recent global study on tobacco consumption suggests global price rises of 50 percent could save more than 60 million lives, and so international opinion is likely to support further cigarette price rises,’ the note said. ‘This means that the UK Gov’t is unlikely to take any action to mitigate against Brexit-induced price rises on cigarettes.’

Grimwade said that the return of duty-free tobacco sales to travellers between the UK and the EU would likely coincide with a large reduction in the number of cigarettes they could bring back to the UK. “The new limit is expected to be somewhere around 200 cigarettes instead of the current 800, which will make it even more difficult for UK consumers to find cheaper supplies of cigarettes,” he said.

Exports plunge

Exports of cigarettes from South Korea plunged during the first quarter of this year, according to a story in The Korea Herald citing figures published yesterday by the Ministry of Agriculture, Food and Rural Affairs.

The value of the country’s cigarette exports from January to March, at $210.6 million, was said to have been down by 28.3 percent on that of the same period of last year.

The exports were hit hard by the imposition of a 100 percent special consumption tax on cigarettes in the United Arab Emirates, which is Korea’s largest overseas customer for cigarettes.

In October, the UAE imposed sin taxes on tobacco, soda and energy drinks, partly as a way of lowering its rates of obesity and diabetes, and to limit the consumption of addictive substances.

The UAE additionally imposed a five percent value-added tax on cigarettes in January.

Taken together, the new taxes caused the retail prices of Korean cigarettes to double.

With Saudi Arabia having imposed a ‘sin’ tax on cigarettes before the UAE did, and with other countries in the Gulf Co-operation Council set to follow suit this year, Korean cigarette exports are forecast to fall further.

Tariff threats ‘troubling’

A trade war between the US and China could have a devastating impact on North Carolina’s tobacco growers, according to a story by Brian Murphy and Zachery Eanes for the News & Observer.

North Carolina exported leaf tobacco worth more than $156 million to China last year, making China the biggest national consumer of the state’s tobacco.

However, the value of North Carolina’s tobacco exports to China was already down – from more than $184 million in 2015 and $166 million in 2016 – when, on Wednesday, China announced plans to impose higher tariffs on more than 100 US products, including tobacco.

Tariffs on unmanufactured tobacco would be raised from 10 percent to 35 percent, while duties on cigarettes and cigars would be pushed up from 25 percent to 50 percent, according the US Department of Agriculture.

The tariffs are only proposals at this time and would not go into effect until at least the middle of May, leaving time for negotiations between the two nations.

Zippy Duvall, president of the American Farm Bureau Federation, urged the nations to negotiate and “produce an agreement that serves the interests of the world’s two largest economies”.

Meanwhile, Larry Wooten, president of the North Carolina Farm Bureau, said the situation was troubling, to say the least, in relation to tobacco. “When you add pork and soybeans, it really hits North Carolina,” he added.

In addition to being the US’ largest producer of tobacco, North Carolina plants 1.6 million acres of soybean.

In total, North Carolina exported $2.3 billion in goods to China in 2016 up from $1.4 billion in 2006, according to the US-China Business Council. China was the state’s third-largest trading partner after Canada ($6.2 billion in goods) and Mexico ($3.1 billion).

The News & Observer story is at: http://www.newsobserver.com/news/politics-government/politics-columns-blogs/under-the-dome/article207952919.html.

Tax relief not justified

A recent study has indicated that sales of illicit cigarettes account for under nine percent of Pakistan’s market, according to a story in the Express Tribune.

The results of the Study to Assess the Volume of Illicit Cigarette Brands in Pakistan was launched on Wednesday by the Pakistan National Heart Association and the Human Development Foundation.

They indicate that tobacco-industry claims that illicit cigarettes account for more than 40 percent of the market are wrong.

The results are said to indicate also that the third tier of taxation introduced by the Federal Bureau of Revenue (FBR) to give relief to tobacco companies was not justified.

The FBR initiative is said to have caused a loss of billions of rupees to the government exchequer and to have increased tobacco consumption considerably, increasing the nation’s health burden.

The study was carried out recently under the technical guidance of the Knowledge Hub on the Economics of Tobacco Control Project, which is part of the World Health Organization’s Framework Convention on Tobacco Control (FCTC).

It assessed volume sales of illicit cigarettes in 10 cities and their adjoining rural areas across Pakistan.

Data from Karachi, Lahore, Sukkur, Multan, Hyderabad, Peshawar, Quetta, Rawalpindi, Muzaffarabad and Nowshera, were said not to have supported tobacco-industry claims.

The study said there was no justification for the tax break provided by the third tier.

