Rolling paper manufacturers benefit from pandemic-related downtrading and moves to legalize cannabis.

By Stefanie Rossel

With Covid-19 refusing to clear the stage and Russia invading Ukraine, crisis appears to have become the new normal. For many industries, business as usual ceased when the pandemic broke out two years ago, bringing about an economic slump. Worldwide, consumers have had to cope with lower disposable incomes. Such a development often prompts smokers to switch from expensive factory-made cigarettes to more affordable roll-your-own or make-your-own products—and, indeed, manufacturers of cigarette rolling papers have noted a positive effect on their businesses.

“Speaking exclusively from a business perspective, we had two extremely strong years with record sales levels,” relates Santiago Sanchez, executive president of Republic Brands in France. “We were fortunate to have our plants running at full capacity as we didn’t have to shut them down for a day. Of course, the health of our employees was a priority, but thanks to the strict sanitary measures taken from day one, we were able to maintain or even increase our volumes.”

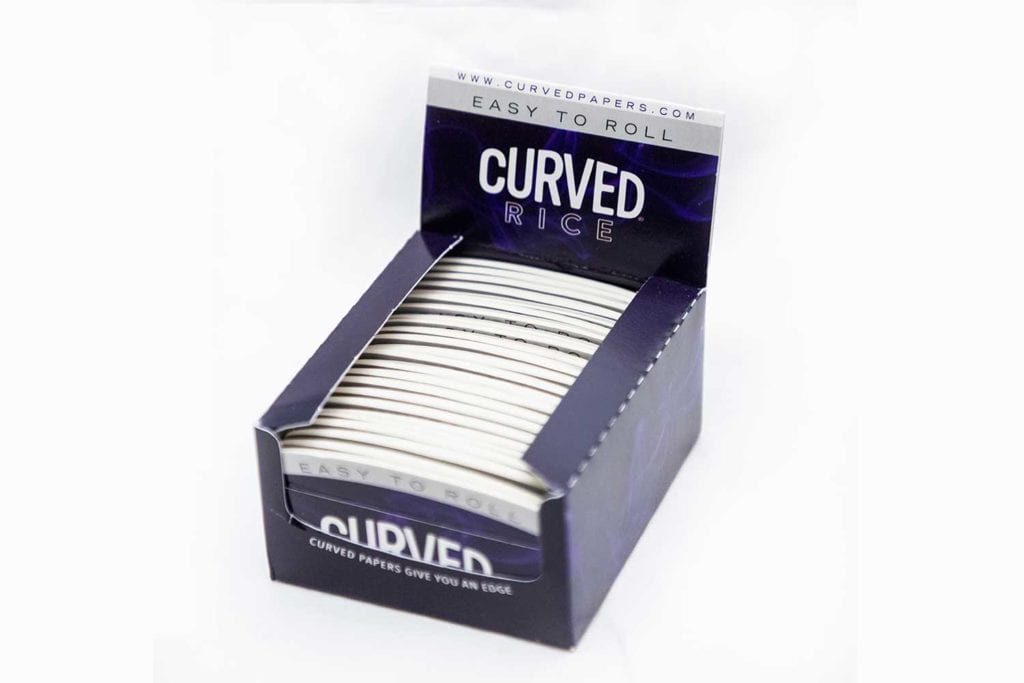

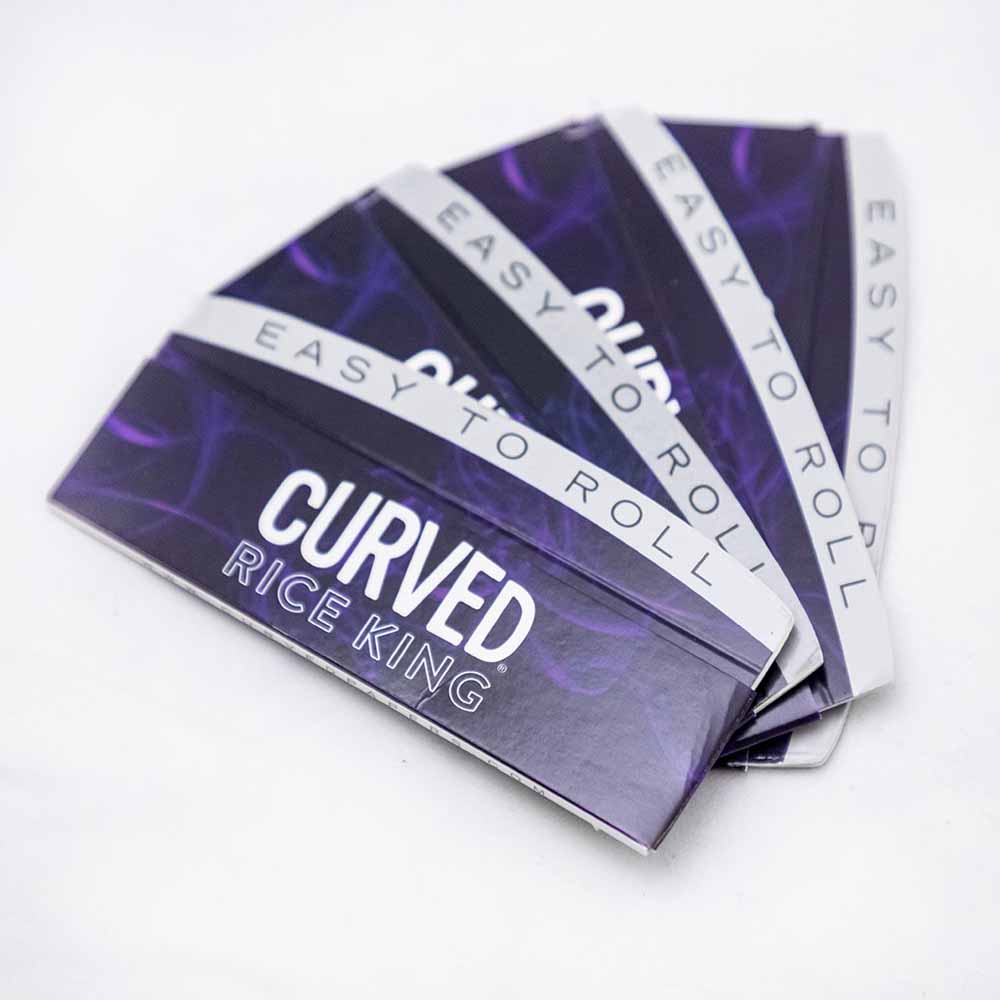

Michael O’Malley, founder and CEO of Curved Papers in the U.S., says his rolling paper sales were up 40 percent last year. “People are just blazing weed like never before,” he says. “And it’s a good alternative among the choices people have made to cope.”

Lisa Esser, head of corporate affairs and business development at Gizeh Raucherbedarf in Germany, has observed an enormous shift of sales within Europe due to closed borders during the pandemic. While in 2019, almost 20 percent of cigarettes consumed had been nonduty paid, it was “only” 14 percent in 2021, she points out. The development was similar for rolling tobacco. However, while the absolute share of duty-paid tobacco sales in Germany grew during the pandemic, this does not reflect more tobacco consumption in absolute terms. Rather, says Esser, a large share of the previous cross-border sales has returned to national retail.

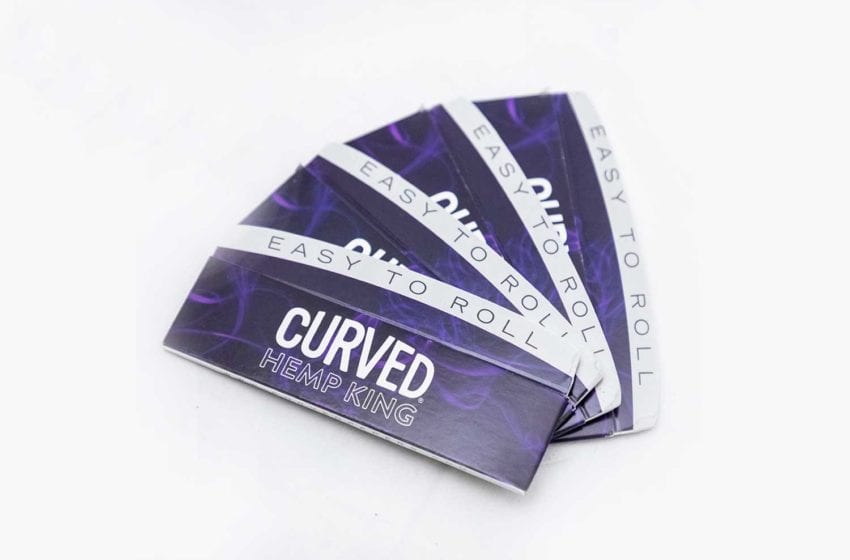

(Photo: Curved Papers)

