Filter manufacturers face higher prices and tow shortages, though not everybody has been equally affected.

By Stefanie Rossel

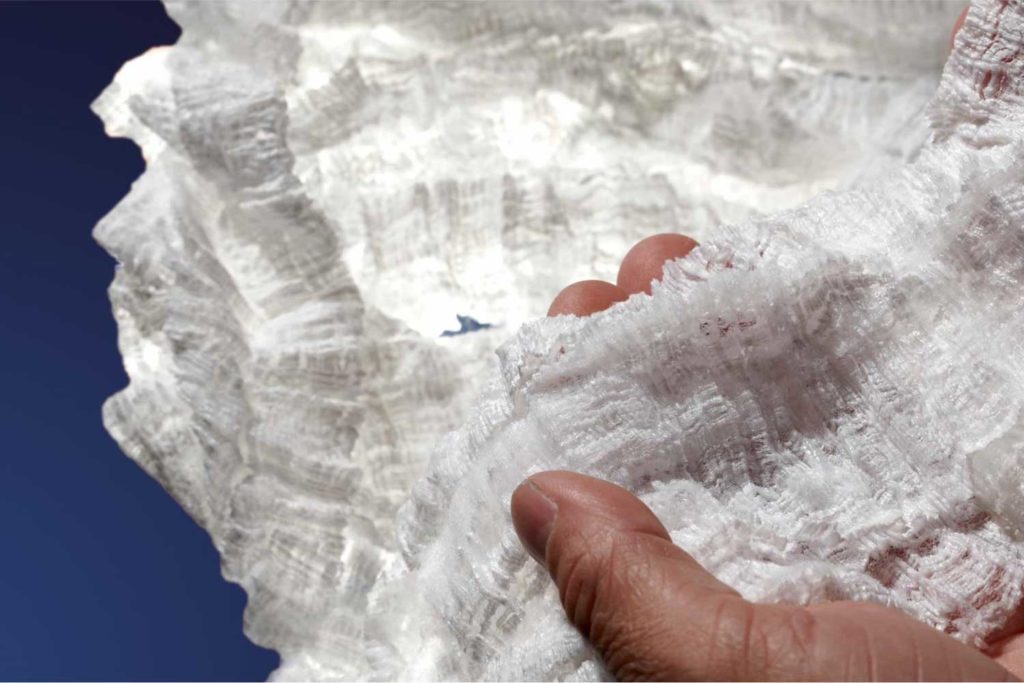

Of the roughly 5.2 trillion cigarettes consumed globally each year, 98 percent feature a filter made from cellulose acetate (CA) tow, a thermoplastic cellulose fiber with excellent absorption characteristics manufactured from dissolved wood pulp. Over the past years, suppliers of this base material faced many challenges, among them the continuous decline in global cigarette consumption since 2013, which also meant decreasing demand for tow and cigarette filters.

Since last year, however, the situation has reversed: The market for acetate tow has tightened. In May 2022, Celanese Corp., one of the world’s leading suppliers of acetate tow products, declared force majeure on western hemisphere acetyl chain and acetate tow products because of unanticipated interruptions in raw material supply in the Texas Gulf Coast. The condition was lifted again in December. Celanese Corp. was unavailable for comment.

In the meantime, other tow manufacturers announced price hikes. Cerdia, for example, announced a cost surcharge of $0.46 per kilogram on all acetate tow grade shipments as of March 2022.

“Last year, prices for acetate pulp went through the roof because of rising costs for wood, chemicals, labor, energy and shipping,” says Christian Chavassieu, managing partner at CelCo Cellulose Consulting in Geneva. “Manufacturers could either accept the price increase or risk a shortage.” Acetate tow suppliers also suffered from other issues, such as a lack of essential chemicals. Acetate tow is made by dissolving wood pulp in a mixture of acetic anhydride and sulfuric acid. The resulting solution is then extruded through small holes to form thin fibers, which are cut into small lengths after cooling.

To create high-purity cellulose pulp as used in acetate tow, 95 percent to 97 percent of the cellulose content has to be extracted. Only a handful of specialized companies are capable of this process. The cellulose “bank” is the world’s biggest source of organic raw material with 700 billion tons, according to CelCo Cellulose Consulting. The overwhelming part of cellulose products manufactured every year is used to manufacture paper, packaging and tissue.

The specialty cellulose industry, of which acetate tow manufacturers are a part, accounts for only 2.5 percent of the entire processed cellulose spectrum. “Hit with higher pulp prices, suppliers of acetate tow have been forced to pass the increase on to their customers. In its recently published second quarter results, Eastman Chemical said that prices for acetate tow went up 33 percent, leading to 32 percent higher selling prices,” says Chavassieu.

