Suppliers of adhesives and glue application systems prepare to accommodate new product requirements.

By Stefanie Rossel

In cigarette construction, adhesives are an invisible but indispensable ingredient. Even though adhesives often make up only a small percentage of the final product, they can have a major impact on the product life usage and consumer experience, explains Selda Akbasli, global business manager for rolled paper and tips at adhesives manufacturer H.B. Fuller. “Adhesives play a critical role as an enabler and a must-have technology that makes the products work. Due to its innovation, versatility and flexibility—not only in selecting technologies and raw materials—the industry now has many options that contribute positively to the way products are conceived and manufactured, reused or recycled.”

Efficiency, sustainability and cleaner application: These trends currently dominate the market for adhesives and glue application systems. Akbasli says that as markets are in constant evolution and manufacturers are under pressure to control costs and improve customer service, efficiency is a top priority for her customers. Tobacco companies seek to improve production processes and improve their machinery’s performance while using fewer resources and producing less waste.

“In some cases, it is not a matter of preferring a lower priced grade but looking for good value for money and quality,” she says. “For instance, often a high performance, higher priced adhesive can enable the user to apply less [adhesive], and the cost in use of the more expensive product will actually be lower. Additionally, customers are aiming to optimize their business complexity and reduce SKUs, for instance.”

To meet these requirements, H.B. Fuller has developed Ipacoll 2606, which provides robust performance on both high-speed tipping and filter applications, according to the company. Excellent initial wet tack and clean application performance enables superior mileage optimization with no impact on bond strength, the manufacturer claims.

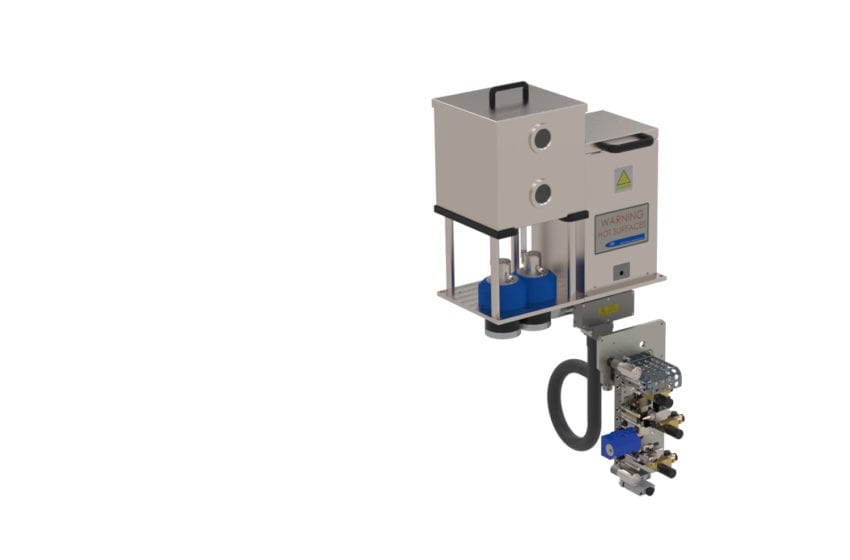

On the application equipment side, there is also interest in enhanced efficiency, according to Danielle Roxborough, business development manager at SPI Developments, which in 2018 joined the Tembo Group, a holding company that also includes tobacco machinery manufacturer ITM. “Customers want application systems to run as smoothly as possible and without interruptions—and without the engineers being involved with the machine,” she says.