Rising Production Costs

The numerous pandemic-related disruptions, including container shortages and raw material price increases, have also impacted suppliers of rolling paper. The availability of cartons and cellulose have been especially affected. “The vast increases in energy costs are not only hitting us but also our suppliers, who often pass on these costs to us,” says Esser. “There are also considerable challenges in logistics, with much longer lead times and shipping costs partly exploding. We expect price hikes of 10 [percent] to 20 percent across the entire value chain. Nevertheless, our supply of materials has been secured and continues to be of highest priority for us.”

During the first days of the lockdown, particularly in 2020, Republic Brands was concerned about logistical problems, both in the supply of raw materials and in the shipment of their finished products, according to Sanchez. “Thanks to the strong mobilization of logistics companies, our activities have not suffered in terms of logistics,” he says. “On the other hand, in the second half of 2021, we faced, like all other industries, difficulties in the Chinese supply chain, particularly the shortage of containers. These were just the beginnings of the tensions we are currently experiencing.”

Curved Papers, which caters mainly to the U.S. and Canadian markets, says it has been able to keep its stocks at the required levels. “Shipping has made us take a hit, but we’re not yet changing our price to the customer,” says O’Malley. While the conflict in Ukraine has not directly impacted his company, the global double whammy of a pandemic followed by the threat of World War III has made it hard to start new initiatives around the world. “It seems a matter of keeping what you have together and trying to respond to demand,” says O’Malley.

Esser expects a dramatic rise in costs and purchasing prices. “Risk assessment has shown that the pricing situation represents the biggest risk,” she says. “The situation has been exacerbated by the Ukraine crisis. We must contend with difficult conditions and are in close contact with our suppliers to be able to mitigate potential hurdles early on.”

Republic Brands is present in more than 100 markets and, as a result, feels the impact of the conflict, according to Sanchez. “I will not say anything original if I say that the Ukrainian war, in addition to being a humanitarian disaster in Europe, is significantly affecting all our activities in every sense of the word,” he says. “I have never seen anything like this before. Rising prices [for raw materials] are not the only problem. There is also a lot of pressure on the availability of raw materials. Just as there is a lot of pressure on the availability and consumption of energy. Some companies in our sector or in related industries—cigarette paper, acetate tow, etc.—consume lots of energy and are therefore highly exposed to the risk of increased energy costs. For our part, and even if it is symbolic, we have decided to stop our sales in Russia and Belarus. This is the minimum we could do.”

(Photo: Gizeh Raucherbedarf)

Greening Processes

In addition to coping with current challenges, companies are working to become more sustainable. O’Malley, whose rolling papers are manufactured in the Dominican Republic, says his company’s paper comes from Forest Stewardship Council-certified forests and is produced under processes following strict European standards. “We would like to use more recycled material in our packaging,” he says. “We are always innovating.”

Gizeh, meanwhile, is striving to install sustainable processes in all of its operations. “Improvement is an ongoing project,” says Esser. “The maximum reduction of energy consumption is given high priority. In Austria, for example—our largest production site—we have invested in a photovoltaic system. Besides, we are constantly trying to reduce the use of fresh fibers and instead utilize fast-growing alternatives or recycled materials.”

Republic Brands, too, is continuously working to minimize its carbon footprint. “An important step has been obtaining the ISO 14001 certification, which confirms the implementation and the effectiveness of an environmental management system. The group and all its employees adhere to a set of common values that are grouped together in an environmental charter, which can be accessed from our website.” The company’s factory in Perpignan, France, and its booklet distribution warehouse are powered by hydroelectric power stations in the Pyrenees and in the Alps.