All tax relief should be removed and taxes on tobacco should be increased, the study recommended.

The full story is at: https://tribune.com.pk/story/1677803/1-research-says-illegal-cigarette-sales-less-9/.

Still waiting for Godot

The EU Commission said last week that the fight against the illegal tobacco trade is a ‘cross-border phenomenon that requires a global approach and international co-operation’.

In answer to a number of questions by a member of the EU Parliament, it said also that the measures enshrined in the Protocol to Eliminate Illicit Trade in Tobacco Products, introduced through the World Health Organization’s Framework Convention on Tobacco Control (FCTC), which the EU had signed and concluded, aimed to address this problem.

‘Once entered into force, the FCTC Protocol will be the main tool to prevent illicit tobacco trade at the international level,’ it said.

In a preamble to her questions, posed in December, the Lithuanian MEP, Laima Liucija Andrikienė, said the government of Belarus had recently announced that a private investor would increase the manufacturing capabilities of the Grodno Tobacco factory.

According to the announcement, the increase in production was due to start in January 2018, in response to a growing demand for Belarusian cigarette brands.

The EU was among the target markets.

The MEP alleged that Belarusian cigarette brands manufactured at the Grodno factory were smuggled into more than 20 member states where they could not be legally sold.

They already represented around EUR1 billion in yearly tax losses.

Andrikienė asked:- Will the European External Action Service (EEAS) address this issue with the government of Belarus?

- Will the EEAS request information about the member state markets on which Belarusian cigarette brands can legally be sold and how the exports will be tracked to avoid ruptures in the supply chain?

- Will the EEAS point out that low taxes applied in Belarus on cigarettes are the incentive for smuggling into the EU?

In its reply, the Commission said that during the meeting of the EU-Belarus Co-ordination Group held in Brussels on December 19 and 20, the Commission services and the EEAS had raised the issue of the increased inflow of illicit cigarettes from Belarus to the EU and the decision by the Belarusian government to increase the production of cigarettes.

‘The Commission services and the EEAS have further invited Belarus to enhance the fight against illicit trade in tobacco products, strengthen the co-operation with the Commission and in particular with the European Anti-Fraud Office, sign and ratify the Protocol to Eliminate Illicit Trade in Tobacco Products to the World Health Organization’s Framework Convention on Tobacco Control (“FCTC Protocol”) and approximate its excise duty rates to the EU excise duty rates on manufactured tobacco,’ it said. ‘This issue will be followed up in bilateral dialogues with Belarus and in the EU-Belarus Co-ordination Group, which is the platform for political dialogue between the EU and Belarus.

‘In close co-operation with member states’ customs authorities, the Commission services monitor the illicit trade of tobacco products in the EU, including with respect to tobacco products originating in Belarus.

‘However, the fight against illicit tobacco trade is a cross-border phenomenon that requires a global approach and international co-operation.

‘The measures enshrined in the FCTC Protocol, which the EU signed and concluded, aim to address this problem.

‘Once entered into force, the FCTC Protocol will be the main tool to prevent illicit tobacco trade at the international level.’

Illegal trade doubled

The consumption of illicit cigarettes in Thailand more than doubled between the fourth quarter of 2016 and the fourth quarter of 2017, according to a story in The Nation citing the results of a study conducted on behalf of Philip Morris (Thailand).

The increase was said to have implied an annual cost to the country of at least Bt3.6 billion in ‘lost’ tax revenue.

The study, conducted by Nielsen, showed that non-domestic cigarettes, or cigarettes without a Thai tax stamp, captured 6.6 percent of the market in Q4 2017, up from 2.9 percent in Q4 2016.

The study of 10,000 discarded cigarette packs found the problem was most widespread in the south of the country, with the provincial incidence at 76.6 percent in Satun, 67 percent in Songkhla, and 40 percent in Patthalung, said Pongsathorn Ansusinha, PMT’s director of corporate affairs.

Two cigarette brands made up about half of the non-domestic packs, neither of which was registered with the Excise Department.

Pongsathorn said that after the excise tax reform in September 2017, PMT had expected a significant reduction in licit cigarette consumption because some smokers could no longer afford to buy licit cigarettes. They would either quit smoking or turn to the roll-your-own tobacco or illicit cigarettes.

“By using the 6.6 percent rate, we estimate the consumption of non-tax-paid cigarettes in Thailand could reach about 100 million packs,” he said. “This could mean a loss of excise revenue of at least Bt3.6 billion per year, assuming excise tax of Bt36 per pack in 2018.”

And Pongsathorn warned that the loss could rise to as much as Bt5 billion a year by 2020 because the excise burden was set to rise again in October 2019.