At Cerdia’s much-anticipated 12th filter colloquium, speakers detailed the progress in reducing the industry’s carbon footprint.

By Stefanie Rossel

“On the road toward a sustainable future” was the theme of Cerdia’s 12th filter colloquium, which took place in Freiburg, Germany, June 3–5. The conference has a rich tradition. Except for the time of the Covid-19 pandemic, the acetate tow manufacturer’s event has taken place every three years since the mid-1980s. This year, speakers from all parts of the tobacco industry supply chain shared their strategies to reduce their carbon footprint.

Sustainability has always been important to Cerdia, which was created after the Blackstone Group purchased Rhodia’s acetate tow business in 2016. However, as Cerdia CEO Jens Ebinghaus explained in his opening speech, the topic gained even greater prominence after the acquisition and the company’s subsequent rebranding.

Cerdia employs approximately 1,100 people worldwide and has revenues of around $750 million. In addition to its Freiburg facility, it operates factories in Santo Andre, Brazil; Serpukhov, Russia; and Kingsport, Tennessee, USA. While investing in core filter tow technology and diversifying into new business segments, the company focuses heavily on ESG, which encompasses energy diversity and efficiency as well as safety, compliance and governance, and community engagement.

In 2023, Cerdia allocated 45 percent of its capital expenditure to projects supporting sustainability. According to Ebinghaus, the business environment for tow manufacturers has become significantly more volatile since 2019. The rising costs of raw materials, for example, has forced manufacturers to increase efficiencies. At times and often regionally, the industry also suffered from issues relating to transportation, disrupting supply chains. In addition, the geopolitical situation has become more challenging, with conflicts in Ukraine and the Middle East erecting new hurdles for business, for example. At the same time, business opportunities have emerged from next-generation products such as heated-tobacco products (HTPs), sales of which have been growing rapidly in recent years.

Lots of Levers

Part of Cerdia’s roadmap to sustainability was a “double materiality” assessment, carried out in 2022, according to Maria Viloria, Cerdia’s head of sustainability and R&D. Through a survey, the company learned what was most important to its customers, suppliers and other stakeholders. Based on these findings, it created a “significance map” that put Cerdia’s ESG priorities in perspective. The company then developed a set of sustainability objectives that are in line with the U.N. Sustainable Development goals and established a sustainability committee to support its strategy.

By 2030, Cerdia aims to reduce its greenhouse gas emissions by 30 percent, its landfill waste to zero and its water withdrawal by 10 percent compared to 2019. Medium and major injuries are to be reduced to zero and complaints to under 0.5 per delivered kiloton. The company has been sourcing its wood pulp from 100 percent certified sustainable forestry for years.

By 2030, Cerdia aims to have trained 95 percent of its employees in compliance and to have fully implemented the EU Corporate Sustainability Reporting Directive (CSRD). In autumn 2024, Cerdia will move its Basel headquarters to a new, carbon dioxide (CO2)-neutral building. The company, which in 2021 received a silver medal from the business sustainability rating provider Ecovadis, is now aiming for gold.

Cerdia’s new biosteam project, which is planned to come online in the first quarter of 2025, will play a vital role in the company’s CO2 reduction strategy by using biomass for steam production, according to Holger Twrdy, Cerdia’s vice president, manufacturing. The power plant will reduce the Freiburg factory’s CO2 emissions by 15 percent to 20 percent, or 26,000 tons annually, and Cerdia’s overall CO2 emissions by 10 percent.

Further CO2 reduction of around 1,500 tons per year will come from a new absorption column in the Freiburg plant’s acetone absorption division, which will also start production early next year. In addition, the company will expand an existing CO2-free residential heating project, supplying green energy to Freiburg’s Dietenbach district.

HTPs on the Rise

Esther Abe, Cerdia’s market intelligence manager, provided an overview of the global tobacco market during the colloquium. After years of decline, cigarette sales stabilized in 2020, and Abe expects them to grow slightly, with increases in HTP and super-slim cigarette sales offsetting declines in other categories.

She expected the global cigarette market to reach 5.55 trillion sticks in 2024 and anticipates it to increase to 5.7 trillion units by 2030. According to Abe, China’s cigarette market is likely to increase by a compound annual growth rate (CAGR) of 0.3 percent by 2030 due to the rising popularity of super slims and restrictions on vape products while HTPs are the fastest-growing segment in the rest of the world.

Abe expects sales of combustible cigarettes to remain stable in China but to decline in the Commonwealth of Independent States, the Americas and Europe. The main sources of volume growth will likely be Africa and the Middle East, she said.

The HTP category is envisaged to grow by a CAGR of 17 percent, to reach approximately 526 billion sticks in 2030. While Cerdia will remain focused on filter tow for the tobacco industry, which accounts for 85 percent of its business, it is also exploring other lines of business. To that end, the company recently established a new business development (NBD) team, which is exploring complementary acetate tow applications.