The Power of Pot

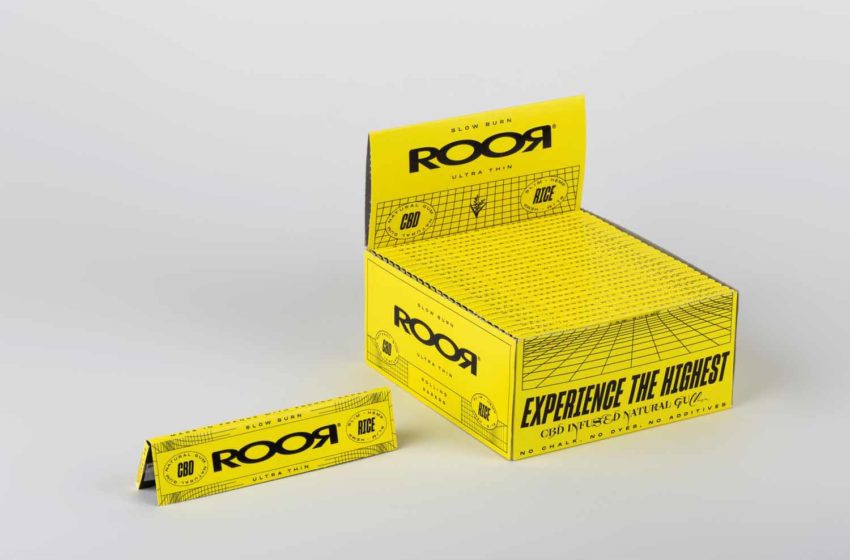

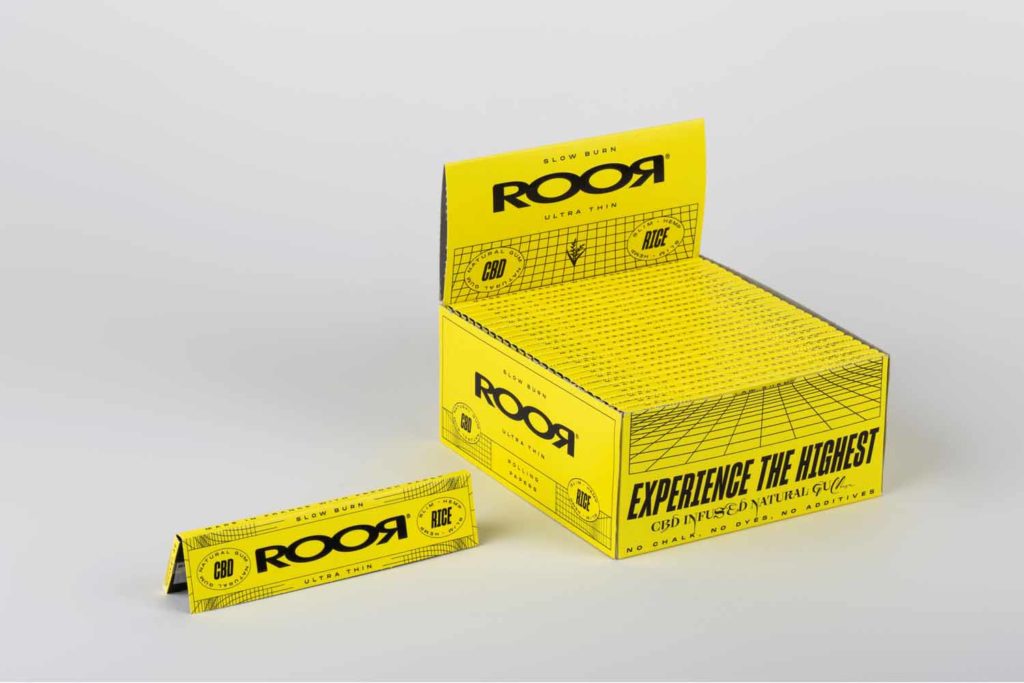

While the current business environment for rolling papers is far from ideal, new opportunities keep arising as more jurisdictions around the world legalize cannabis. “In countries where legalization has occurred in recent years, such as Canada and the United States, we are seeing a growth in sales,” confirms Sanchez. “The debate is open in many European countries, and now the only question is how soon the legislation on cannabis use will be relaxed,” he says. “We were the first to develop a new product for this category—namely a cigarette paper booklet with a CBD-infused gum line. Under the iconic Roor brand, these products have been launched in select European countries. In addition, one of the products is made from rice paper. Currently, this is the only product containing real rice fiber—from Camargue, France—although many others print ‘rice’ in their packaging.”