Higher selling prices were also due to more efficient use of production facilities. “Some players, such as Eastman, have diversified their mills to produce textile fibers to improve their capacity utilization,” explains Chavassieu.

HTPs Drive Demand

Hyunyoung Park, sales and business development manager at Taeyoung Industry Corp., a South Korea-based supplier of mono, dual and triple filters, says the scarcity of acetate tow occurred in part to an unplanned production stoppage at a leading supplier. “This trend has not ended and will continue until the balance shows stable figures,” he says.

The increasing popularity of heated-tobacco products (HTPs), too, has contributed to the tight market, according to Robert Pye, CEO of specialty filter manufacturer Filtrona. “We see rapid double-digit growth in HTPs, which basically use different grades of tow but actually increase the amount of tow that is used in comparison with combustible cigarettes because of the filter design. It eats up the decline in demand we have seen from traditional cigarettes.”

Pye also attributes the current challenges in the acetate tow market to the Covid-19 pandemic, which decoupled supply chains. “Before, we were all in a just-in-time sort of mode, developing strategies for our supply chains,” he says. “This has changed—we have seen people wanting to have more inventory in their supply chain. Basically, manufacturers have reduced the risk of shortage and developed a different way of managing supply chains.”

The Russia-Ukraine conflict has left its mark too, with some supply from those locations affected. “This has definitely made the supply chain more complex,” says Pye. Like Chavassieu, he expects these developments to continue. “We’re seeing an inflationary market in acetate tow,” Pye says. “Supply is somewhat tight. It won’t continue up, but how much it comes back would be something the market would have to see. I don’t see too much change for next year.”

Their views are reflected by another major acetate tow manufacturer, Japan-based Daicel, whose management recently forecast that the worldwide demand for cigarettes would gradually start increasing after 2026. Daicel’s management said it anticipated demand for acetate tow to remain stable or increase, driven by the proportion of demand for HTPs, which currently account for 3 percent of the global tobacco market and are expected to increase by 0.5 percent to 1 percent annually in the future.

An increase in the length of cigarette filters to cater to consumers’ growing health awareness and an increase in filter use in countries such as Indonesia, Bangladesh and India were named as further contributing factors. Daicel expected the recent increases in raw material and fuel prices to level off soon but the demand for acetate tow to consistently exceed supply.

Sustainable Solutions

As a long-time global player with long-term supplier contracts, Filtrona has been unaffected by the shortages, according to Pye. “The way we had our supply chains organized allowed us to grow in double digits that year. We also supply a sustainable range of products, which helped customers in some markets.”

Park adds that his company has noticed new requirements for a secure supply chain and sourcing stability. “Customers are benefiting from the stable supply chain network we have built up and continued during the pandemic,” he says.

Pye notes that the shortage of cellulose acetate has been driving interest in Filtrona’s biodegradable filters, such as the Eco range of products, in more regions, predominantly around western Europe but also elsewhere. “Also, products like BiTech, a mono-segment filter produced in a single pass and offered in various ratios of tow and either paper or other nonwoven materials, thus using less acetate tow than a normal filter, were more sought after,” he says.

While paper-based solutions have traditionally been more expensive than CA filters, the price gap has narrowed recently. “These days, the cost and capability of the nonwoven products are more interesting,” says Pye. “There are certain characteristics to the product line that make them more interesting to compete with acetate tow.”

Excluding China, special filters account for 5 percent of the global market. Of these, Filtrona has a market share of nearly 50 percent. The remaining share is divided between smaller local players. “We see the market growing, mainly in areas where tobacco companies may want to differentiate themselves from other brands, for example, when they operate in regions with plain packaging,” says Pye. “Special filters are also becoming increasingly popular with manufacturers with a maturing customer base, i.e., when consumers are moving up from their gross domestic product, more specialty products come into these markets. India is an example of this: A few years ago, the country had very limited flavor-based products. Today, it has lots of flavors, tubes and other complex filters. The market has more specialty filters in the last two years than in the last 10 years combined.”

Pye thinks this trend will continue. “Filtrona’s task is to bring new filter technologies into these markets,” he says. “That’s why we have a joint venture in China. The Chinese market uses all sorts of slims, such as super slims or demi slims, but not too many combined filters, and previously, there hasn’t been a market for additives either.”

Despite the challenges, the market is quite dynamic, according to Pye, with different regions having requirements for different filters and specialty filters and even in filter supply. “We see this dynamic playing out not on a daily but on a quite regular basis, with sustainability and HTPs becoming more important,” he says. “The challenges in supply chains haven’t quite left us, so I think it’s an interesting time. As a supplier and committed partner to this industry, we’re making sure that we can help the industry move into more sustainable solutions but also ensure they get the supply because their supply chains are challenged as well.”