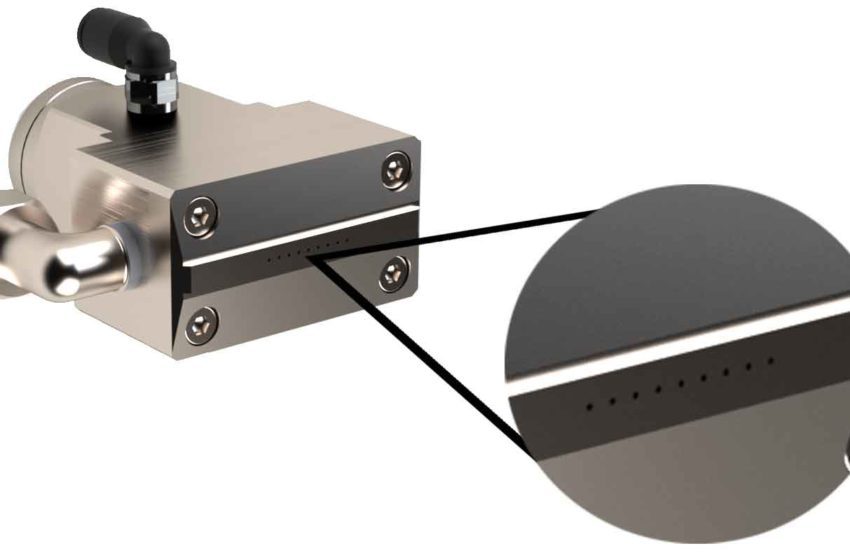

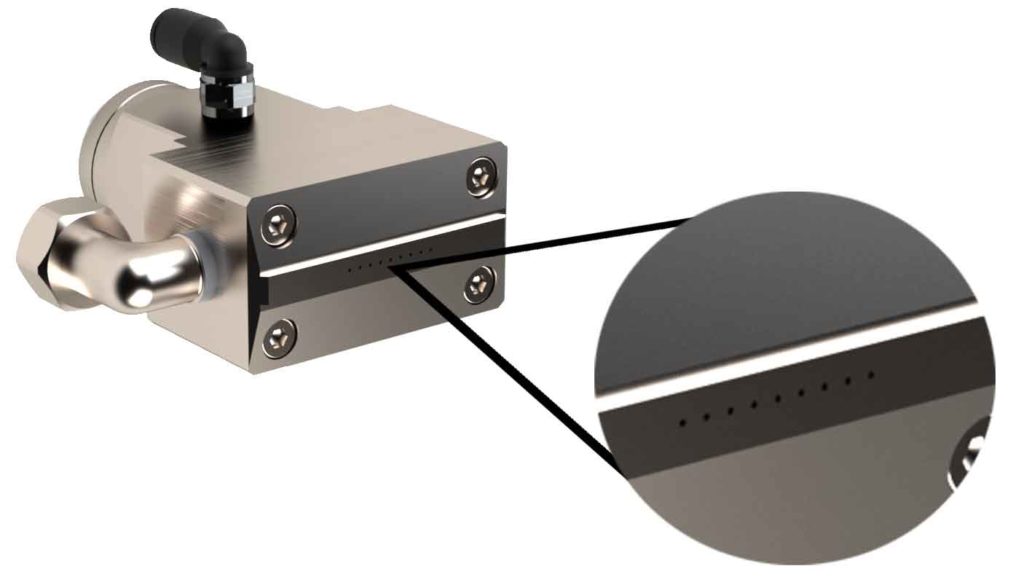

SPI recently launched a new multi-line applicator, a small plate that is available with three holes to 15 holes, creating very thin lines of glue. “The innovation for this came from our paper straw-making machine,” says Roxborough. “We were developing a glue system that we were selling to our sister company to create multi-lines to make the paper straw. We then saw this could be transferred into the tobacco industry. We have now moved on from our previous triple line applicator to this cleaner, more accurate, more flexible application.”

Sustainable is the Way

Environmental considerations have gained prominence throughout the nicotine industry, including in adhesives. In Europe, the Single-Use Plastics Directive is forcing cigarette manufacturers to rethink their use of cellulose acetate filters. This has given rise to more sustainable solutions, such as filters made from crimped paper. Interestingly, adhesives are exempt from the directive.

“Everyone would love to be more sustainable, but sometimes this comes at the cost of something else,” says Roxborough. “If you’re using paper filters as being better for the environment, you shouldn’t be using a plastic glue. The question is, how do you move away from such things as PVA glue—which is not sustainable but plastic—or hotmelt, which is thermoplastic?

“We are seeing some requests about creating applicators that could do starch-based glues. This is almost going full cycle; in the 1970s, starch-based adhesive was used to create cigarettes on a filter. Today the science is better, though. We believe that glue manufacturers will drive this development rather than SPI, which will follow with the respective application system.”

According to Roxborough, gluing paper filters to a cigarette involves only minor tweaks to existing technologies, such as adjusting the angle of the applicator’s nozzle. “The interest from SPI’s point of view actually is in terms of flavoring because that’s a different challenge altogether,” says Roxborough. “From gluing, it’s the same principle, but how do you make a paper filter taste and feel like a normal filter?”

“Sustainability is getting higher and higher on the agenda,” notes Jean Pierre de Smet, global tobacco adhesives business manager at adhesives supplier Henkel. “Paper-based filter products may need different adhesives. We develop them case by case and customer dependent.” In the short term, he states, adhesives have a role as carbon footprint (LCA) reduction enablers. “In the longer run—and if supported by the cigarette manufacturers—we might think about LCA reduction of the adhesive itself.”

Wanted: Automated Cleaning

H.B. Fuller can draw on a strong track record in adhesives to bond paper substrates for packaging. “We are continuously investing resources and capabilities to develop customized products for very specific applications such as coated paper or crimped paper as the market evolves to answer the new consumer needs.” She is seeing a rise in interest in “greener” products as regulations around the handling of chemicals become tighter and governments are introducing stricter laws. “In Europe, companies need to continue complying with the latest legislation driven by the Green Deal, like the tendency to remove aluminum. And we at H.B. Fuller have solutions to eliminate aluminum paper from the package to make it simple and easy to recycle in established wastepaper and board recycling streams. Net sustainability is a mega-trend, and the most substantial contributions adhesive producers make in the realm of sustainability are through product innovation, reducing the environmental impact of production processes and improving the sustainable performance of tobacco through their formulations.”

