By George Gay

I occasionally wonder why, given the obstacles strewn in their path, some of the companies aiming to advance the cause of tobacco harm reduction by developing next-generation products (NGPs) don’t abandon their quest—a thought that was brought into even sharper focus last year by the tribulations surrounding the issues of flavor bans and lung disease in the U.S. Of course, for a number of reasons, the major tobacco manufacturers could not abandon their harm reduction products completely, but, with solid traditional tobacco product businesses behind them, they could surely ease back on the accelerator pedals of their NGP development motors.

And this was the basis of one of the questions I raised when I had the opportunity on Nov. 26 to speak on the telephone with David Newns, group innovation and science director for Imperial Brands. Was it worth investing in NGP innovation and the science underpinning it given the often irrational but effective opposition that was aligned against such efforts? “I think that at times when things get harder, the only option is to double down,” said Newns. “We’ve made a commitment as a company to offer something better to the world’s smokers—that’s our mission—and therefore, we can only double down on our investment and double down on the hard work it takes to do the science and to have those difficult conversations with regulators and government agencies. The business is absolutely committed to delivering on that mission.”

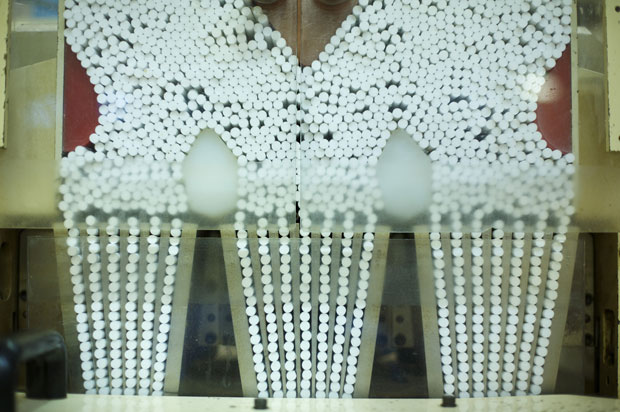

Newns, who joined Imperial Brands two years ago when it acquired Nerudia, the NGP innovation business he co-founded, is responsible for what he describes as a global community of about 300 people involved in two core areas: product innovation and product science. The innovation team, which is based largely in Liverpool, England, is charged with developing products for Imperial Brands’ NGP portfolio, which currently includes vapor products, heated-tobacco products and oral nicotine-delivery (OND) products. The product science team, meanwhile, is responsible for the scientific assessment and safety of those products: ensuring the company delivers products that meet its own product stewardship standards and deliver the potential to reduce, at population levels, the harm caused by tobacco consumption. It also works with regulators on getting those products approved.

Newns’ teams work within all NGP categories, including some not yet in commercial distribution. They work on innovations that can be implemented quickly—steps forward that, for instance, might deliver different nicotine or flavor experiences to consumers—and they work on game-changing innovations whose potential lies further in the future. Imperial Brands’ innovation processes, Newns said, were based on its being consumer led but also on consumer leading. It was a consumer-led organization that spent a lot of time with consumers, understanding their wants and needs. But, at the end of the day, consumers didn’t know what they didn’t know, and it was Imperial Brands’ role to bring them to a place they never knew existed.

Looking outward

Newns readily admits that achieving such game-changing shifts is easier said than done, but he indicated that one way forward was to make a cultural shift. While Imperial Brands operated within an industry that traditionally was quite insular, his company differentiated itself by looking outward, he said. It had a team that scoured the world talking to inventors, potential partners and anybody who could add value to its processes, and it was in touch with agencies that specialized in predicting the future, particularly consumer trends. In fact, he ended the interview with a request to anybody who thought they could help Imperial Brands on its harm reduction “journey” to get in touch. “[W]e are not going to do this on our own,” he said. “No one knows all of the answers, but together, we can certainly make harm reduction a reality.”

Most of the projects Imperial Brands is working on already have some kind of open innovation input. For instance, Newns said, the company was working currently on nicotine droplet size—cooperating with partners who could help the company better understand this aspect of its products. Overall, it was about leveraging those sorts of capabilities and employing Imperial Brands’ skills in putting together the acquired data and knowledge so as to accelerate the pace of bringing better products to consumers.

