The nation is the second African country to implement the measure after Mauritius. Read More

Tags :Plain Packaging

Not all is lost for brand owners operating in dark markets.Read More

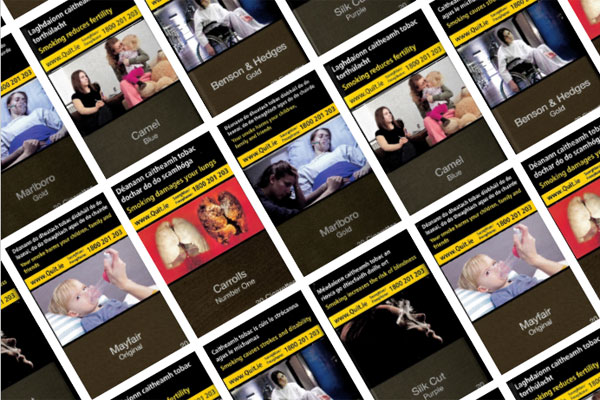

Nearly 140 countries and territories now also require graphic warnings for tobacco.Read More

The measure also mandates health warnings covering 65 percent of the packaging. Read More

Creative packaging allows for branding and distracts from health warnings, say critics. Read More

The country is the first in Africa to enact legislation requiring generic cigarette packaging. Read More

Twenty-one countries/territories have adopted the measure and 14 are working to implement it. Read More

The legislation accounted for about a quarter of the decline in smoking, says expert.Read More

Saudi study refutes suggestions that tobacco flavors changed after plain packaging. Read More

Retailers may continue selling their current stock of branded tobacco products for a year. Read More