The choice of an adhesive impacts tobacco production’s carbon footprint in a variety of ways, explains Akbasli. “We have ongoing projects for bio-based raw materials and products, and customers can already purchase our adhesives in bulk returnable and reusable containers to eliminate packaging waste, through to using our operator training packages to optimize the adhesive application ensuring maximum efficiencies. Whichever combination of options are selected, the adhesive is a small percentage of any tobacco product, and improvements in the overall carbon footprint of the production facility will be in the corresponding proportion.”

Applying glue to cigarettes can be a messy business, and demand is growing to make the process cleaner. Roxborough says that “autonomation”—that is, intelligent automation—is becoming a big thing among customers. “The glue is very messy, and it’s very difficult to keep applicators clean. Currently, it’s a very old-fashioned way of wiping the nozzles at the end of the shift. What we see now are requests for nozzles that clean themselves. For years, we have had what we called positive shut-off, so when the machine stops, the needle closes the hole, pushes all the excess glue out, and that prevents leakage while the machine is not running. But the excess glue needs to be removed.” SPI is working with certain customers to create self-cleaning solutions for glue applicators. This technology may ultimately find its way into the general tobacco industry market.

Novel Products, Novel Needs

For a decade now, suppliers of adhesives and glue application systems have had to contend with a shrinking global cigarette market. The new smoking alternatives make up for just part of that reduction as many don’t use adhesives. “Only heated-tobacco products require adhesives and compensate for the decline of combustible cigarettes,” says de Smet. “Adhesives for HTPs have higher quality requirements.”

As a leader in both traditional and HTP markets, H.B. Fuller does not expect any disruption to its business, with HTPs gaining traction and growing. “One of the biggest challenges we see for HTPs is the heat resistance of adhesives to ensure product integrity during use. At H.B. Fuller, we have recently developed Ipacoll 2364, a superior performance product that addresses the temperature resistance needs,” says Akbasli.

“Another [challenge] is related to the fact that the HTP industry is highly technical, regulated and always under high security. To closely monitor what is evolving in this segment and keep track on the latest developments, H.B. Fuller collaborates and develops strong relationships with its customers, paper vendors, machine manufacturers and other suppliers throughout the value chain. Working together and being part of the solution design from the beginning make it easier to develop adhesive solutions that meet the needed requirements valued by the market, even under short time pressures.”

Roxborough notes increasing interest in the company’s multi-line application system from HTP manufacturers as the production process involves connecting different materials, such as foil, metal, reconstituted tobacco, paper and acetate filters.

Understanding the Full Lifecycle

As is the case in other industry, the supply chain, impacted by Covid-19, Brexit and the war in Ukraine, among other factors, remains a major issue for adhesive suppliers. In the current environment, small components normally considered insignificant can stop machinery from being shipped, according to Roxborough. Electronic supplies are particularly difficult to obtain. “SPI was fortunate to have enough on the shelf, so delivery was only a bit delayed,” says Roxborough. “But we’re getting to the point now where we will have to think of redesign allowing for alternatives. This is pushing costs up. We have seen a massive increase in costs from suppliers, from services through energy supplies. We try not to pass the higher costs on to customers, but we had to do it due to the economic climate we’re in.”

De Smet says that like everyone in Europe, his company has been suffering from disruptions and an unstable supply chain. “Thanks to the leverage of Henkel in the adhesive industry, we have been able to supply all our customers in line with their needs,” he says. “More contingency and security of supplies was given by a strategic combination of our footprint and our product portfolio.”

Meanwhile, dynamics have shifted, with many countries moving toward recession, demand across raw material markets decreasing and transoceanic shipping prices dropping to pre-Covid levels. “Yet many key input costs, such as energy, are expected to remain high through 2023 versus historical level,” says Akbasli. “As economies move forward, companies need to maintain a keen eye on fundamental consumer demand and focus on increasing agility. For instance, the move to on[-shore] or near-shore high demand/highly volatile goods will continue as organizations seek to be more reactive to demand changes and control logistics costs. Supply is currently balanced while pressure on margins up and down the supply chains is expected to increase. With this, and for most companies, cost containment will be the top priority this year, and supply chains will be under intense scrutiny to keep costs under control.”

In 2023, cigarette consumption will be affected by economic crisis, inflation and excessive taxes, especially in developing countries, according to Akbasli.

“This tends to promote hard-to-control illicit trade that poses many challenges across all industries,” she says. “At H.B. Fuller, we have the advantage of a robust, global and secure supply chain, making us a trusted partner. […] When considering the development of next-generation adhesive solutions, the goal is that adhesive manufacturers understand the full product lifecycle, including recyclability, bonding and de-bonding on demand, alternative cure processes and use of renewable or bio-based raw materials to name a few.”

De Smet confirms that the supply chain is normalizing, and raw material cost is moving slowly but steadily to historical levels. “The challenge may be that we’re still in a potentially fast-changing environment. Opportunities may be found in a close cooperation between tobacco industry and its suppliers to manage costs keeping the holistic view in mind.”

Despite all the challenges, SPI can reflect on a strong 2022, and, with a full order book, look forward to a good 2023. While tobacco remains its main focus, the company is collaborating with ITM and other Tembo Group members on projects for nontobacco industries, such as the homecare and paper businesses. To accommodate its growing team, the company will move to new premises this year.