Founded in 2014, Curved Paper started out offering cigarette papers for cannabis consumption. “Eventually, hemp and flax came in as a couple of concerns or interests drove innovation of hemp and other nonwood material-based papers,” says O’Malley. “There is something to the don’t-cut-down-trees thing, of course, though we do it sustainably—but they do make the best rolling paper. The inexorable drive toward lighter papers, which zoomed right past the desirable range for a while there, was accompanied by this diversion away from wood pulp papers.

“Hemp-based papers are popular as [hemp] is from the same plant as marijuana. The papers commonly called ‘rice papers’ are mostly made from hemp and flax. The term ‘rice’ is from the early days of fine paper centuries ago. Fine paper first came from China and was indeed made from rice. So as Europeans developed printing and the fine European paper we have had for centuries now, they called all fine paper rice paper, and that term of art remains in use till this day not only in rolling papers but in all kinds of paper industries.”

Curved Paper offers seven styles based on four kinds of paper at two popular sizes, 1 1/4 and KSS. “Our marketing is still only U.S.[-based] and Canada-based, so our focus remains on cannabis,” says O’Malley. “Tobacco is 25 times as big. We have customers in the U.K. and the EU and all over the world, and we look forward to the global market, which is much larger for some of our exact same products. We are not looking to flood the market with a lot of silly products. In the long run, easy, simple and natural are going to be strong qualities to market. While cut corners are making a big move in 2022, our easy-to-roll curved edge is the next-generation solution to the same problem—and our key differentiator.”

Having recently decided to legalize recreational marijuana (see “State of Euphoria,” Tobacco Reporter, February 2022), Germany is poised to become the EU’s most important cannabis market—although it will likely take years before cannabis will be legally available in the country. Esser welcomes sensible regulation, saying that consumers should have access to less risky, quality-controlled legal products.

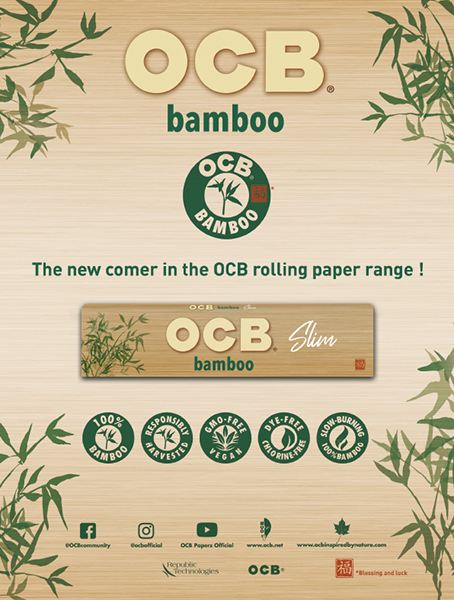

Unlike O’Malley, Sanchez does not necessarily believe that the best rolling papers are made from trees. Many cigarette and RYO paper companies, he says, use other fiber sources, such as hemp, flax, rice and bamboo, etc. These materials, notes Sanchez, are generally not inferior to base tree paper and in many cases cause less pollution.

He cites the example of Roor, which is already distributed in Germany without referencing cannabis. “We only develop our business in strict compliance with national regulations. However, as soon as legislation is made more flexible, we will develop our strategy accordingly.”

For O’Malley, European cannabis is a promising horizon. “The way it came from the West Coast here to New York and then to Europe is a prediction we made long ago that is playing out,” he says. “After a rolling papers brand matures, unless there is a major innovation, like introducing a curved version, it often becomes a pseudo-lifestyle brand to engage already loyal customers. This opportunity is huge as the political engagement behind legalization activates communities, as it will in Europe in the coming years and as it will continue [to do] in the U.S. So, even though tobacco is the big opportunity in actual use of the products, the cannabis culture stuff will be rich with opportunities for content creation for rolling paper brands.”