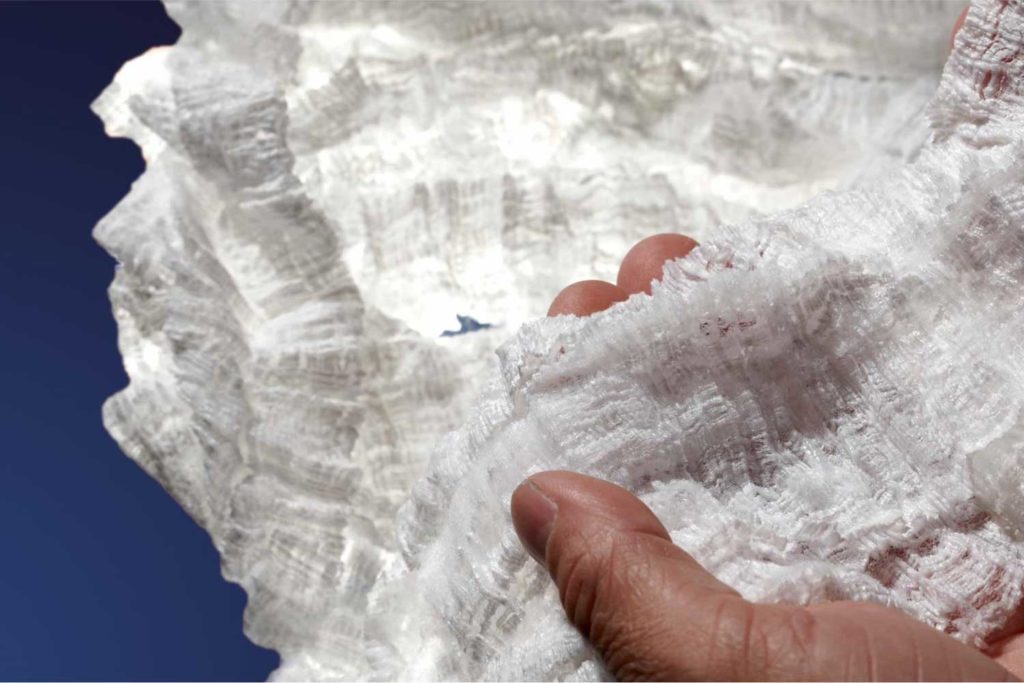

According to NBD head Josef Hudina, the product is meltable in various recipes, soluble in many eco-friendly solvents and hydrophobic enough to be suitable as a plastic substitute. Moreover, it can be processed in the form of fibers, films, granules or powders. With its new cellulose acetate compounds, CellspherA Micro and CellspherA Granules, Cerdia offers an alternative to fossil materials that are widely used in the personal care industry. As the EU microplastic restriction boosts the demand for natural alternatives, Hudina is convinced that cellulose acetate could pass the EU microplastic exemption.

Speakers at the colloquium anticipated tobacco industry regulations to increase further.

Cerdia Product Stewardship Manager Emmerich Sackers detailed the scope and requirements of the European Deforestation Regulation, which entered into force in 2023 and will apply to large businesses from the end of this year.

Jan Muecke, managing director of the German Association of the Tobacco Industry and New Products, pointed out that the recent decision at the 10th Conference of the Parties to the Framework Convention on Tobacco Control (FCTC) to focus on the environmental concerns described in FCTC Article 18 will likely influence how the EU Tobacco Products Directive, the U.N. International Plastic Treaty and the EU Single-Use Plastics Directive end up dealing with cigarette filters.

Further legislative initiatives are underway under the European Green Deal, including the Packaging and Packaging Waste Regulation, the Corporate Sustainability Due Diligence Directive, the CSRD, the Ecodesign for Sustainable Products Regulation, the EU Batteries Regulation and the Green Claims Directive.

Comprehensive Approach Required

Instead of a one-size-fits-all approach, the road to sustainability is a puzzle with many pieces, all of which are vital. Logistics, for instance, account for 11 percent to 12 percent of total CO2 emissions, as Sergio Barbarino, chairperson of the Alliance for Logistics Innovation through Collaboration in Europe (ALICE), explained.

The EU aims to decarbonize its transportation sector by 2050. ALICE has identified five pillars for the future of logistics: In addition to energy-efficient fleets and assets that use the lowest possible emissions energy source available, which presently is at the center of efforts, the focus in the mid-term should be on the management of demand, smart use of transport modes and sharing of fleets and assets.

Procurement is another factor. Benjamin Saur, global category manager of sustainability at BAT, shared that 42 percent of his company’s greenhouse gas emissions are under the procurement department’s remit. BAT has designed a Supplier Climate Enablement Program that segments the approach to neither overburden suppliers’ own organizations nor BAT.

In manufacturing, the biggest lever for increasing sustainability lies in increasing machine and process efficiency, according to Klaus Masuch, head of strategic product management secondary at Koerber Technologies. Options for actions, he said, are machinery-driven, people-driven and service-driven improvements along with data-driven and software-driven improvements, with a focus on tobacco savings and emphasis on the development of eco-friendly alternatives, such as biodegradable filters.