At the same time, however, Newns cautions about the industry trying to get too far ahead of itself. Ten years ago, he said, when vaping started, the industry made a promise to smokers that it hadn’t yet fulfilled: It was going to make switching from smoking to vaping fairly easy. A lot of people had subsequently tried vaping and discounted it, so it was the industry’s responsibility to make good on that original promise. And in this respect, a lot had been learned about what consumers wanted, and the technology had changed in line with those demands, so some people were returning to vaping. But it was necessary even at this stage to ensure that expectations were managed appropriately. The industry was not going to replicate the combustible cigarette with something that was not a combustible cigarette.

In this regard, Newns said that Imperial Brands was working on, and saw a lot of scope for, technologies that went beyond its current core NGP categories, though he again warned that bringing these to market would take time, partly because of issues to do with consumer acceptance. Vaping was more than 10 years old, and it was still not trusted by a large proportion of consumers, so Imperial Brands would develop new technologies, new products and new categories but commercialize them only when consumers were ready to use them.

Flexible solutions

This idea of consumers being ready—or not—is an interesting one because Newns made the point that once smokers had made the leap of accepting vaping, they were more ready to look at other, perhaps more radical, changes. But each consumer was unique, and products of the future needed to be flexible enough to allow different consumers to use more than one product and use them to suit their particular needs, which might change throughout the day.

Imperial Brands’ Blu vapor brand is said to provide an example of this type of flexibility. The closed system Myblu was a convenient device with a wide range of nicotine strengths and flavors from which consumers could choose what was right for them at particular times of the day, Newns said. And work was under way on a new generation of the brand, with one aim being to develop a device that would make it easier for smokers to switch to vaping.

Blu is available in 21 markets and is said to be doing well in many of those markets. And while 21 might not seem huge given that there are something like 190 countries in the world, Newns tends to look at this issue from the other end of the telescope where your gaze is focused on 169 potential markets. The existence of 21 markets for Blu was the wrong way to look at things, he said, because it represented only a snapshot in time. It was more important to consider where the smokers were than where the vapers were. In Germany, Imperial Brands had created the closed system vapor market from nothing, and that had been highly successful for the company. If you didn’t launch in markets where there were no vapers, you would never create a new market.

Newns accepts that the market situation is complicated by vaping bans, restrictions and simple economics, especially in countries such as India that should offer amazing opportunities, but he said that Imperial Brands’ mission was to convert a billion smokers to better products, even if that meant doing it one smoker at a time.

Focusing on what you can control

The trouble is that there is a major obstacle to such progress, at least in the U.S. and those countries that tend to follow where the U.S. leads. Powerful, influential agencies in the U.S., urged on by various special interest groups, have laid trip wires for the forward steps the vapor industry has tried to make, especially last year. But Newns refused to be swamped by the negative. He accepted that a lack of facts and data had led to initial missteps by some in the U.S. over the outbreak of acute lung disease among a number of people using vapor devices. He said that though the focus of investigative efforts had since narrowed to vitamin E acetate, a thickening agent not used in any Blu products, those missteps had a significant, detrimental effect on harm reduction. But his reaction was to say that it was the industry’s duty to focus on those things that were within its control, and those things were developing products that could be shown scientifically to add an overall population health benefit then trying to convince regulators and governments to join the industry on its harm reduction journey.

When I protested that getting regulators and governments on board had often proved all but impossible, Newns pointed to the ongoing reconsideration of the proposed U.S. federal ban on vaping flavors that had been set in motion after the industry and consumers had made fact-based presentations on the role that flavors played. And in the U.K., the government had been consistently positive about vaping for a sustained period of time. Even when things got tough in the U.S. last year, the U.K. government had doubled down on its support for the vapor category. “And I think that’s the policy that leads to better health outcomes for populations,” he said. “Hopefully that instills the confidence for smokers to move to better alternatives. I think that messages that are not clear lead to confusion and paralysis.”

This makes it sound as if it is all about vaping when it is not. In the spring of 2019, Imperial Brands entered the heated-tobacco product arena with the trial launch of Pulze in Fukuoka, Japan—a trial that, according to Newns, prompted “really great” feedback and led to the nationwide launch of the product at the beginning of November. Consumers were said to have liked the futuristic look of the device and to have appreciated that using it left no lingering smell.

Meanwhile, in the OND category, Imperial Brands’ Zone X tobacco-free snus (branded as Skruf, the company’s traditional snus brand, in some markets) was said to have been launched and well received in Austria and Germany, two countries that are not traditional snus markets. Newns described the product as “exciting,” one that allowed people to consume nicotine while driving or performing other activities that required them to use their hands.